It has been about a month since the last earnings report for Omnicom Group Inc. (NYSE:OMC) . Shares have lost about 6.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Omnicom Beats on Q2 Earnings, Revenues Decline Y/Y

Omnicom reported modest second-quarter 2017 results, with year-over-year increase in earnings on decent organic growth. Net income for the reported quarter was $328.1 million or $1.40 per share compared with $326.1 million or $1.36 per share in the year-ago quarter. GAAP earnings for the reported quarter beat the Zacks Consensus Estimate by $0.01.

Revenues

Omnicom's revenues for the quarter were $3,790.1 million compared with $3,884.9 million in second-quarter 2016. Fall in revenues was primarily due to negative foreign exchange rate of 1.5%. Acquisitions, net of dispositions led to a 4.4% decrease in revenues. Revenues beat the Zacks Consensus Estiamte of $3,764 million

Quarterly Performance

By business disciplines, revenues for Advertising were up 4.2% year over year to $2,017.8 million, CRM (customer relationship management) increased 3.7% to $1,131.9 million, PR (public relations) revenues decreased 0.3% to $342.6 million, and Specialty revenues increased 2.2% to $297.8 million.

Across regional markets, North America revenues improved 0.2% to $2,175.6 million. Asia Pacific was $405.3 million, up 7.1% year over year, Euro & Other Europe improved 7.8% to $662.1 million while the U.K. improved 9.3% to $350.4 million. Revenues from Latin America were $121.2 million, up 5% while that of Middle East and Africa improved significantly to $75.5 million by 20.4%.

Operating profit in quarter increased $3.7 million to $565.5 million from $561.8 million in the second quarter of 2016. Operating margin was 14.9% compared with 14.5% for the year ago quarter. EBITA (earnings before interest, taxes, and amortization) increased $3.7 million to $594 million from $590.3 million in the year-ago quarter. EBITA margin increased to 15.7% from 15.2% in the year-earlier period.

Balance Sheet & Cash Flow

Omnicom generated free cash flow of $797.5 million over the six months ended Jun 30, 2017 compared with $763.8 million in the year-ago period.

For the 12 months ended Jun 30, 2017, return on invested capital and return on equity aggregated 19.9% and 51.8%, respectively. During the same period, the company had a total debt of $4,949 million with cash and short-term investments of $1,874 million.

During the period from 2007 through Jun 30, 2017, Omnicom distributed 107% of net income to shareholders through dividends and share repurchases.

Moving Forward

Omnicom has a track record of strengthening its business and expanding its global client base through acquisition of complementary companies. We remain encouraged by the healthy quarterly results of the company and its continued acquisition spree.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

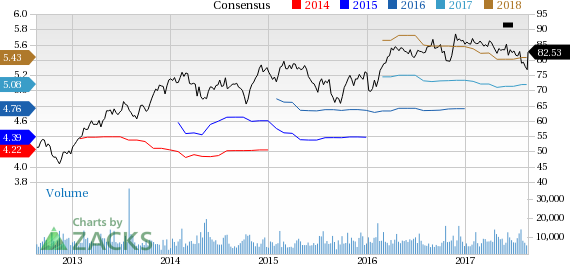

Omnicom Group Inc. Price and Consensus

VGM Scores

At this time, Omnicom's stock has a poor Growth Score of F, however its Momentum is doing a lot better with a C. The stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than momentum investors.

Outlook

Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Omnicom Group Inc. (OMC): Free Stock Analysis Report

Original post

Zacks Investment Research