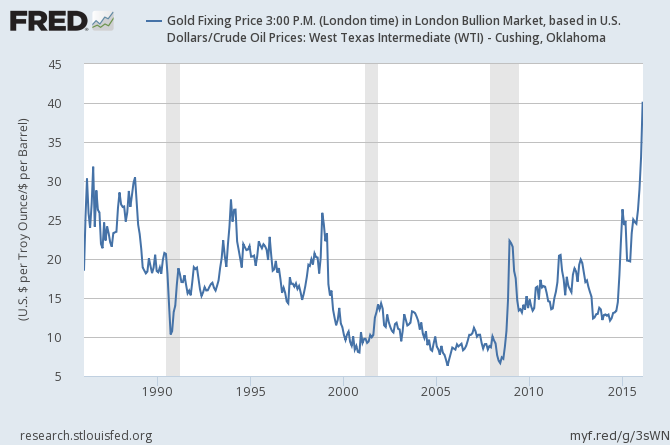

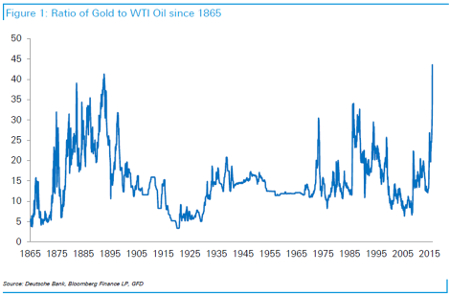

Oil is at the lowest level relative to gold of the last 30 years, when the Fed data series begin. Deutsche Bank (DE:DBKGn) has calculated the series back to the Civil War. Based on their work, an ounce of gold buys you more barrels of oil than anytime since 1892. An ounce of gold currently buys you just over 42 barrels of oil.

For me, this indicates an oil supply-demand issue more than some massive, global deleveraging and shrinking of money supply. At present this is a micro economic event that, unfortunately, could have systemic, macro economic implications. Some of the recent volatility can be attributed to the markets contemplating potential financial sector fallout from the energy sector blood bath. As they do, remember, though an ounce of gold is easier to store than 40 barrels of oil, this may be the sale of the century. I’m fairly certain a group of value hunters and bargain shoppers are circling and licking their chops.