Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

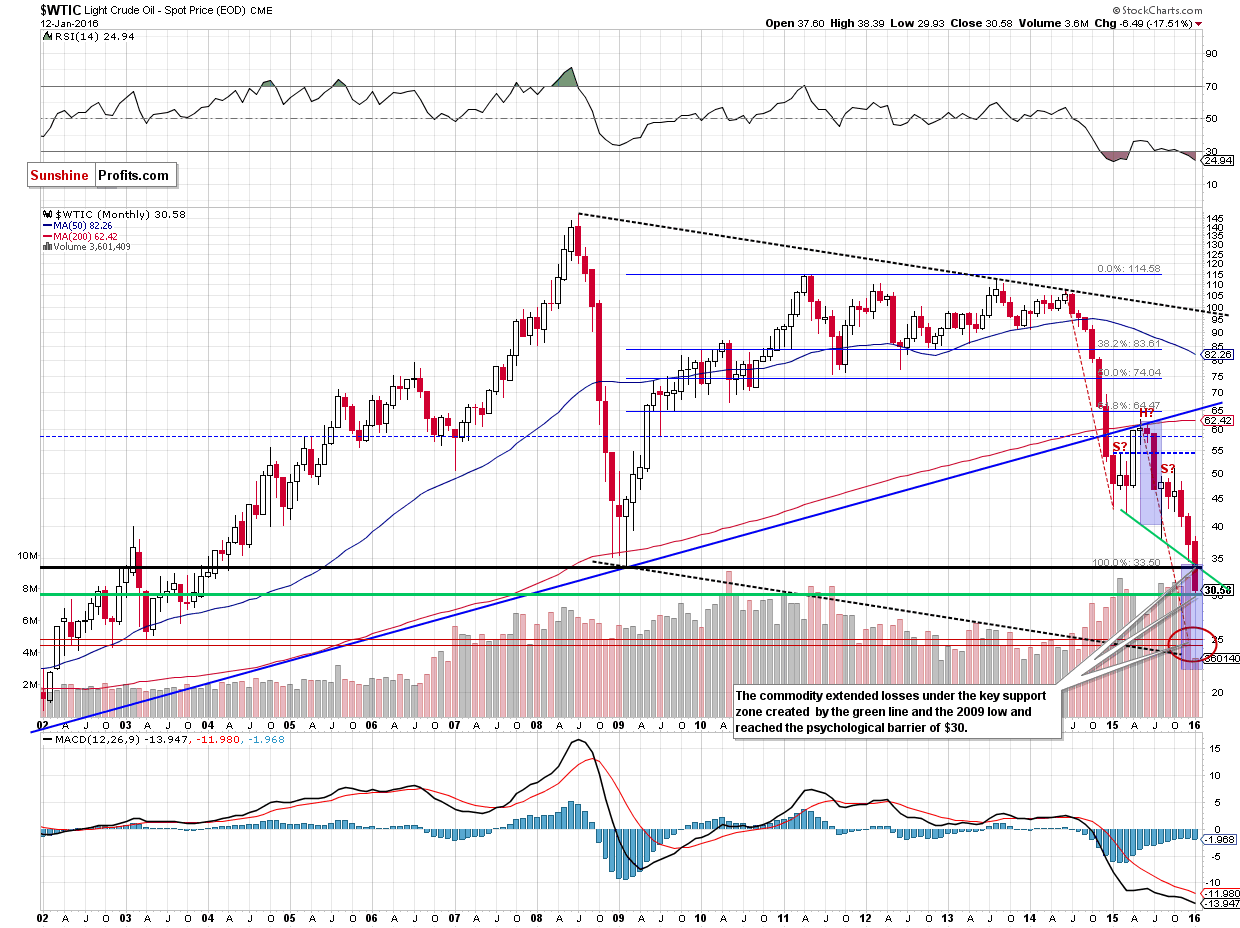

On Tuesday, crude oil lost 1.77% ahead of the release of the API weekly inventory report. As a result, light crude slipped slightly below the barrier of $30, hitting a fresh multi-year low of $29.93. What’s next?

