Not all markets are equal. There are times when markets offer a lot of opportunity and there are times when markets offer little. For me to think that my approach to trading will be equally profitable every year or every month or every week would be insane. The reality is that markets are cyclical in relationship to a particular approach to market analysis and trading.

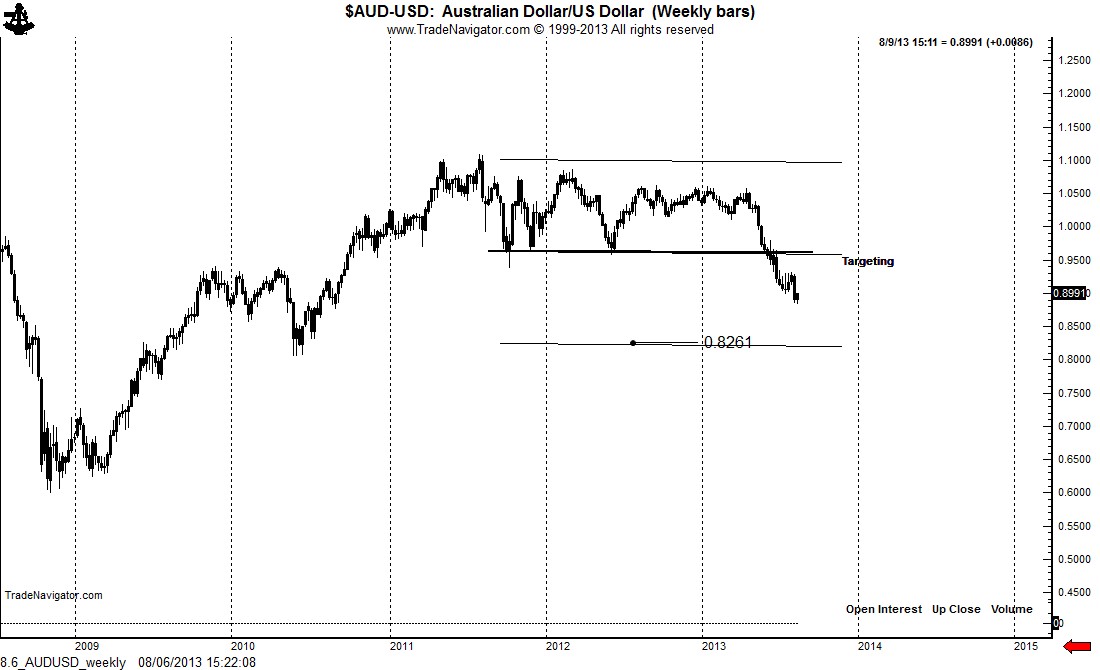

Worded differently, there are times to make money and there are times to prevent losses. From a classical charting perspective, with the time frame I look at (weekly chart patterns), there is just not much to be done. I currently have only one position — short Australian dollars (with a breakeven stop). I was completely flat for most of July. In contrast, typically I am carrying between three and six trades at any given time.

