Shares of On Semiconductor Corp. (NASDAQ:ON) rallied to a new 52-week high of $17.51, eventually closing a tad lower at $17.38 on Sep 15.

The share price momentum can primarily be attributed to the company’s growing diversified global customer base driven the Fairchild acquisition and the expansion of its own product portfolio.

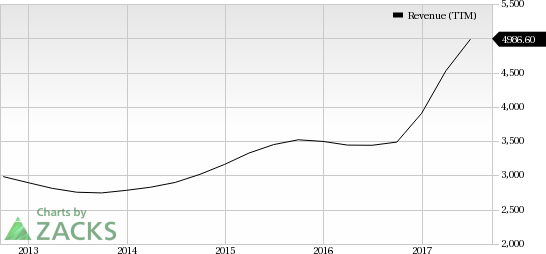

The increase in its customer base was reflected in the company’s second-quarter results as non-GAAP revenues were $1.338 billion, surging 52.4% year over year and 4.4% from the previous quarter, and beat the Zacks Consensus Estimate of $1.31 billion. The figure was also better than the guided range of $1.285–$1.335 billion.

On Semiconductor stock has gained 36.3% year to date, substantially outperforming the 20.7% rally of the industry it belongs to.

Driving Factors

Notably, the company’s September 2016 acquisition of Fairchild has aided top-line growth. Management expects to see further growth in Fairchild’s revenue contribution in the near term, driven by the company’s strong foothold in the power semiconductor market post the acquisition.

Moreover, the Advanced Driver-Assistance Systems (ADAS) is growing at a steady pace and is expected to reach $42.4 billion by 2021, per MarketsandMarkets. We believe the accelerated growth of the ADAS market has increased the adoption rate of the related applications provided by On Semiconductor, thereby improving its growth opportunity in the automotive market.

Further improving end markets, less customer and product concentration have aided the company’s impressive performance. Growing demand for the company’s CMOS image sensor is also a key catalyst.

Thus, with all these key growth drivers the company is well placed for growth in the smartphone, automotive and industrial end markets. These have also provided the company with a competitive edge against the likes Broadcom Limited (NASDAQ:AVGO) , Diodes Incorporated (NASDAQ:DIOD) and Infineon Technologies AG (OTC:IFNNY) .

Zacks Rank

On Semiconductor currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020. The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Infineon Technologies AG (IFNNY): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Diodes Incorporated (DIOD): Free Stock Analysis Report

ON Semiconductor Corporation (ON): Free Stock Analysis Report

Original post

Zacks Investment Research