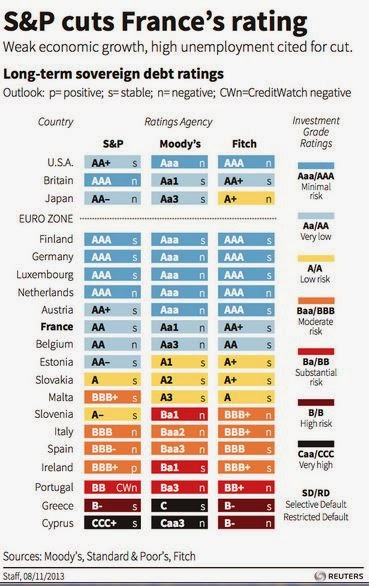

S&P, which continues to grant the UK triple-A status, cut France's rating to double-A last week. We can understand why ratings matter for corporations. The rating agencies may have access to private information. We can understand why ratings for many low income economies can be helpful. The information may be difficult to obtain and might not be followed by many economist.

However, when it comes to the high income countries that have troves of analysts and economists scrutinizing their economic data, we are skeptical of the value of ratings. They rely on publicly available information, which is readily accessible.

The asymmetries of information are minimal. What might vary is how the information is processed. This seems true in general. In essence then, it is a question of the timeliness of the rating agencies actions, and the capability of their economists.

This Great Graphic, comes from Thomson Reuters, which synthesized the data from the three main rating agencies for the high incomes economies. Judging from the lack of market reaction to the rating agencies actions, not only in France, but also the US, Japan, UK, and Italy (not meant to be exhaustive; merely suggestive), one can conclude that the rating agencies are slow to reach the conclusion that investors already have, or that such ratings, especially in a period of financial disintegration (strengthening of the home bias) are less relevant.

It may be that movement within the high investment grade status is of little significance, but a move out of investment grade would be seen as more serious. Yet this would seem to be a bit circular as many asset manager mandates have rules about the credit rating, defined by one or more of the top three rating agencies, of their investments. Those fund managers that are limited to investment grade investment only, may have to jettison bonds if they lost that assignation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

On Sovereign Ratings Of High Income Countries

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.