Frozen concentrate orange juice has lost value nine consecutive sessions dragging prices to their lowest trade since 3/8. In the last three weeks November futures are lower by 16%. Stochastics have entered oversold levels and we’ve completed a 61.8% Fibonacci retracement as of yesterday.

Prices appear to be down on recent data showing a slowdown in US orange juice demand…imagine a market that still trades on fundamentals? Nielsen data published 6/24 by the Florida Department of Citrus showed US sales of orange juice in the last four weeks ending June 8, were at their lowest point in the last 11 years. The weaker demand has at least until now countered concerns over a smaller Florida orange crop this year. Reporting live from Miami, FL the top US citrus producers happen to be in my backyard. They’ve been hit with widespread citrus greening and abnormally dry weather, which has caused fruits to drop from their trees prematurely. The USDA has cut its estimate for the state’s crop by close to 13% since the season began to 134 million 90-pound boxes. So the market has priced in a decline in demand larger than the decrease in supply…ECON 101.

Being a contrarian and value hunter I am looking for an entry point to take a bullish stance with clients anticipating a recovery in coming weeks as I believe prices have overshot to the downside.

Two Trade Ideas

- Get long November futures and buy just out of the money puts 1:1. The $125 (3 cents out) current premium approximately $1,100.

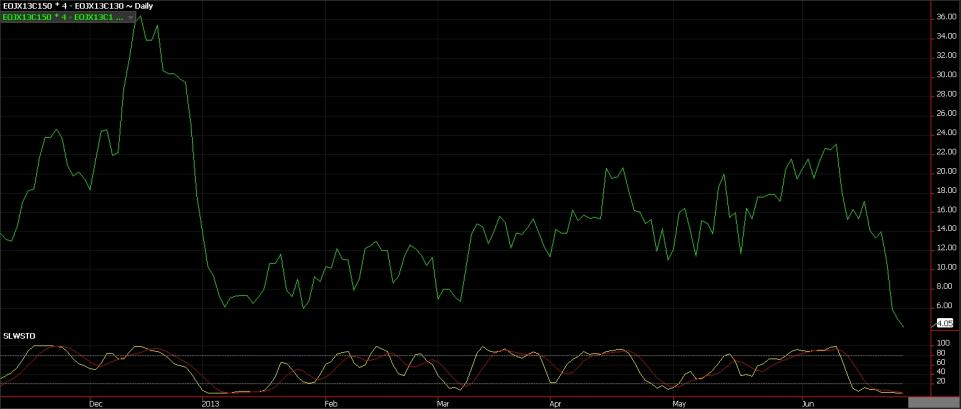

- Back ratio spread, forr example selling (1) November $130 call and buying (4) $150 calls. You should be able to pick up for $900ish per spread. Consider there will be higher transaction costs as there are (5) options in total. See chart of aforementioned spread below.