Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective.

On Thursday, crude oil moved higher on news that OPEC could extend its output-cut deal to non-members after concerns over a surge in U.S. crude and shale production increased. Thanks to these circumstances, light crude climbed to $54 and re-tested the key resistance zone. Will we see another reversal and declines in the coming days?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

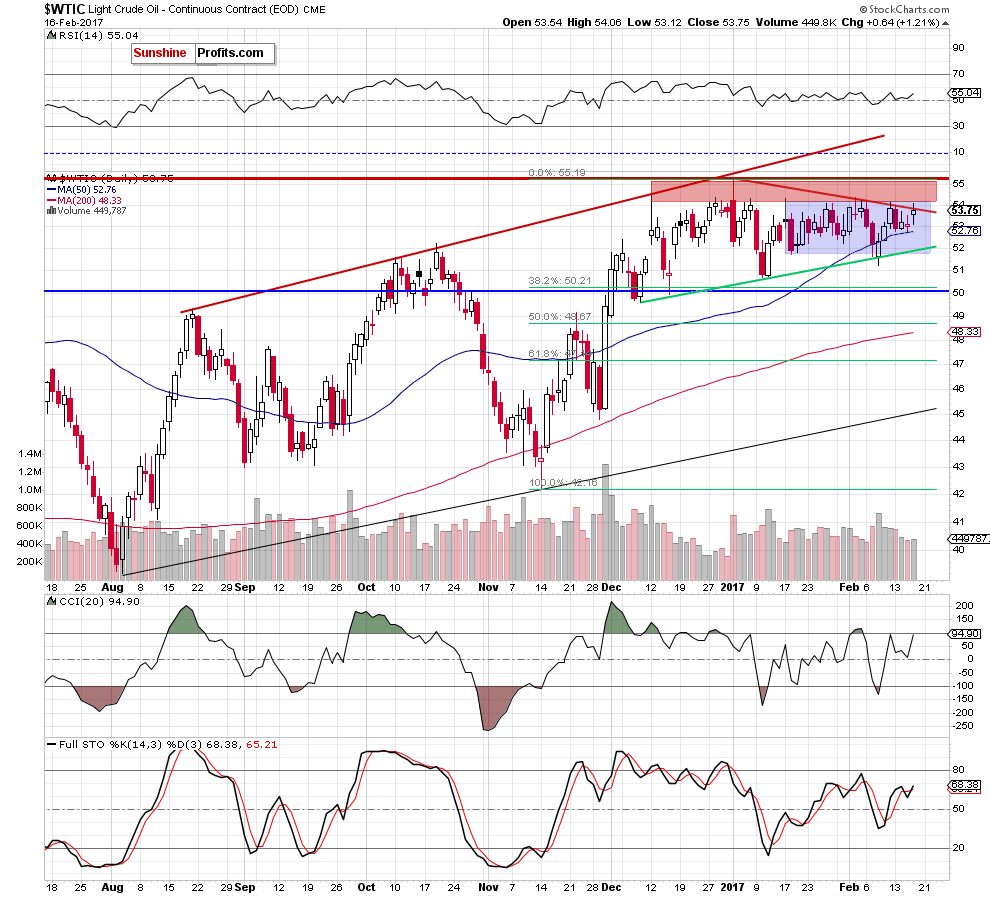

The overall situation in the medium term remains unchanged as crude oil is still trading in a narrow range between the red gap on the north and the previously-broken long-term red line on the south. Today, we’ll focus on the very short-term changes.

From this perspective, we see that crude oil extended gains and came back to the short-term red declining resistance line (based on the previous highs) and the lower border of the red resistance zone. On the daily chart, we see that this area topped oil bulls several times in the past, which suggests that the history will likely repeat itself once again and we’ll see another reversal and decline in the very near future.

