- Oil’s late decline is sentiment-driven, not related to economic fundamentals

- Supply is already at maximum capacity, with no short-term or long-term growth prospects

- Any pick-up in demand will break through the supply ceiling putting massive upward pressure on oil prices

During the third quarter oil prices have followed the market’s steady decline, falling by 25% since early July. And yet, oil supply seems to only be getting tighter and tighter with little-to-no chance of loosening any time soon. Supply is stalling while demand is set to pick up, hinting that the upshot in prices we saw as Covid restrictions loosened might happen all over again.

Bearish Sentiment, Bullish Fundamentals

Much like most other financial instruments in 2022, oil’s downward path has more to do with market sentiment than with supply and demand dynamics. The Federal Reserve’s aggressive policy, a benchmark for other central banks, has investors bracing for a recession. Its hikes have also pushed the USD to 20-year highs, making USD-priced commodities (such as oil) more expensive globally.

For weeks now, banks have begun to warn that oil markets will eventually read through the noise and return to economic fundamentals, where all factors point in the same direction: upwards.

JPMorgan is among the most bullish, with the bank’s oil and gas analysts saying they expect Brent to rebound to $101 by the end of the year. Goldman Sachs predicts Brent to reach $125 by early 2023. Morgan Stanley and UBS both revised their expectations downwards, yet their 4Q Brent targets remain at $95 and $110, respectively.

The common thread underlying the banks’ reasoning is tight supply. On all fronts, supply seems to be on a downward trajectory with no signs of growth.

The G7 is steaming ahead with a global oil price cap and the EU’s ban on seaborne Russian oil imports is set to be implemented by December 5th. Russia has already warned that it will refuse to sell oil to countries enforcing the price cap, leaving those aligned with the G7 struggling for supply. Russia will also likely face practical challenges in delivering oil to its ‘new’ buyers (i.e. India & China) given the freeze from Western insurance and tanker services. Either way, sanctions will limit global oil supplies.

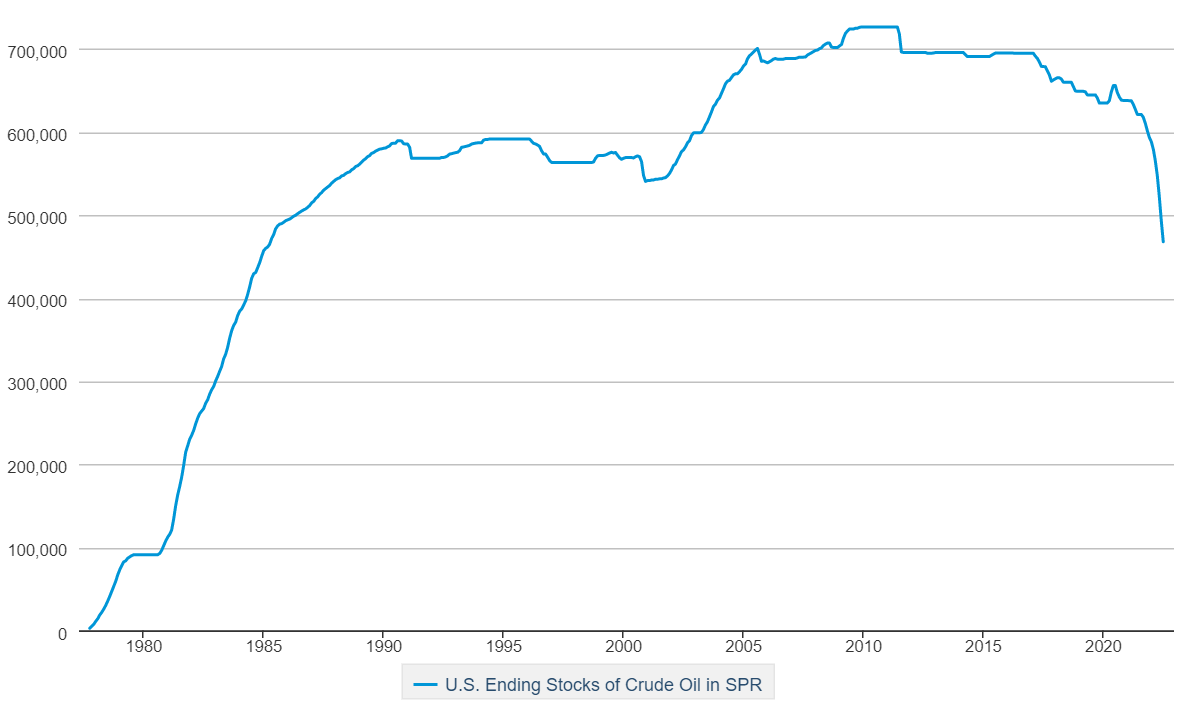

In the US, the Strategic Petroleum Reserve is at its lowest level in decades, causing worry in the White House. As of now, it seems that releases are set to fade out this fall, with final deliveries potentially reduced or even canceled.

Supply Side Pressure Continues

More bad news for the supply side - just last week rumors emerged that OPEC+ might reduce output should Brent drop below $90. Analysts estimate the cartel would need to reduce output by roughly 1m bpd to keep the price up. This comes after OPEC+ already cut their October target by 100k bpd, showing the group’s willingness to respond to changing market conditions. The cartel’s next meeting is on October 5th. With Brent currently at $85, a further cut in production targets shouldn’t come as a surprise.

An analysis of the supply factors paints a bleak image – the market is undersupplied, with little in the way of upside. As Saudi Aramco’s Amin Nasser warned, years of underinvestment in new oil production are beginning to make an impact. And, in this macro climate, energy capital expenditure is showing no sign of picking up. In fact, it is plummeting.

The slowdown in demand explains part of the market’s underestimation of global oil supply tightness. Yet, demand is bound to recover at some point and there are two situations that suggest that may happen sooner rather than later. 1) China (and its 1.4b people) remains largely under lockdown and is bound to reopen by the end of the year; 2) spiraling gas prices will lead to increased demand for fuels (including oil) in the generation of electricity.

The current equilibrium in oil markets is temporary and fragile, held in place by a step back in demand. Any step forward would break through the supply ceiling, putting massive upward pressure on price. It is not a matter of whether demand will recover, but when.

In my next piece, I’ll be sharing an energy company well-positioned to ride the demand recovery when it happens.

Disclosure: The author does not currently hold a position in any oil-related securities. This article is written for informational purposes only. It does not constitute a solicitation, offer, advice, counseling, or an investment recommendation.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »