Gold (ARCA:GLD) and oil (NYSE:USO) both have long histories. Both have taken a turn as a consolidator of power and wealth. And both have withstood the test of time. The last few years though they have become very interesting commodities in a different way. gold quit a 10-year uptrend. It has moved slightly down or sideways for nearly 4 years now. And oil went from being the commodity that would give the US energy independence through shale to crashing and burning with over supply and strong substitutes like solar and wind.

But gold and oil have a relationship together as well. Lately that relationship had swung in favor of gold. But with the start of 2015 that has begun to change. And now the ratio of the two commodities stands at an important level.

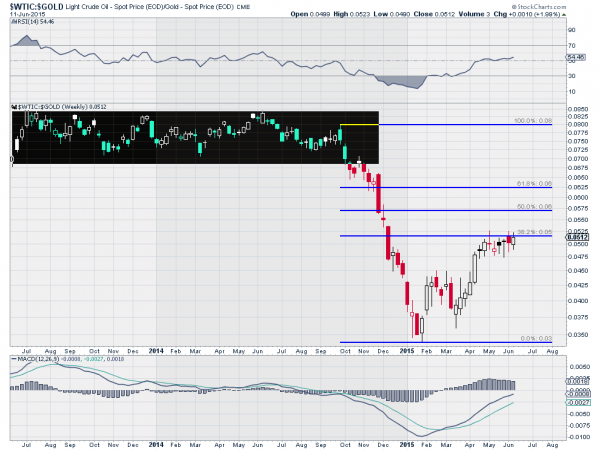

The oil-to-gold ratio chart above shows that relationship. from 2013 almost until the end of 2014 it was very stable between a ratio of 0.070 and 0.084. But then when oil started to implode the last half of 2014 the ratio fell with it. All the way to a low 0.030 in January 2015. Where oil was cut in half the oil to gold ratio took an even bigger hit.

Fast forward to today and the ratio has bounced substantially. In fact it has retraced 38.2% of the move down. This is an important retracement in the ratio. It is often a level where a bounce will fail. So a move through this level will be a sign of strength. And the momentum indicators support that happening. The RSI is rising through the mid line while the MACD is rising too.

In simple terms this can mean that Oil continues higher or Gold continues lower or both happen. In a more complex world the ratio can continue just by both moving in the same direction (up or down) but with one moving faster than the other. What cannot happen for the ratio to continue higher is that Oil falls and Gold rises. Seems a pretty simple trade to make when 4 of 6 outcomes go with the current movement.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.