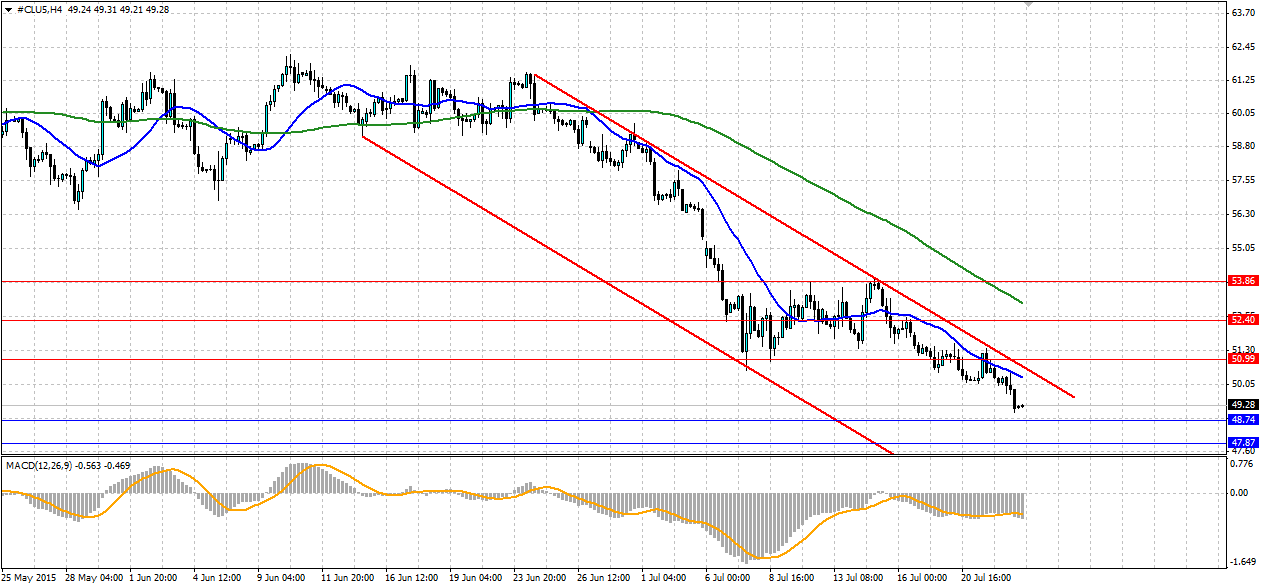

Oil has been trending lower as a bearish channel dominates proceedings. That is unlikely to change and the bearish sentiment sweeping commodity markets is only confounding things.

Source: Blackwell Trader

The glut of oversupply in the oil market has seen crude light swing back into a bearish channel that has taken the commodity back below the psychological $50 mark. The economic troubles in Europe and especially China have seen demand for oil tail off which is a worrying sign for oil producers. Further adding to the bearish pressure was the news that sanctions will be lifted on Iran which will open up its oil fields for investment, adding to supply. The outlook is bleak for oil unless we see a large number of producers drop out, or economic activity pick up in China. But in the short term, that is unlikely.

The channel has been tested several times on its way down to the current levels. Each time the bears have defended it strongly which shows the momentum behind this bearish run. The MACD indicator also shows the momentum with it remaining below zero for pretty much the entire length of the channel.

The angle of the 100 H4 SMA (Green line) also shows the momentum of the bearish movement, with the 20 SMA maintaining a fair distance away from it. The 20 SMA is also likely to act as another line of resistance along with the channel itself.

Oil will target an area of liquidity that is not far below the current price. The $48.74 handle has acted as a swing point for oil several times earlier this year, so we could see some increase volatility as the bulls draw a line in the sand. If this fails, as the momentum suggests it will, look for further support at 47.87 and 46.38. If we do see a shift in momentum, look for resistance to be found at $50.99, 52.40 and 53.86 further up. As above, watch for dynamic resistance along the channel and the two moving averages.