Interesting day so far, eh, folks? Looks like we bottomed about half an hour into the day, and the bulls have been gobbling up stocks ever since. That’s A-OK! I think July is going to be fantastic for the bears and for all the bulls buying up stocks at these prices—thanks! I want a grind-it-out decline, not a crash.

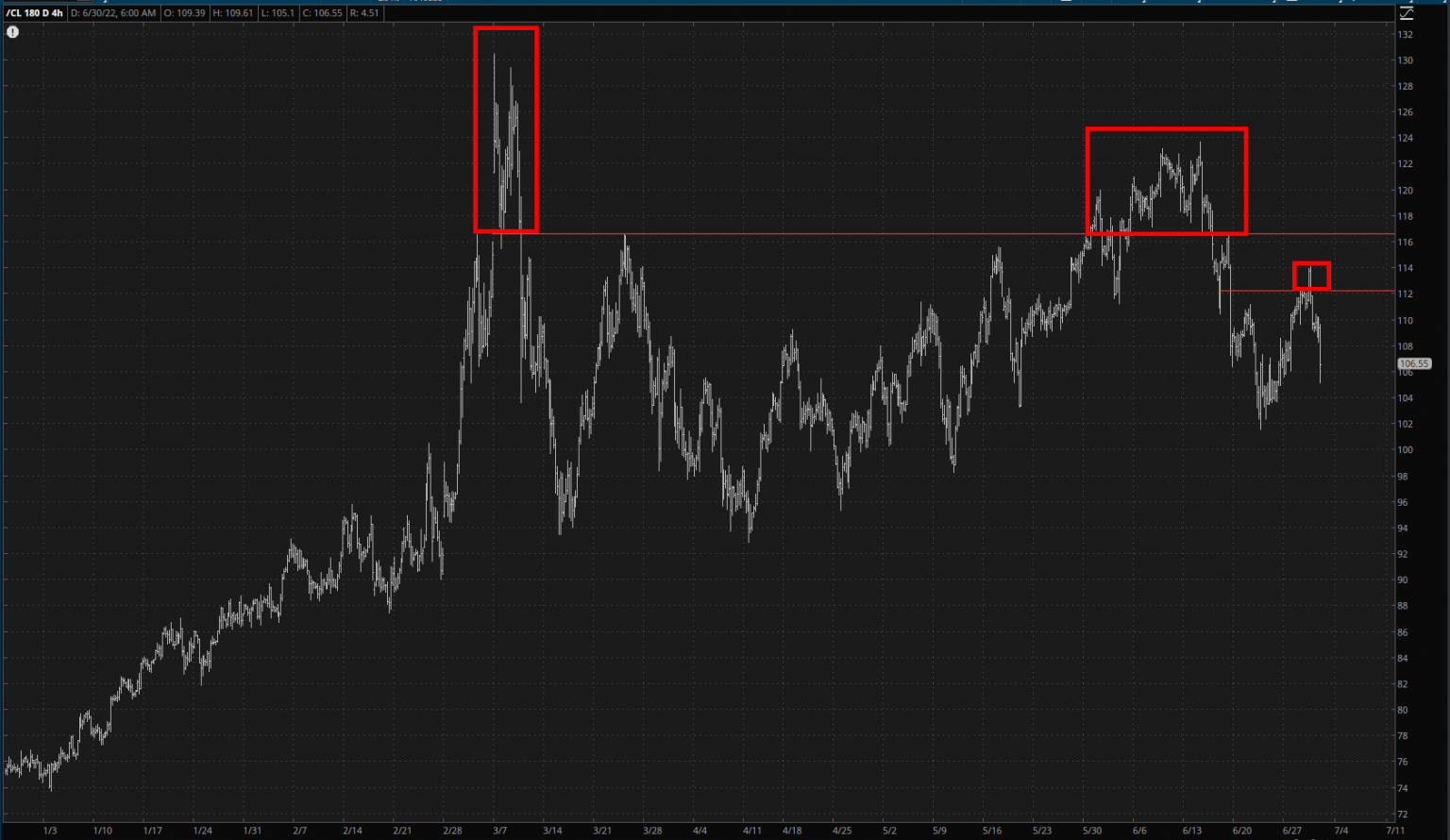

I agree with the notion that we’re back in the summer of 2008 again. Energy is a favorite sector of mine, and I am fully loaded up there. The war has been the driver, largely, but we keep getting one false breakout after another. In other words, oil is the last man standing, and as it falls, all assets will come along for the ride.

Specifically, I have SPDR S&P Oil & Gas Exploration & Production ETF (NYSE:XOP) September puts. I took profits on 25% of those earlier today, with every intention of getting back in more heavily if the price makes sense. The wedge failure is the shape of things to come.

Longer-term, you can see just how long-lived bear markets on the XOP can be.