New York-based Omnicom Group Inc. (NYSE:OMC) is one of the largest advertising, marketing and corporate communications companies in the world. OMC is expanding its global footprint and is moving into new service areas by leveraging its digital and analytical capabilities and partnering with innovative technology firms in key markets.

However, OMC forms an integral part of the communications industry, which is highly competitive in nature and is susceptible to market risks of losing contracts related to media purchases and production costs. With rising operating costs and adverse currency translation effects gradually shrinking margins, investors have been eagerly waiting for the company’s latest earnings report. In the last four trailing quarters, OMC has reported a positive average earnings surprise of 1.5%, beating estimates on all occasions.

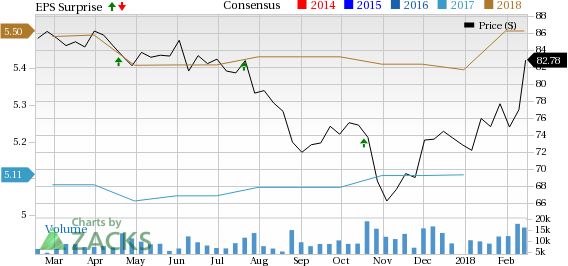

Omnicom Group Inc. Price, Consensus and EPS Surprise

Currently, OMC has a Zacks Rank #3 (Hold), but that could definitely change following fourth-quarter 2017 earnings report, which was just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key stats from this just-released announcement below:

Earnings: OMC beats on earnings. The Zacks Consensus Estimate called for EPS of $1.54, and the company reported EPS of $1.55.

Revenues: Revenues missed estimates. OMC posted total revenue of $4,176.6 million, compared with Zacks Consensus Estimate of $4,206 million.

Key Stats to Note: OMC reported modest organic growth of 1.6% in fourth-quarter 2017.

Stock Price: Shares did not show any change in the pre-market trading following the release at the time of this write-up.

Check back our full write up on this OMC earnings report later!

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Omnicom Group Inc. (OMC): Free Stock Analysis Report

Original post

Zacks Investment Research