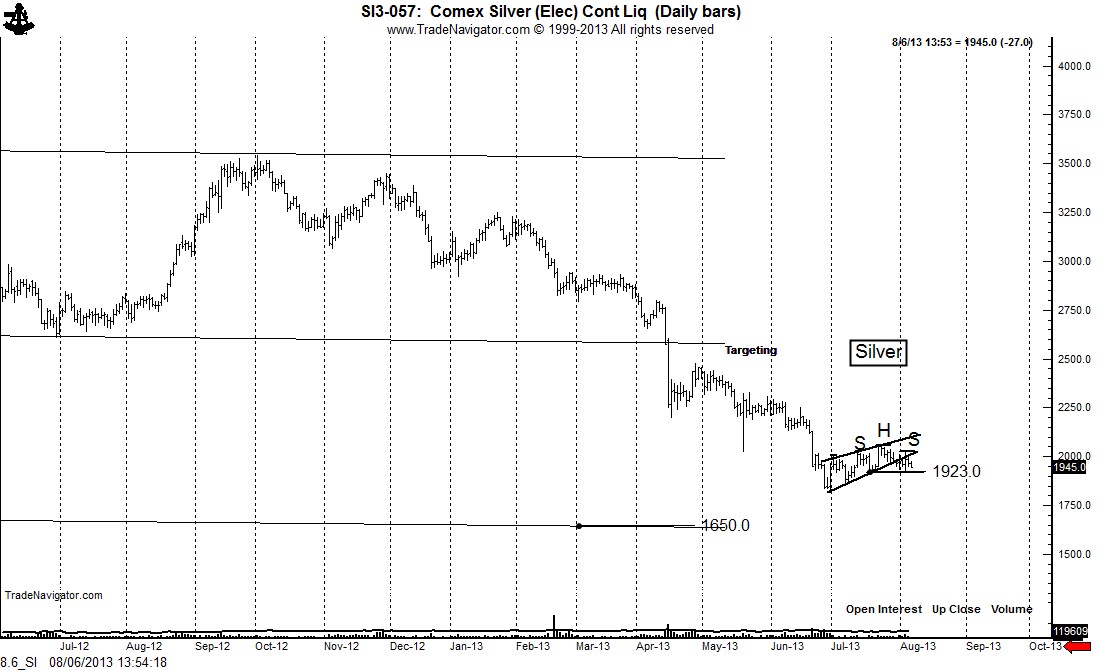

I have no idea what the metals are doing. If someone put a gun to my head and said I had to take a position in metals, I would probably go short Silver. Silver has been unable to rally while Gold and Platinum bounced approximately $170 off their June lows. My target in Silver remains 16.50. I cannot believe the amount of radio and TV advertising I have heard and seen in the past few weeks — all stating that we are in a “once in a lifetime” opportunity to buy Siver below the cost of production.

Silver has completed a small bear wedge. I have little motivation to trade the metals, but if I did, going short Silver would be my preference.

So what markets have my attention? Very few, but there are a few.

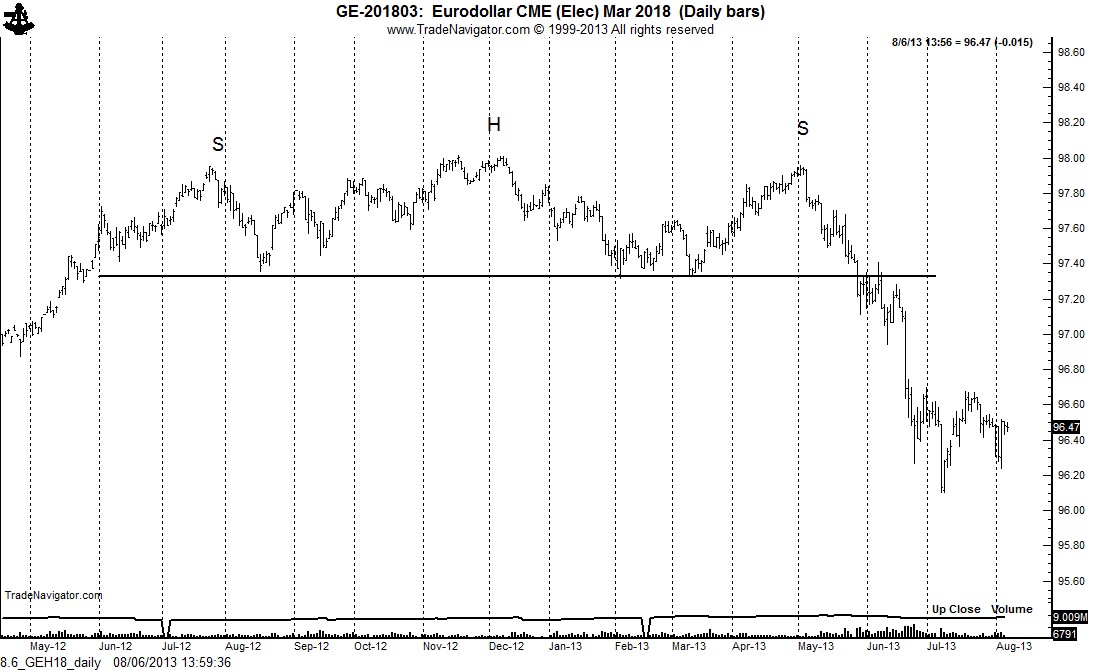

The deferred contracts of Eurodollars (interest rate, not forex) are in a major bear trend. Despite the best intentions of Benny Bernanke and the rest of the idiots at the Fed, a Zero Interest Rate Policy (ZIRP) cannot continue forever.

