Old Republic International Corporation (NYSE:ORI) has announced the offering of 3.875% senior notes with aggregate principal amount of $550 million that are due to mature in 10 years. The notes have been offered at 99.819% of face value. Interest on these senior notes will be paid semi-annually on Feb 26 and Aug 26 of each year from 2017 onward.

Though the notes will mature on Aug 26, 2026, the company has retained the option of redeeming some or all of the notes at any time prior to Jul 26, 2026 at a redemption price equal to 100% of the principal amount of the notes, plus accrued and unpaid interest.

Old Republic International plans to deploy the net proceeds for general corporate purposes, including the repayment of its outstanding convertible senior notes that would mature in 2018, unless converted earlier.

Old Republic International has displayed its prudence by issuing senior notes amid a low interest rate environment to procure funds. It demonstrates a conscious effort by the company to capitalize on the low interest rate environment to reduce interest burden, thereby facilitating margin expansion.

As of Jun 30, 2016, long-term debt of the company was $982.9 million. This indicates an increase of 3.2% from that at the end of 2015. The debt-to-equity ratio as of Jun 30, 2016 was 22.5% compared with 24.6% at the end of 2015. However, the latest offering will increase the debt-to-equity ratio significantly, by 1250 basis points to be precise. Nevertheless, given Old Republic International’s strong capital position, we remain confident about the company’s debt servicing capability.

Zacks Rank and Stocks to Consider

Currently, Old Republic International holds a Zacks Rank #3 (Hold). Some better-ranked stocks in multiline insurance space include Allianz (DE:ALVG) SE (OTC:AZSEY) , James River Group Holdings, Ltd. (NASDAQ:JRVR) and Swiss Re Ltd. (OTC:SSREY) . Each of these stocks sports a Zacks Rank #2 (Buy).

ALLIANZ AG-ADR (AZSEY): Free Stock Analysis Report

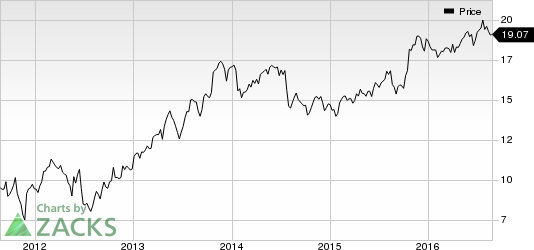

OLD REP INTL (ORI): Free Stock Analysis Report

JAMES RIVER GRP (JRVR): Free Stock Analysis Report

SWISS RE LTD (SSREY): Free Stock Analysis Report

Original post

Zacks Investment Research