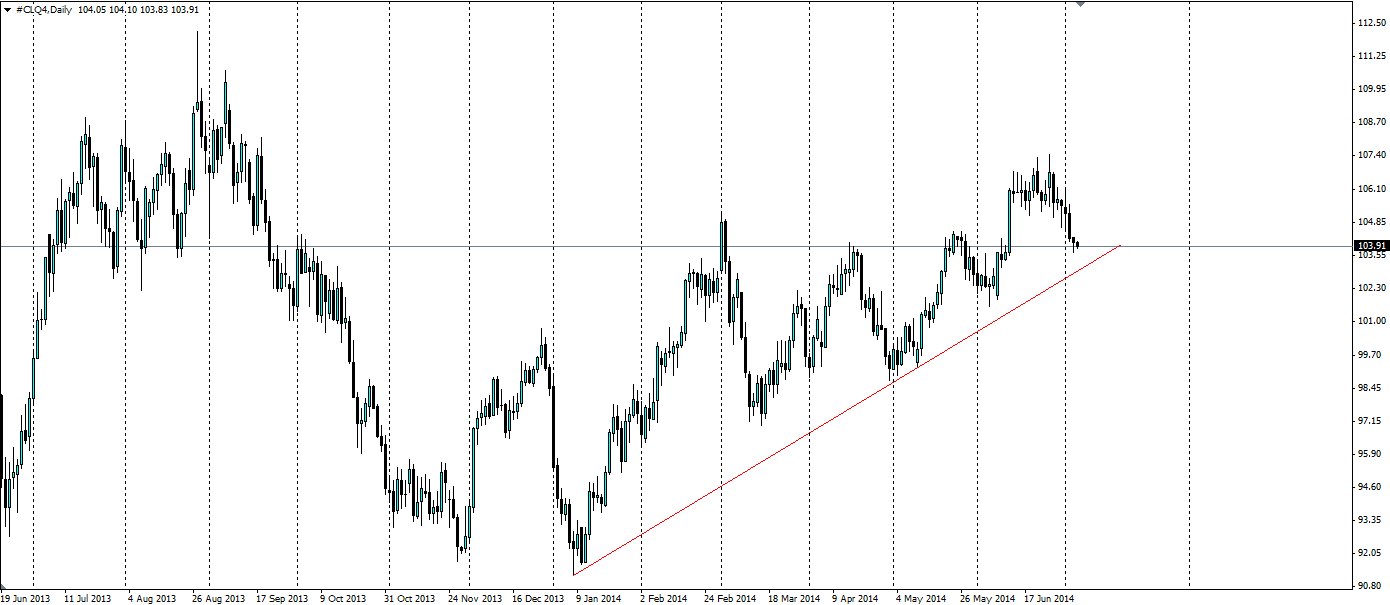

Oil has pulled back recently and is eyeing up the trend line that has been in play since January. A touch of this could provide a bounce higher or a breakout that will send oil down to its predicted long term price level.

The oil market, unlike many of the currency markets, was muted yesterday as the US Non-farm Payroll data added a healthy dose of volatility to the USD. The US Economy (excluding the farming sector) added 288,000 jobs in June, up from 217k in May. This is an impressive result for the US and is hopefully a sign that the recent dismal GDP figure (of -0.73% in Q1) is only a blip. Surprisingly, the price of oil fell on this news. It also fell when the data showing US stockpiles of crude oil were down 3,155,000 barrels last week, almost a million more than expected. The simple answer is risk.

The recent tensions in Iraq seem to have tailed off slightly. There was a tangible fear that Iraq, and the regions that produce oil, will be engulfed in an all-out civil war, but these fears seem to have abated for now. There certainly is a risk that this still could happen, but the general global risk outlook has calmed down, as reflected in the recent pullbackin oil prices from nine month highs’ around the $107 a barrel level. This leaves us a shade above the trend line and the likelihood is that oil will test it.