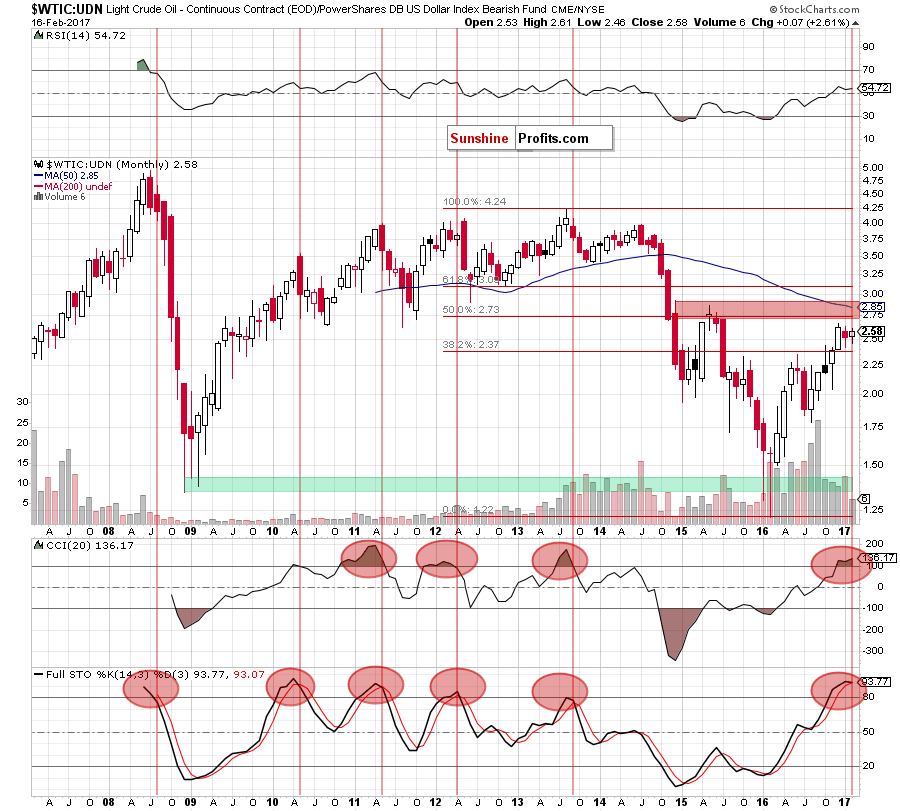

This scenario is also reinforced by the current situation in the WTIC:UDN ratio. As a reminder, UDN is the symbol for the PowerShares DB US Dollar Bearish (NYSE:UDN), which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of the dollar's exchange rates with world's most important currencies, the WTIC:UDN ratio displays the value of crude oil priced in "other currencies".

From the long-term perspective, we see that the ratio is still trading under the red resistance zone (created by the 50% Fibonacci retracement, May, Jun and Jul highs and reinforced by the 50-month moving average), which suggests that reversal may be just around the corner.

This scenario is also reinforced by the current position of the indicators, which increased to the levels not seen since 2013. As you see, in all previous cases (marked with red) such high readings of the indicators preceded bigger or smaller downward moves, which increases the probability of declines and lower prices of the commodity.