The March 2018 Eurodollar contract completed a major H&S top in late May. I expect this top to remain in place. The market is in a seven-week pause or consolidation. This consolidation has taken the form of an inverted H&S bottom. A decisive close above 96.70 would complete this bottom and likely lead to a retest of the major H&S top. However, periods of uncertainty (or congestion) usually are resolved in the direction of the major trend. Thus, there is a chance that this current congestion will morph into a bearish continuation pattern. I do not have a position in Eurodollars, but I am monitoring the market for a trading opportunity.

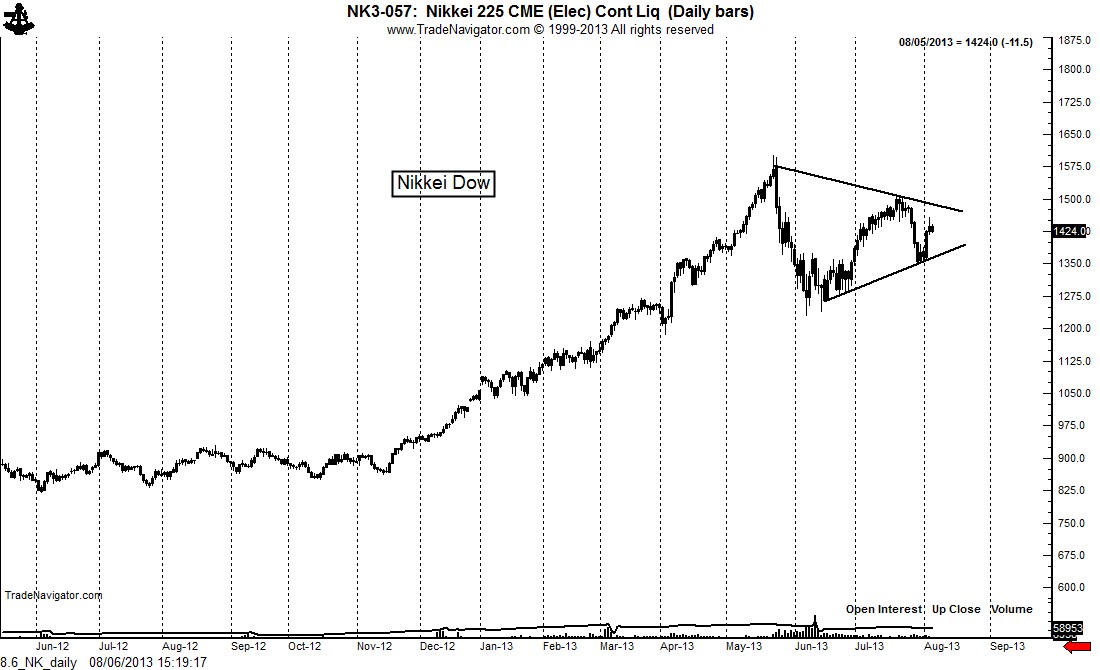

I am also closely watching the Japanese markets — both stocks and the yen. I believe the Japanese stock market is in a generational bull trend. The daily and weekly Nikkei charts display a possible 12-week triangle. I do not have a position in the Japanese stock market, but I am watching for a decisive close above the July high as a signal to go long.

The target in the Aussie dollar remains 8250. I am short this market with a relatively close protective stop. I am not sure if the sustained trend will continue to the target or if a longer period of consolidation will occur. I am prepared for both scenarios.

My favorite potential trade is short the British pound. The dominant pattern is 4-year symmetrical triangle completed in February. This pattern has a target of 1.35xx. I believe the market is forming a descending triangle (dashed line). I am flat, but am looking for selling opportunities.