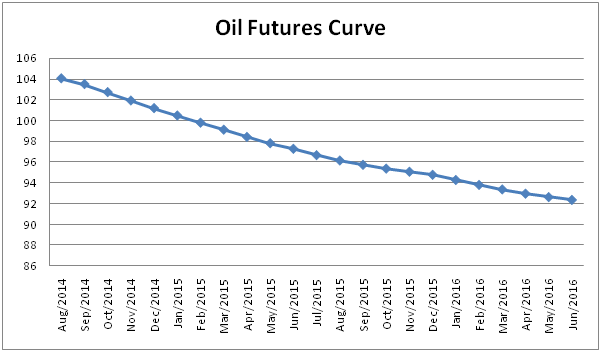

The long term outlook for oil is a decidedly negative one. The below futures curve shows that by June 2016 we can expect the price of crude oil to be around $91 a barrel. Futures curves are not a crystal ball showing the future prices, but they are an indication of market sentiment and expectations. In this case the market is long term bearish on oil.

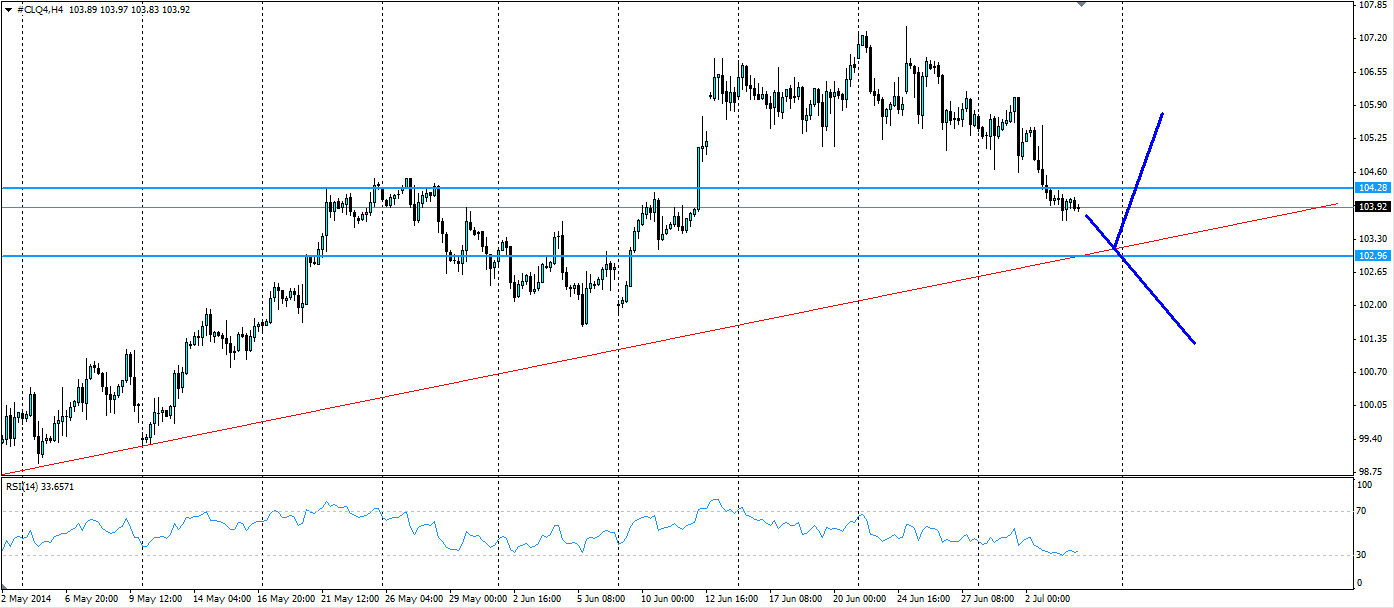

So the trend line is likely to be tested, and long term is likely to break down as the price heads back below the US$100 mark. But in the absence of any market shaking news, oil is likely to trade of technicals and bounce higher off the bullish trend line.

Luckily, we can take advantage of both situations. A stop buy above the current resistance, or above the price when it touches the trend line, will take advantage of a bounce off the bullish line as the price trades off technicals and it moves higher. A stop sell below the trend line will take advantage of a breakout of the trend line from a reduced global risk outlook as the price pushes lower to the long term expected price levels.

Either way we should see the price of oil test the support along the long term trend line. Savvy traders will set up to take advantage of this key dynamic support level.