Oil its one of the main drivers for the global economy and as much as people don’t like to talk about it, it really is a necessity that the global machine needs to run in order for our lives to function. Lately though, oil futures have been looking a little lack lustre after the recent US government debacle and economic worries. But should we be worried when it comes to trading oil futures – I think not.

The current global demand for oil is still gathering pace, as demand is outstripping supply. Even though the US has recently become the worlds largest oil producer; surpassing the likes of Saudi Arabia –this fact is a misinterpretation to the general public, as the US lags behind Saudi Arabi by 3 million crude barrels of oil a day.

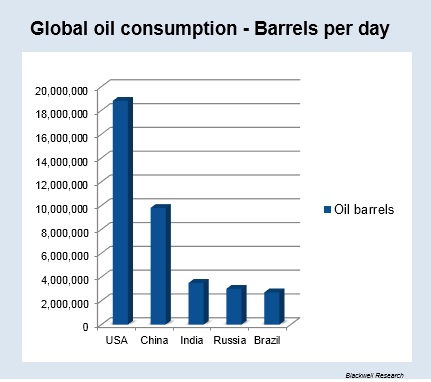

Current market conditions have never been better for the demand for oil. China recently overtook the USA as the world’s largest importer of oil, and this is likely to continue until at least 2015 according to analysts' estimates. Oil in itself is effectively supply and demand orientated, as demand spikes more oil comes on-line. However, it can’t come as fast the market likes (oil takes up to 5 years to get to market) and therefore we end up with prices above the general consensus like we have seen in the last 10 years.

Why do I say that prices will get steeper?

Current global consumption is at 89.74 million barrels a day in 2013 according to OPEC, and is expected to rise going on into 2014, as global economic growth is expected to be roughly 3.5%. In addition to this, China’s demand for oil is expected to increase further, as demand is expected to rise by 3-4% a year.

So when taking a look at one of the most traded oil instruments in the world WTI, there is plenty of opportunity abound. In the most recent week, the world teetered on the edge of a fiscal cliff as the US government shut down weighed heavily on global demand; as an economic shock could have sent oil markets plummeting.

With the economic drudgery behind us, I think now is certainly a good time to look at the oil markets. Currently the WTI market is getting close to breaking through its recent downward trend. I certainly see a strong case for it picking up, as the recent downtrend was in part to a possible economic shock from the US. The current Fibonacci levels show the 38.2 point acting as resistance and support for the market. Presently though, the market is stuck after the government shutdown was avoided. I would make the case that any serious oil trader will be watching these market movements to see if the technicals can come into play and break through the current trend line downwards.

The soft resistance level looks to be at 103.70, while hard resistance is likely to be found at 105.10 in the market. The 23.6 level will be a barrier that will be hard to cross, but the oil market looks strong enough currently to cross this threshold.

In addition to this, risk appetite is expected to pick up and will act further as a positive for oil growth globally. I would expect going into 2014 we can expect strong growth, and even the possibility of oil breaking through the strong point of 112.00 which seems to be the hard-line of resistance the markets fear to cross.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil: Futures Are Looking Brighter

Published 10/17/2013, 03:14 AM

Updated 05/14/2017, 06:45 AM

Oil: Futures Are Looking Brighter

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.