The fundamentals on crude are still rather bearish and should make $100 a barrel nothing but a pipe dream (if you’ll excuse the pun). But there is a potential for an upside trade on crude oil in the short term, as a falling wedge suggests a bullish breakout may be in the cards.

There is still plenty of oil sloshing around the markets, which is no secret; there is plenty of data to look at that will tell you this. The latest API figures show an inventory build at Cushing of 1.3m barrels, versus the expected -1.2m. Oil pushed to the lower end of the wedge as a result.

Further adding bearish pressure were US rig count figures, which showed a drop of just a single rig. The recent rise in oil prices may have taken some pressure off producers on the borderline of closing. As always, watch for the Energy Information Administration crude inventory figures due later today as they will no doubt add volatility to the commodity.

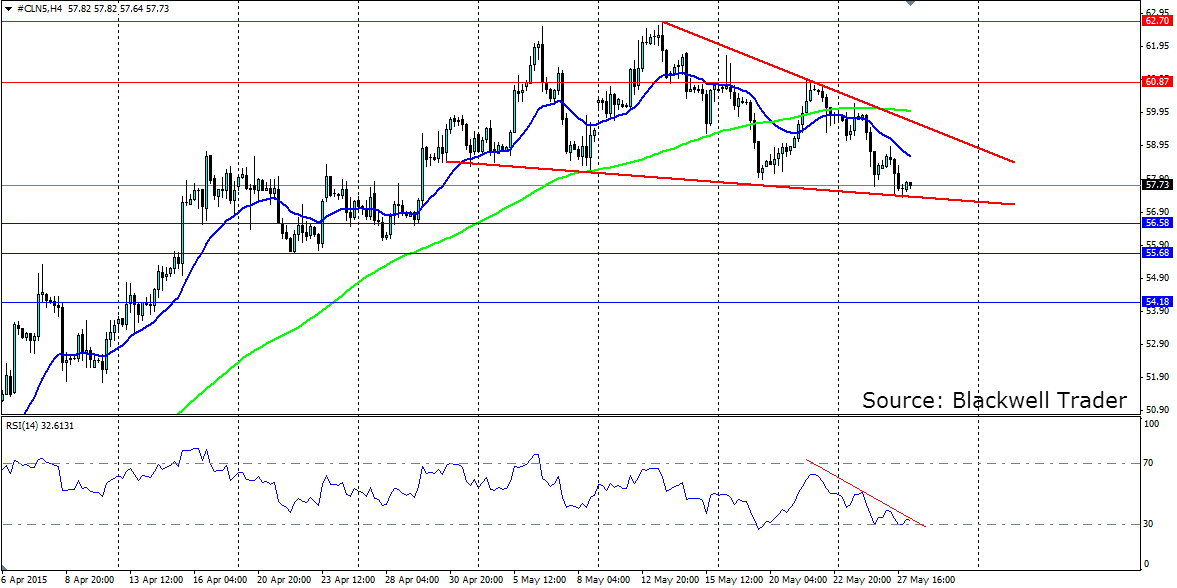

To technicals, and we can see a squeeze occurring in the price of June WTI futures contracts, from the highs seen in Mid May, to the low found yesterday. The text book case of a falling or descending wedge during an uptrend is for a bullish breakout and a continuation of the uptrend. The RSI appears to support an upside push as it consolidates just above oversold.

If we take a bullish bias, look for a strong bounce off the bottom line of the wedge and further consolidation within it before a breakout upwards. A bullish breakout will see a continuation of the recent bullish trend, which will certainly put the highs at $62.70 under pressure and could even stretch over the $64 a barrel mark, i.e. the width of the wedge. Firm resistance will be found at $60.87, the highs at $62.70 and further out at $65.98

Conversely, if fundamentals hold, we could see a bearish breakout that will invalidate the recent bullish trend. The recent double top pattern and the moving averages turning downwards would support a bearish bias. Support will be found at $56.58, $55.68 and $54.18.