Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.21 and initial downside target at $43.37) are justified from the risk/reward perspective.

Crude Oil started this week with a quite sizable (over 4%) rally and the move higher was accompanied by relatively high volume. Can we expect to see higher crude oil prices shortly?

Not really, and even if this is the case, it seems that more declines would still follow. Let’s take a closer look at the chart:

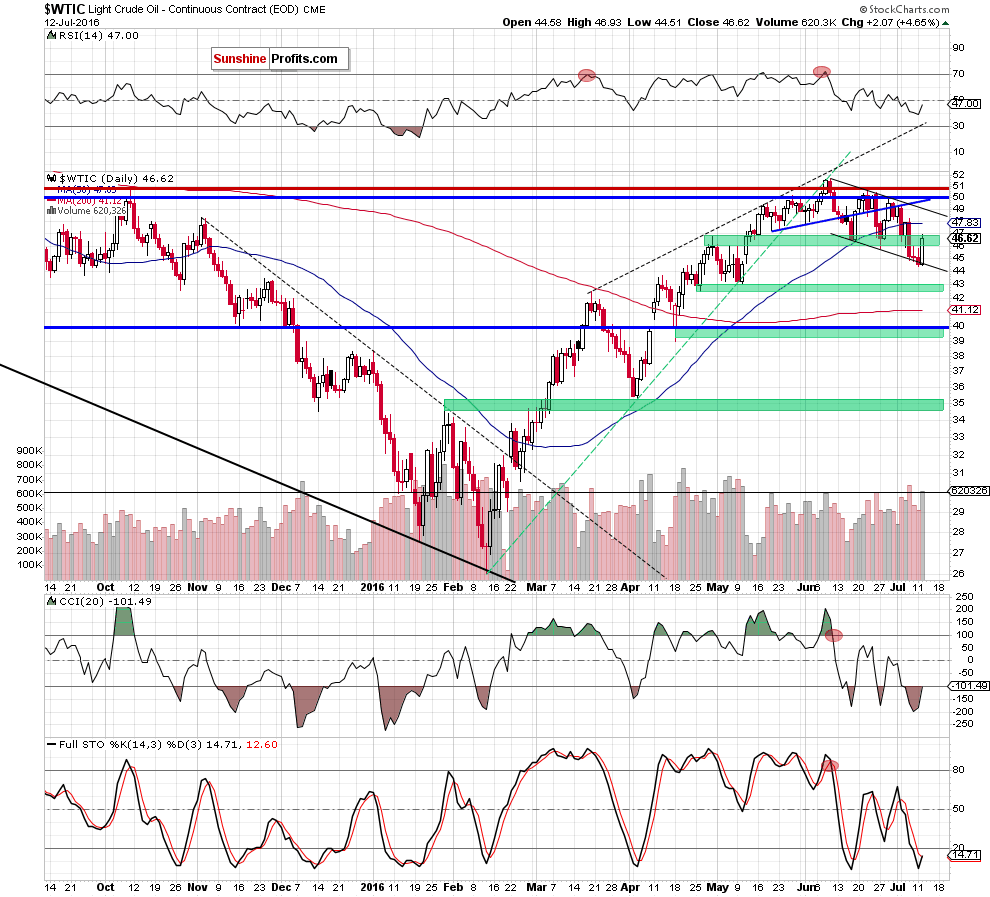

The volume that accompanied Tuesday’s upswing was indeed significant compared to what we saw in the previous few days, but please note that we saw similar spikes in volume close to local tops during both this year’s move higher and last year’s decline. For instance, in late November 2015, crude oil topped right after the big-volume session.

As far as the price move itself is concerned, crude oil moved to the green resistance area that it broke just a few days ago. There was no breakout above it, so technically nothing changed. More importantly even if crude oil moves higher, the declining resistance line (currently at about $49) and the previous 2016 high are likely to stop the rally. Naturally, the above rally higher does not have to happen and today’s pre-market decline seems to confirm it.

Summing up, Tuesday’s move higher didn’t cause crude oil to break even above the closest resistance area, so it didn’t change anything. The outlook remains bearish.

- Very short-term outlook: bearish

- Short-term outlook: bearish

- MT outlook: bearish

- LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54.21 and initial downside target at $43.37) are justified from the risk/reward perspective.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.