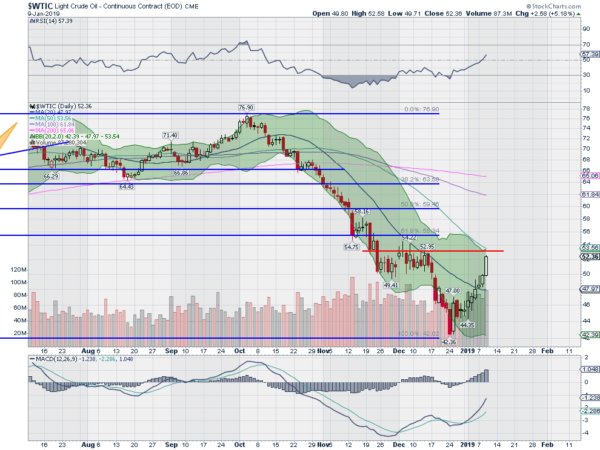

Crude oil completed a full retracement of the move higher from the June 2017 low to the September high on Christmas Eve. Since then there has been nothing but upside. Will it continue?

There is a strong story building in crude oil. After a tumultuous few months capped by high volume selling in November and December the reversal started to take hold. With only one day where the price did not go up, it is definitely due for a breather. But the path looks good for this move higher to continue.

A look at the chart above sees a potential road block along the way. Since mid-November the 53.00 to 53.25 area has played an important role. First as minor support on the way down, then more important resistance though early December. The price is nearly back at that level, which now happens to coincide with the falling 50-day SMA and the upper Bollinger Band®.

Will this stop crude oil in its tracks? Momentum seems poised to support more upside as the RSI drives up through the mid line and the MACD rises toward a shift to positive. And that Bollinger Band is starting to open to the upside. Time will tell, but the short-term future for crude looks rosy.