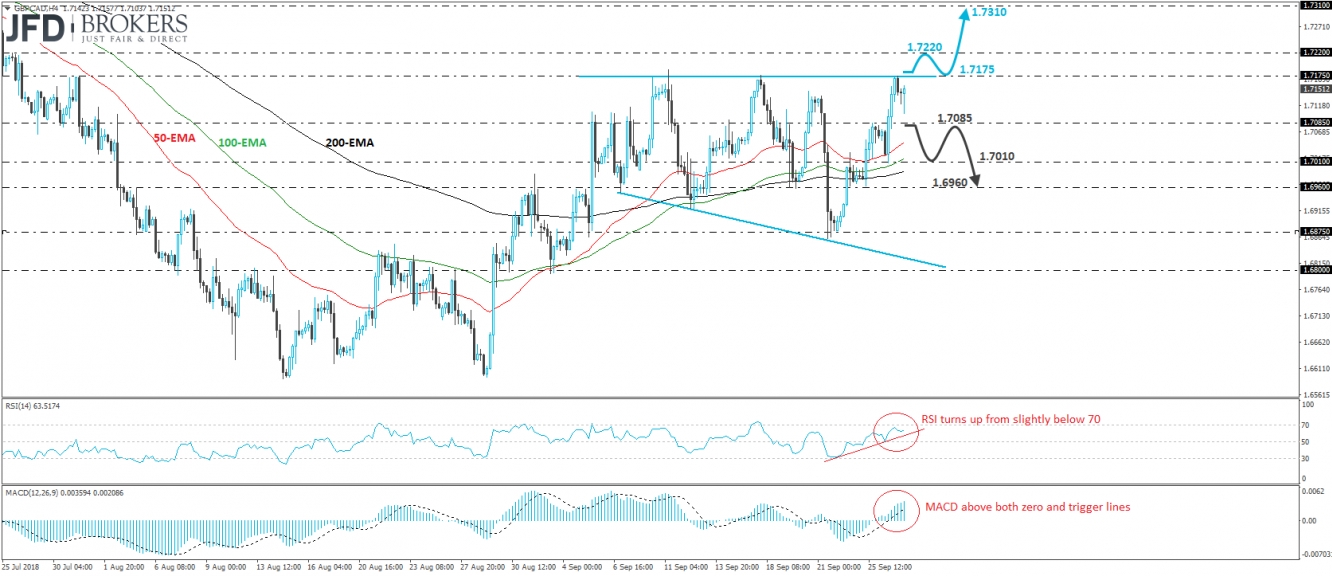

GBP/CAD edged north yesterday after hitting support at 1.7010. The rate emerged above Tuesday’s peak of 1.7085 and hit resistance near the 1.7175 zone, which happens to be the upper bound of a broadening formation that’s been containing the price action since the 5th of September. That said, despite yesterday’s rally, given that the rate is still trading within the broadening pattern, we prefer to remain sidelined for now.

We would like to see a clear break above 1.7175 before we start examining the case for larger bullish extensions. Such a break would confirm a forthcoming higher high on the 4-hour chart and could signal the upside exit out of the formation. The bulls could then aim for our next resistance at around 1.7220, defined by the high of the 26th of July, the break of which could set the stage for the 1.7310 key zone. That area acted as a reliable support from the 28th of June until the 17thof July, while after its break it turned into resistance on the 25th of July.

Taking a look at our short-term oscillators, we see that the RSI lies above its respective upside support line, slightly below 70, and shows signs that it could turn up again. The MACD lies above both its zero and trigger lines, but it shows signs of slowing down. Both indicators detect upside momentum and increase somewhat the likelihood for a break above 1.7175, but the slowing of the MACD suggests that a setback may be on the cards before the next positive leg, perhaps for a test near 1.7085.

Now, if that level does not hold the rate from dropping further, this may be a sign that traders want to keep the pair within the broadening pattern for a while more. Initially, the break could pave the way towards the 1.7010 support, marked by yesterday’s low, where a break could aim for the 1.6960 barrier, fractionally below Tuesday’s low.