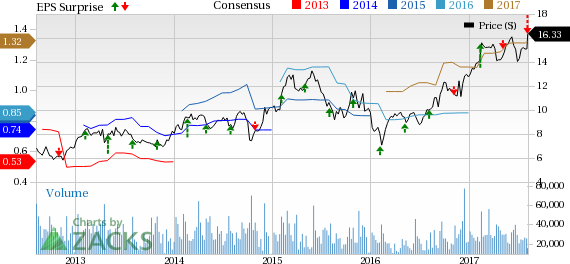

ON Semiconductor Corporation (NASDAQ:ON) second-quarter 2017 earnings of 26 cents per share missed the Zacks Consensus Estimate of 33 cents.

On a GAAP basis, the company reported earnings of 22 cents per share, much higher than earnings of 6 cents reported in the year-ago quarter.

Moreover, ON Semi reported non-GAAP revenues of $1.338 billion, which surged 52.4% year over year and 4.4% from the previous quarter, and beat the Zacks Consensus Estimate of $1.31 billion. The figure was also better than the guided range of $1.285–$1.335 billion.

The year-over-year growth was driven by strong progress of the Fairchild integration and diversified product portfolio for automotive, industrial and communications end-markets.

Notably, shares of ON Semi have gained 27% year to date, significantly underperforming the industry’s16.6% rally. The company’s diversified product and customer base along with improving end-markets will help the stock to sustain its momentum in the rest of 2017.

Revenue Details

ON Semi has three business units namely – Power Solutions Group or PSG (revenues of $671 million), Analog Solutions (revenues of $468 million) and Image Sensor Group (revenues of $198 million).

Automotive (31% of revenues) end-market revenues were approximately $410 million, up 30% year over year and increased marginally quarter over quarter. In the quarter, the company’s image sensor revenues related to advanced driver-assistance systems (ADAS) and viewing applications grew at an impressive rate.

Management noted that growth drivers for automotive applications include ADAS and LED lighting, in-vehicle networking solutions, mixed signal ASICs and protection devices. Exposure to a diversified global customer base was also a positive.

Industrial (26%) end-market revenues increased 59% year over year and 8% sequentially to $351 million. The company noted that its Python line of CMOS image sensors for machine vision applications continues to grow at an impressive rate. The demand for industrial end-markets was driven by industrial power supplies, building automation, lighting, industrial automation and alternative energy. With the acquisition of Fairchild, demand for the company’s power modules increased significantly. Implantable devices and hearing health also led to strong growth in the medical business.

Communications (19%) end-market revenues grew 62% year over year and 6% quarter over quarter to $252 million attributable to growth in its content and major smartphone platforms and traction in the smartphone market.

Computing (10%) grew 50% year over year and 3% quarter over quarter to $131 million. On Semiconductor won designs for power stage for cloud computing and server applications.

Consumer (15%) end-market revenues grew 96% on a year-over-year basis and approximately 7% sequentially to $194 million.

Margins

Non-GAAP gross margin was 36.9%, up 140 basis points (bps) sequentially and 180 bps year over year, reflecting higher-than-expected revenues and improving operational efficiency.

ON Semi incurred non-GAAP operating expenses of $296.8 million, up 48.6% from the year-ago quarter and 4.2% from the previous quarter. The figure was higher than management’s guided range of $281–$295 million, primarily owing to higher variable compensation.

As a percentage of revenues, operating expenses declined 60 bps from the year-ago quarter but increased 240 bps from the previous quarter to 22.2%.

As a result, non-GAAP operating margin expanded 240 bps from the year-ago quarter and 290 bps sequentially to 14.7%.

Balance Sheet

Cash & cash equivalents were $871.6 million, up $142.7 million sequentially. In the second quarter, operating cash flow was $333.2 million compared with $208.5 million in the previous quarter. Free cash flow was $264.2 million, up from $155.8 million in the previous quarter.

Guidance

ON Semi revised its annual synergies run rate from the Fairchild acquisition to $180 million, up from the previous target of $160 million for 2017. The company also raised annualized synergies run rate exiting 2018 to $220 million from $200 million. Total annual synergies expectation from Fairchild was maintained at $245 million, which the company looks to achieve by end of 2019.

Management expects to see strong growth in revenue contribution from Fairchild in the near to mid-term. In the third-quarter, on a quarter-over-quarter basis, revenues from communications, computing and consumer end-market are anticipated to increase, automotive revenues are expected to remain flat while the industrial end market might show a decline.

ON Semi now forecasts revenues to be in the range of $1.34–$1.39 billion in third-quarter 2017. Non-GAAP gross margin is projected to be in the range of approximately 36.2%–38.2%, while operating expenses are expected in the range of $285–$299 million.

For 2017, On Semi now expects free cash flow in the range of $600-$650 million, up from the prior guidance of $500–$600 million.

Conclusion

We believe that improving end-markets are positive for ON Semi. The Fairchild acquisition has helped the company to secure a dominant position in the power semiconductor market with a planned focus on smartphone, automotive and industrial end markets.

Further, a diversified customer and product base coupled with improving end-markets has insulated the company against certain end-market and geographical demand volatility. Lower customer and product concentration risk is therefore a positive for its top line.

Moreover, growing demand and greater adoption of CMOS image sensor business and ADAS related applications have given ON Semi a significant growth opportunity in the automotive market.

Additionally, higher synergies from the Fairchild acquisition along with reducing enterprise-wide manufacturing cost will boost profitability.

Zacks Rank & Stocks to Consider

On Semiconductor carries Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Better-ranked stocks in the broader technology sector includeAlibaba Group Holding (NYSE:BABA) , Luxoft Holding (NYSE:LXFT) and Lam Research (NASDAQ:LRCX) , all sporting a Zacks Rank #1.

Long-term earnings growth rate for Alibaba, Luxoft Holding and Lam Research is projected to be 28.97%, 20% and 17.2%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Luxoft Holding, Inc. (LXFT): Free Stock Analysis Report

ON Semiconductor Corporation (ON): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post