Sprott USA Chairman Rick Rule, the Carlsbad, California based natural resource financier with nearly four decades of experience, joined us for a conversation earlier today on the current mining bear market, which is approaching its third anniversary. As expected, Mr. Rule was upbeat, and sounds to be making the most of the opportunities being presented to him.

“Junior capital markets may be closed but Sprott is not. We are aggressively trying to allocate capital in this market.”

Mr. Rule’s only complaint is that issuers (read: small, pre-revenue, hope and dream mining companies) still think they are entitled to financing terms of the 2003-2010 bull market. Mr. Rule said that during that period, half of Canadian listed junior mining companies were spending more than 50% of their capital on general and administrative expenses.

“The exploration industry was stupidly overcapitalized from 2003-2010. Every truly great party causes a truly monumental hangover. We’re in that phase now.”

Mr. Rule is not at all depressed about the current mining bear market, however. He thinks that the top 10-15% of junior companies have already bottomed, and notes that discoveries, such as RMC, FCU or AOI, are continuing to reward investors with five and ten-baggers.

Rule predicted it will take another 18-24 months for resource equities to fully rebound. The largest mining companies are already starting to show compelling valuations, Rule says, which will ultimately attract global capital flows.

We were able to ask Mr. Rule about a few stocks that he’s mentioned in the past, including Fission Uranium, which he feels is being held back by a weak uranium spot price. “Unless I’m wrong and the exploration becomes less predictable, I’ll own the name until it has a different symbol.”

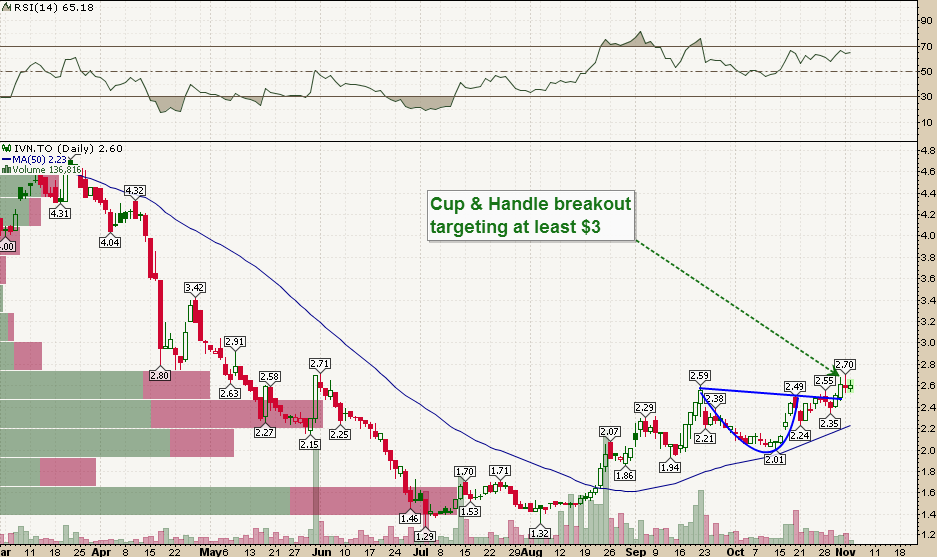

Rule believes Robert Friedland’s Ivanhoe Mines is in a “very special situation” for having the world’s best exploration and development entrepreneur running the company, while also having “two generational discoveries” contained in the one vehicle. “My own experience has been that superb projects finance themselves, including in difficult countries,” offered Mr. Rule on the locations of Ivanhoe’s deposits, DRC and South Africa.

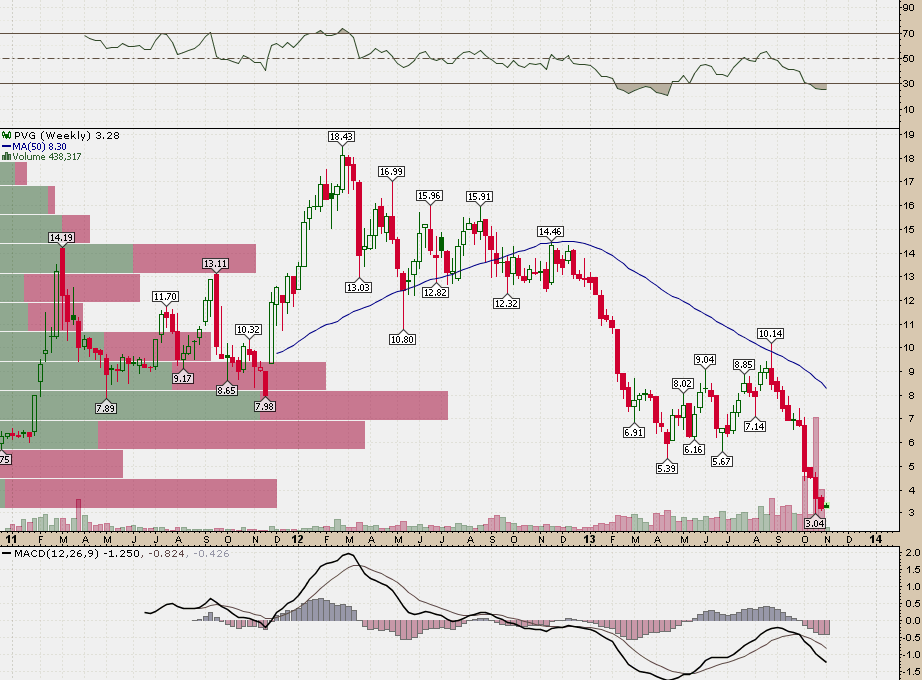

Bob Quartermain’s Pretivm Resources, which has been under tremendous pressure recently, received a show of support from the Sprott USA Chairman. Rule expects results from Pretivm’s bulk sample to be better than expected, adding that he may repurchase shares in Pretivm, but does not own the company currently. “If the results are as I anticipate them, and if the reaction to the results are stilted by some academic discussion… I’ll be an extraordinarily large buyer.” Of Pretivm’s CEO, Rule expressed strong support. “I have known Bob Quartermain for over two decades. To suggest that he is either dishonest or incompetent is of monumental stupidity.”

Mr. Rule says Sprott Inc. has significantly expanded its footprint in Calgary since the acquisition of former competitor, the Toscana Merchant Group, in 2012. “We’re no longer suitcase bankers or investors coming in from California or Toronto”, he claims. Rule says he sees a lot of value in the sub 5000 barrel a day space in Canada. “We would love to play an increasing role helping those companies with equity, off balance sheet finance, with drilling joint ventures, with bridge and mezzanine finance, and acquisition debt finance.”

To conclude our conversation, Mr. Rule simply reminded us that bull markets follow bear markets. “Having lived through the pain, you may as well hang around for the gain.”

We appreciate Mr. Rule for joining the program, and we advise all readers to sign up for updates from the Sprott Organization.

Disclaimer: Please note that nothing contained in this article or the associated audio file are to be considered investment or professional advice of any kind. All facts are to be verified by the reader. Always do your own due diligence. Thank you.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

On The Mining Bear Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.