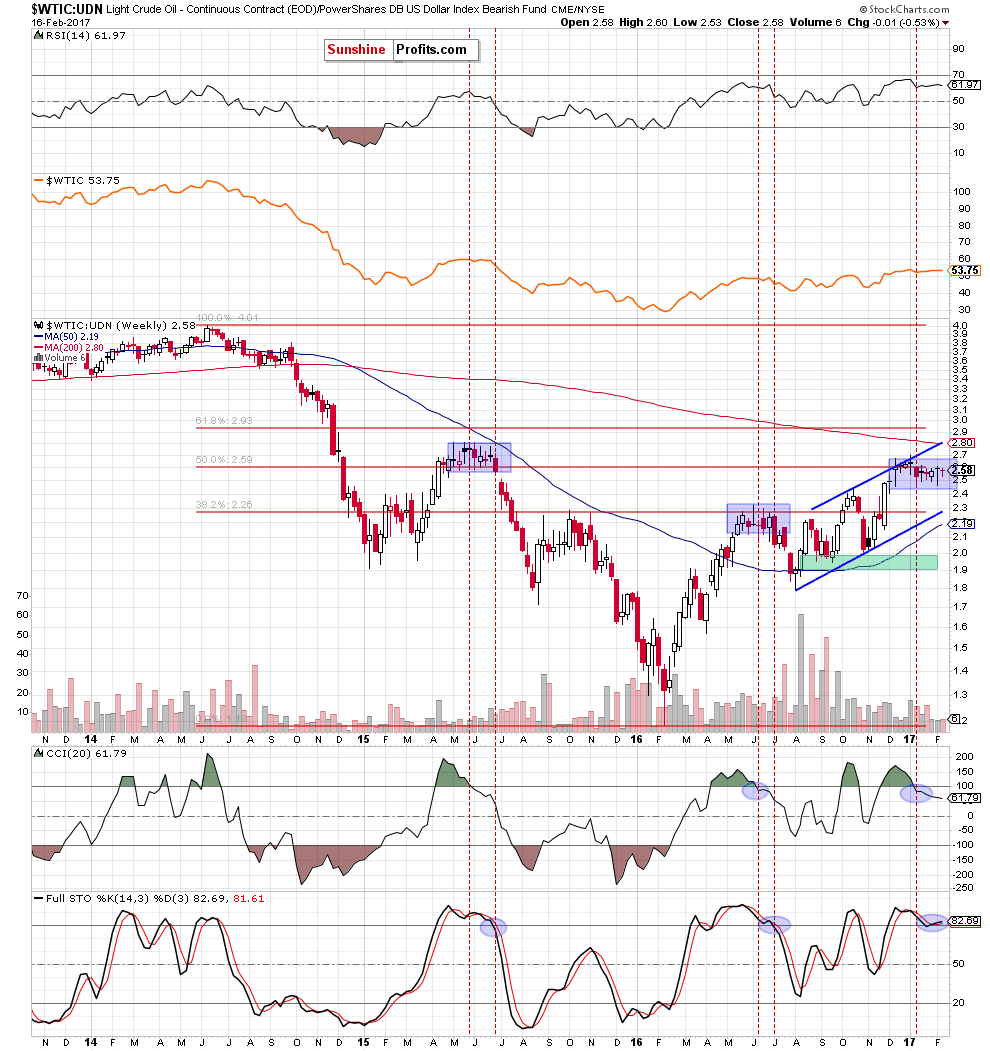

On top of that, the picture, which emerges from the medium-term chart also doesn’t bode well for higher values of the ratio and crude oil priced in U.S. dollars.

Looking at the weekly chart, we see that although the ratio moved higher in the previous week, it still remains in the blue consolidation under the previously-broken 50% Fibonacci retracement and the upper border of the blue rising trend channel, which suggests that oil bulls may be not as strong as they were in the previous months. Additionally, the CCI generated the sell signals (while the Stochastic Oscillator is very close to doing the same), increasing the probability of a bigger decline in the following weeks.

Finishing today’s alert, we would like to draw your attention to the fact that the ratio is consolidating under the resistance zone similarly to what we saw in 2015 and 2016. In both previous cases, they preceded anther move to the downside. Additionally, the sell signals generated by the CCI preceded sell signals in the Stochastic Oscillator and the acceleration of declines appeared after the latter indicator dropped below the level of 80. As you see, the Stochastic Oscillator is currently slightly below this level, which suggests that another move to the downside is just a matter of time.

Summing up, short positions continue to be justified as crude oil remains under the red resistance zone created by the recent highs and the red gap marked on the weekly chart, which together continue to keep gains in check since the beginning of the year. Additionally, the pro bearish scenario is also seen from the non-USD perspective, which increases the probability of declines in the coming week.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $56.45 and an initial downside target at $45.81) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.