Oil markets continue to fall in the current market environment, one in which the bears have total control. But if you’ve been talking to traders, they are all waiting for the big bounce to happen and when it might happen.

The big bounce is the return of the bulls to the market. Something that has been missing now for the past 3-4 months and something that many traders will be eagerly rubbing their hands together over. I myself anticipate the return of the markets and a large bounce of some key support levels and one of those key targets is the 42.10 mark.

A lot of people will be asking if there are further falls in the market. The reality of such falls is likely given the fact that price currently sits at 45 dollars so there is still another leg lower.

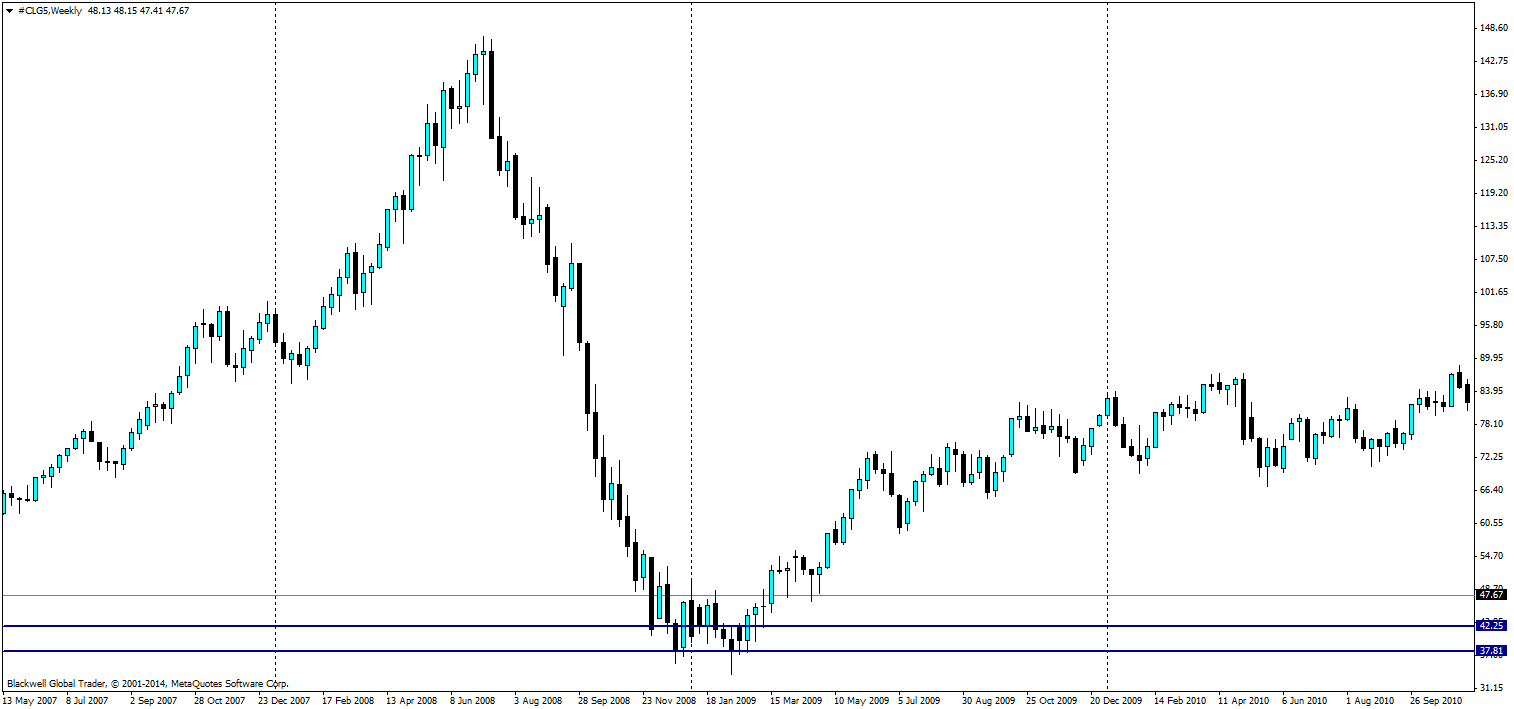

(Source: Blackwell Trader (Oil, W1))

As can be seen on this chart, there is ample support at 42.25 and 37.81; with 37.81 being the last possible leg lower that I can see at present.

The fundamental facts of oil are complex, but with so much oil gushing from the ground, it’s unlikely OPEC wants to make a move, and the next meeting for OPEC is not due till June. So market forces are likely to come into play and control the direction. The reason for this is easy to see. If OPEC reduces supply, then there competitors pick up the slack and make money as there is not enough demand at present. So instead OPEC is trying to price people out of the market altogether in the long run until it can restore some control.

