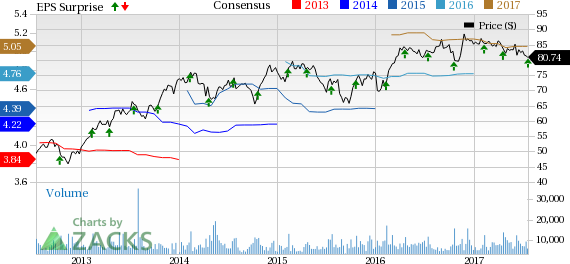

Global marketing and corporate communications firm Omnicom Group Inc. (NYSE:OMC) reported modest second-quarter 2017 results, with year-over-year increase in earnings on decent organic growth. Net income for the reported quarter was $328.1 million or $1.40 per share compared with $326.1 million or $1.36 per share in the year-ago quarter. GAAP earnings for the reported quarter beat the Zacks Consensus Estimate by a penny.

Revenues

Omnicom's revenues for the quarter were $3,790.1 million compared with $3,884.9 million in second-quarter 2016. Fall in revenues was primarily due to negative foreign exchange rate of 1.5%. Acquisitions, net of dispositions led to a 4.4% decrease in revenues.

Quarterly Performance

By business disciplines, revenues for Advertising were up 4.2% year over year to $2,017.8 million, CRM (customer relationship management) increased 3.7% to $1,131.9 million, PR (public relations) revenues decreased 0.3% to $342.6 million, and Specialty revenues increased 2.2% to $297.8 million.

Across regional markets, North America revenues improved 0.2% to $2,175.6 million. Asia Pacific was $405.3 million, up 7.1% year over year, Euro & Other Europe improved 7.8% to $662.1 million while the U.K. improved 9.3% to $350.4 million. Revenues from Latin America were $121.2 million, up 5% while that of Middle East and Africa improved significantly to $75.5 million by 20.4%.

Operating profit in quarter increased $3.7 million to $565.5 million from $561.8 million in the second quarter of 2016. Operating margin was 14.9% compared with 14.5% for the year ago quarter. EBITA (earnings before interest, taxes, and amortization) increased $3.7 million to $594 million from $590.3 million in the year-ago quarter. EBITA margin increased to 15.7% from 15.2% in the year-earlier period.

Balance Sheet & Cash Flow

Omnicom generated free cash flow of $797.5 million over the six months ended Jun 30, 2017 compared with $763.8 million in the year-ago period.

For the 12 months ended Jun 30, 2017, return on invested capital and return on equity aggregated 19.9% and 51.8%, respectively. During the same period, the company had a total debt of $4,949 million with cash and short-term investments of $1,874 million.

During the period from 2007 through Jun 30, 2017, Omnicom distributed 107% of net income to shareholders through dividends and share repurchases.

Moving Forward

Omnicom has a track record of strengthening its business and expanding its global client base through acquisition of complementary companies. We remain encouraged by the healthy quarterly results of the company and its continued acquisition spree.

Omnicom currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the industry include Clear Channel Outdoor Holdings, Inc. (NYSE:CCO) , Publicis Groupe S.A. (OTC:PUBGY) and Social Reality, Inc. (NASDAQ:SRAX) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clear Channel Outdoor has a long-term earnings growth expectation of 3%.

Publicis Groupe has a long-term earnings growth expectation of 12.9%.

Social Reality topped estimates twice in the trailing four quarters with an average positive earnings surprise of 50%.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Omnicom Group Inc. (OMC): Free Stock Analysis Report

Publicis Groupe SA (PA:PUBP) (PUBGY): Free Stock Analysis Report

Clear Channel Outdoor Holdings, Inc. (CCO): Free Stock Analysis Report

Social Reality Inc. (SRAX): Free Stock Analysis Report

Original post