I want to make some comments on the U.S. stock market. People who are forcasting a collapse in the U.S. economy and the stock market are betting on an extremely low probability outlier. Betting on outliers is a road to ruin. Predicting the absolute high of a bull trend that has been going on forever is not a good bet.

I do not have a position in U.S. stock indexes, but my preference is to trade in the direction of a major trend. A market that closed within 1% of its absolute all-time high is not exactly a market in a bear trend. I have NO (that means NONE) interest in playing the markets from end zone to end zone. I want to play the markets between the 30 yard lines. I want you traders to consider this — if you were to never put on a trade that opposed the 14- or 21-day moving average of a market (or whatever length of time you want to establish), would you be money ahead or behind? Think about it...

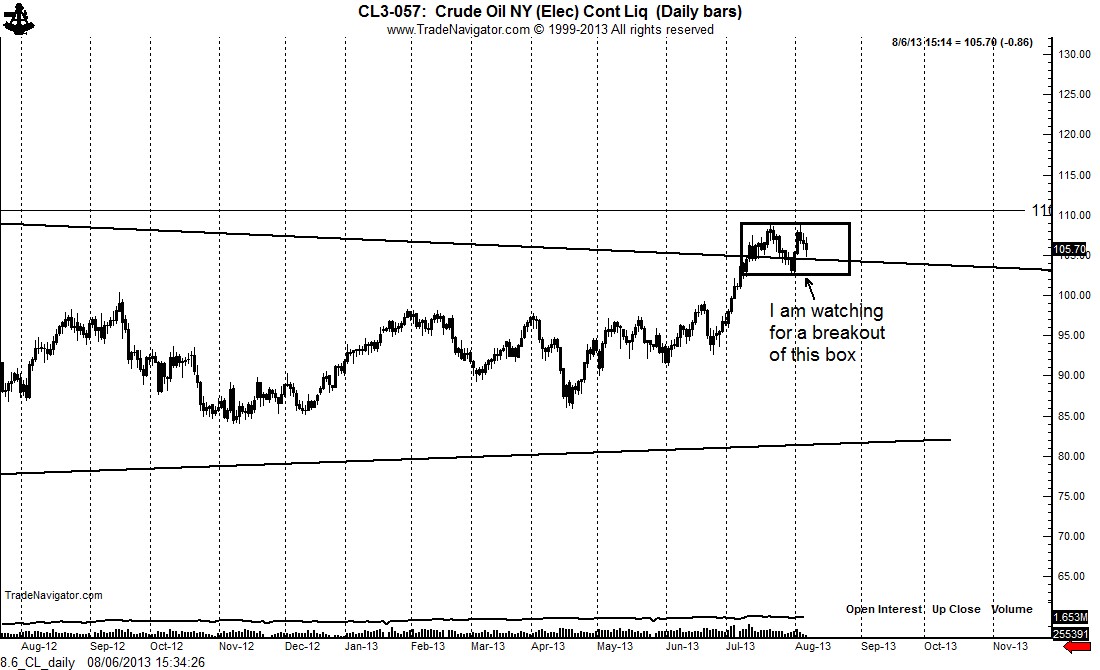

Finally, a word on the energy markets. I am not unaware that Crude Oil has penetrated the upper boundary of a 2+ year triangle. Yet a decisive close above the 2012 high is needed to confirm this triangle as a bullish pattern. I could go either way in Crude Oil. I believe Crude Oil is poised for a $20 to $30 move — I am just not sure of the direction or timing. Still, I am likely to be either short or long in the next month or so.

I wish I could comment on many more markets, but I just do not have an opinion on most markets. Opinions in markets are worthless. I am a trader. Trades count. Opinions count for nothing. I look for decisive breakouts of significant chart patterns. Without these two things — signficant chart patterns and decisive breakouts — there is no reason to trade.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

On Futures Markets (And Why I'm Mostly On The Sidelines)

Published 08/07/2013, 12:22 AM

Updated 07/09/2023, 06:31 AM

On Futures Markets (And Why I'm Mostly On The Sidelines)

Not much to look at is my conclusion

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.