Either way the days of 100 dollar barrels of oil may be over for some time, and long term OPEC forecasts out to 2040 show OPEC planning to keep oil at 100 dollars in real value terms for as long as possible. Anything higher only encourages renewable investment in the long run, and the world is already trying to ditch the addiction.

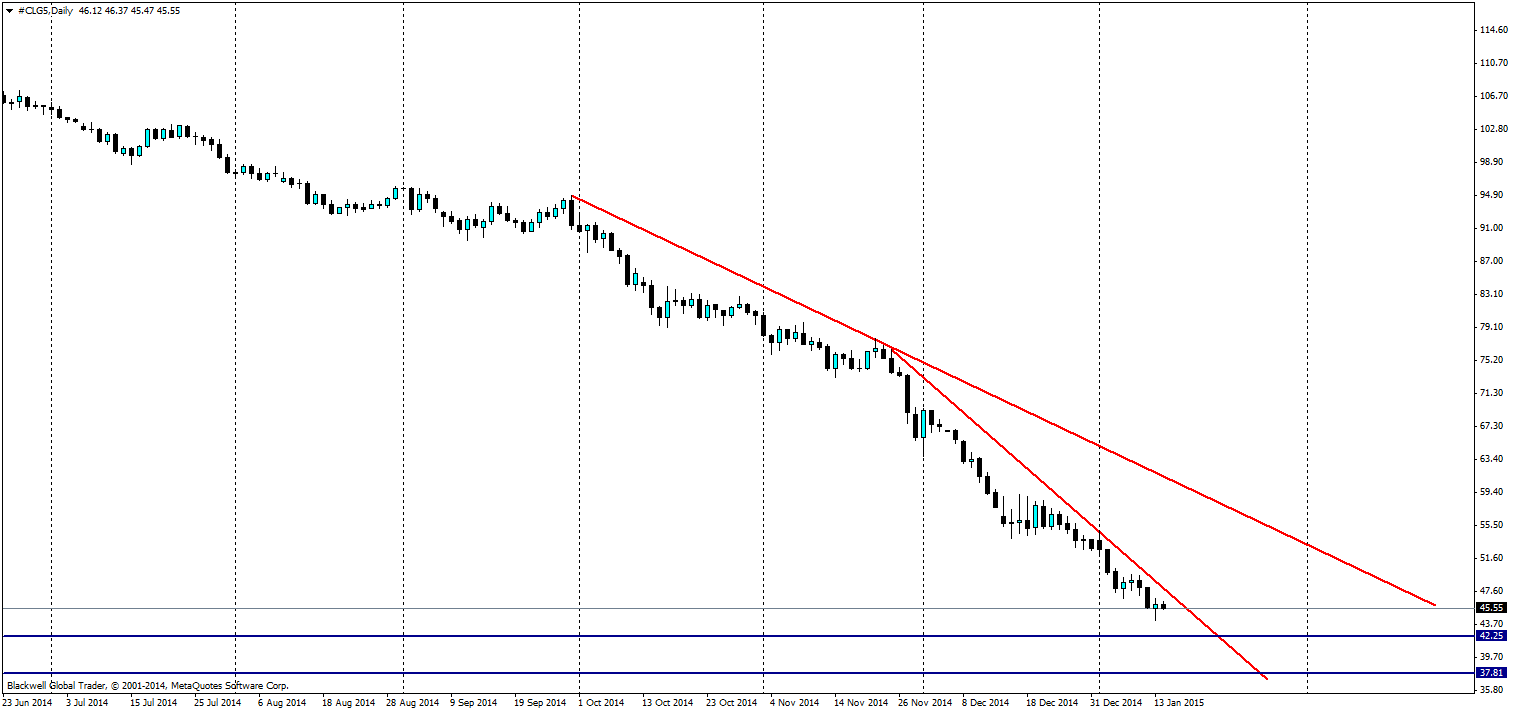

(Source: Blackwell Trader (Oil, D1))

The oil market is very much looking for that last touch and don’t think the market has stopped. Recent technical reports have pointed to the 42 dollar level, and I’m a stern believer in it holding up under pressure. The question is if it will hold when the market touches it. With no OPEC meeting till June the market could indeed hold out for some time and we could see a push into the low 30’s – setting historic lows in the process. However, I believe the real liquidity areas lie between 42 and 37 and we will see some changes for the bears.