Yesterday, crude oil extended losses on worries that the weekly API report would show a build in crude oil inventories. Meanwhile, the report showed that crude stockpiles dropped by 3.9 million barrels, beating analysts' expectations for an increase of 2.5 million barrels. Additionally, official data showed that China’s imports and exports declined less than expected, while country’s trade surplus widened to $60.09 billion in December. Thanks to these numbers, crude oil futures rebounded earlier today. What does it mean for the commodity? Let’s take a closer look at the charts and find out what can we infer from hem about future moves (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

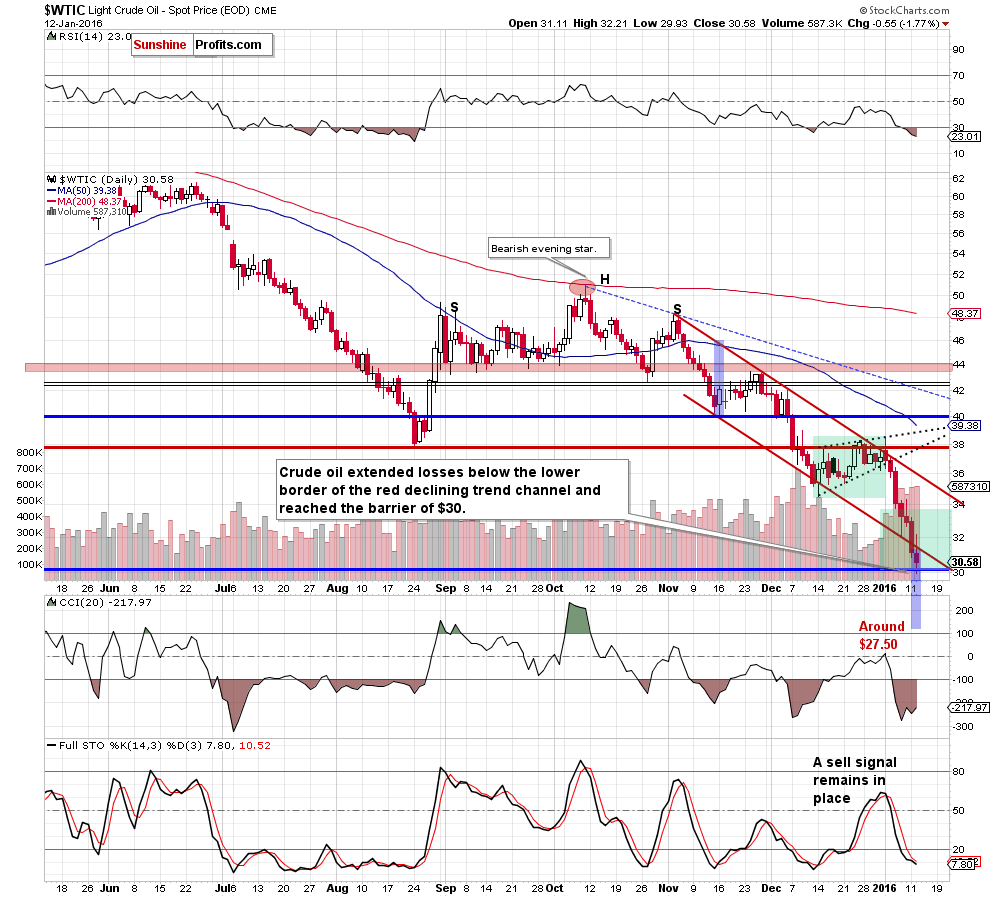

(…) crude oil dropped (…) under the lower border of the red declining trend channel. This is a strong bearish signal, which suggests a test of the psychological barrier of $30 in the coming days – especially when we factor in the sell signal generated by the Stochastic Oscillator and the long-term picture. Additionally, please keep in mind that yesterday’s downswing materialized on huge volume, which confirms oil bears’ strength.

Looking at the charts, we see that the situation developed in line with the above scenario and crude oil hit a fresh multi-year low of $29.93. Despite this drop, the commodity closed the day slightly above the barrier of $30, invalidating earlier small breakdown.

Taking this fact into account, and combining it with the current position of the daily indicators (the RSI dropped to its lowest level since the end of Aug, while the Stochastic Oscillator is oversold), we think that corrective upswing is just around the corner. Additionally, there were seven consecutive sessions in which crude oil lost more than 17% (making our short positions more profitable), which increases the probability of a rebound – especially when we factor in the proximity to the barrier of $30.

As you see on the daily chart, a drop to the barrier of $40 encouraged oil bulls to act, which resulted in a corrective upward move. Therefore, in our opinion, if crude oil moves higher from here, the initial upside target would be around $33.16, where the 38.2% Fibonacci retracement (based on the Jan decline) is.

Summing up, crude oil moved lower once again and reached the barrier of $30, which could trigger a corrective upward move in the coming days. Taking this fact into account we think that taking profits off the table is the best investment decision at the moment (we opened short positions when crude oil was trading around $38).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.