Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil gained 1.30% as investors continued to cover their short positions. In this way, light crude climbed to an intraday high of $37.88 and reached the Aug lows. What does it mean for the commodity?

Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Quoting our Oil Trading Alert posted on Monday:

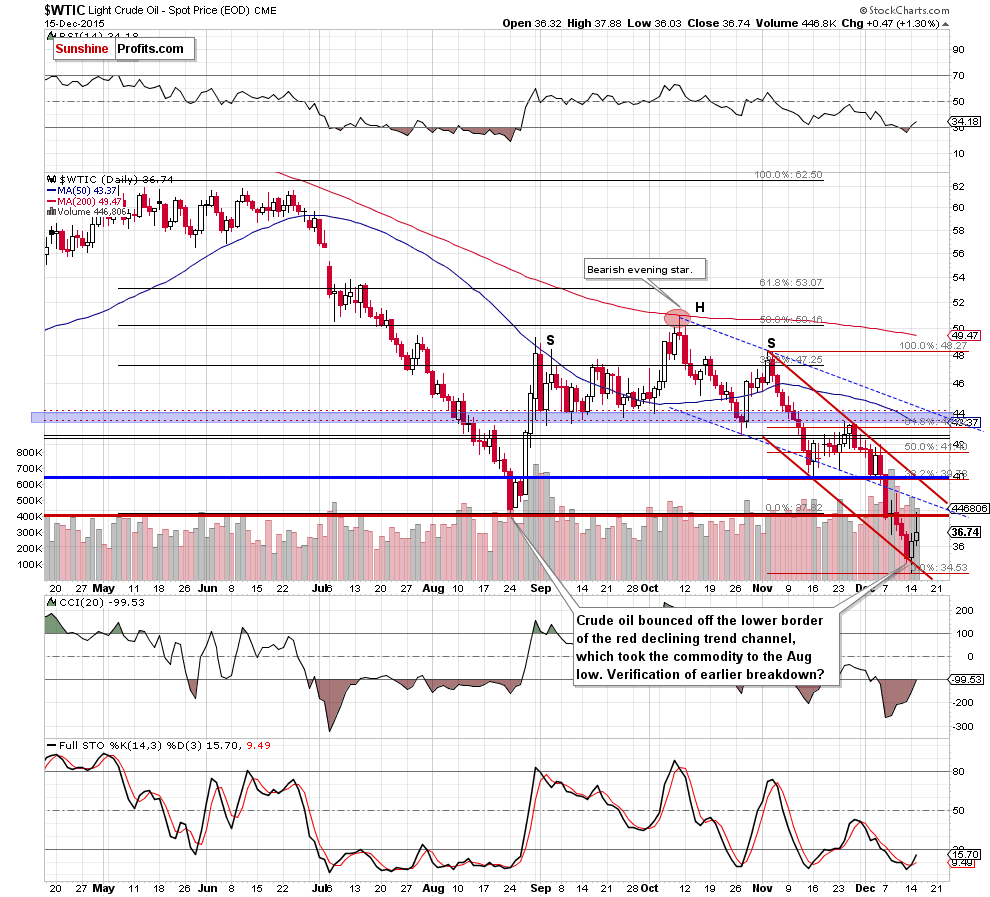

(…) the combination of the lower green support zone around $35.13-$35.52 and the neck line of the head and shoulders formation (marked with black) could be strong enough to pause further declines and trigger a rebound from the current levels (please note that this area is also reinforced by the lower border of the red declining trend channel marked on the daily chart). If we see such price action, the initial upside target would be around $37.75-$38.52, where the Aug lows are. If this resistance area is broken, we may see an upward move even to the barrier of $40.

As you see on the daily chart, oil bulls pushed the commodity higher as we had expected. With this upward move, light crude reached our initial upside target, but then pulled back slightly and closed the day under the Aug low. This suggests that the recent move could be a verification of earlier breakdown under this important level. In this case, further deterioration should not surprise us. Nevertheless, the current position of the indicators (they all generated buy signals) suggests that oil bulls will try to push the commodity higher. If this is the case, and crude oil breaks above the red horizontal resistance line (based on the Aug low), we’ll likely see an increase to our next upside target - the barrier of $40 (please note that this area is also reinforced by the 38.2% Fibonacci retracement based on the Nov-Dec declines).

Summing up, crude oil extended gains and reached the Aug low. Although this move looks like a verification of earlier breakdown (a bearish signal), the current position of the indicators suggests that oil bulls will try to push the commodity to our next upside target - the barrier of $40, which is currently reinforced by the 38.2% Fibonacci retracement based on the Nov-Dec declines. Consequently, in our opinion, the medium-term trend remains down and lower values of the commodity are still ahead us. Therefore, we’ll likely re-open short positions at higher prices (after crude oil will finish its corrective upswing) in near future.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.