Last night’s oil market movements had two great technical features.

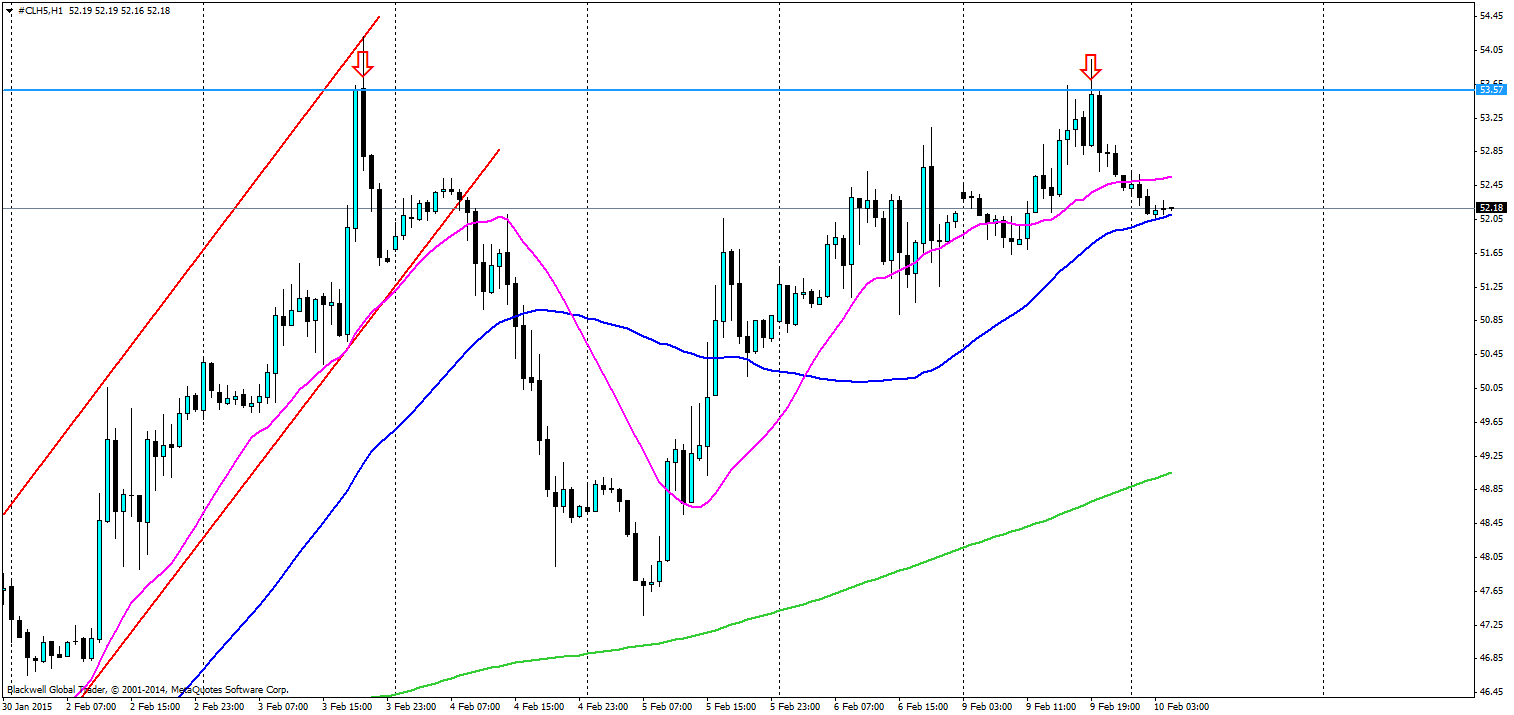

Firstly, a strong double top has formed on the charts as of late when it comes to oil. Last night's strong bullish trend hit rocky water when it hit the key resistance level at 53.57, ever since then the market response has been strongly bearish.

While the market has started to trend back down many will be looking for a sign to jump back in with the bulls long term, and that may be a false move as the long term trend line, as can be seen below is still quite strong.

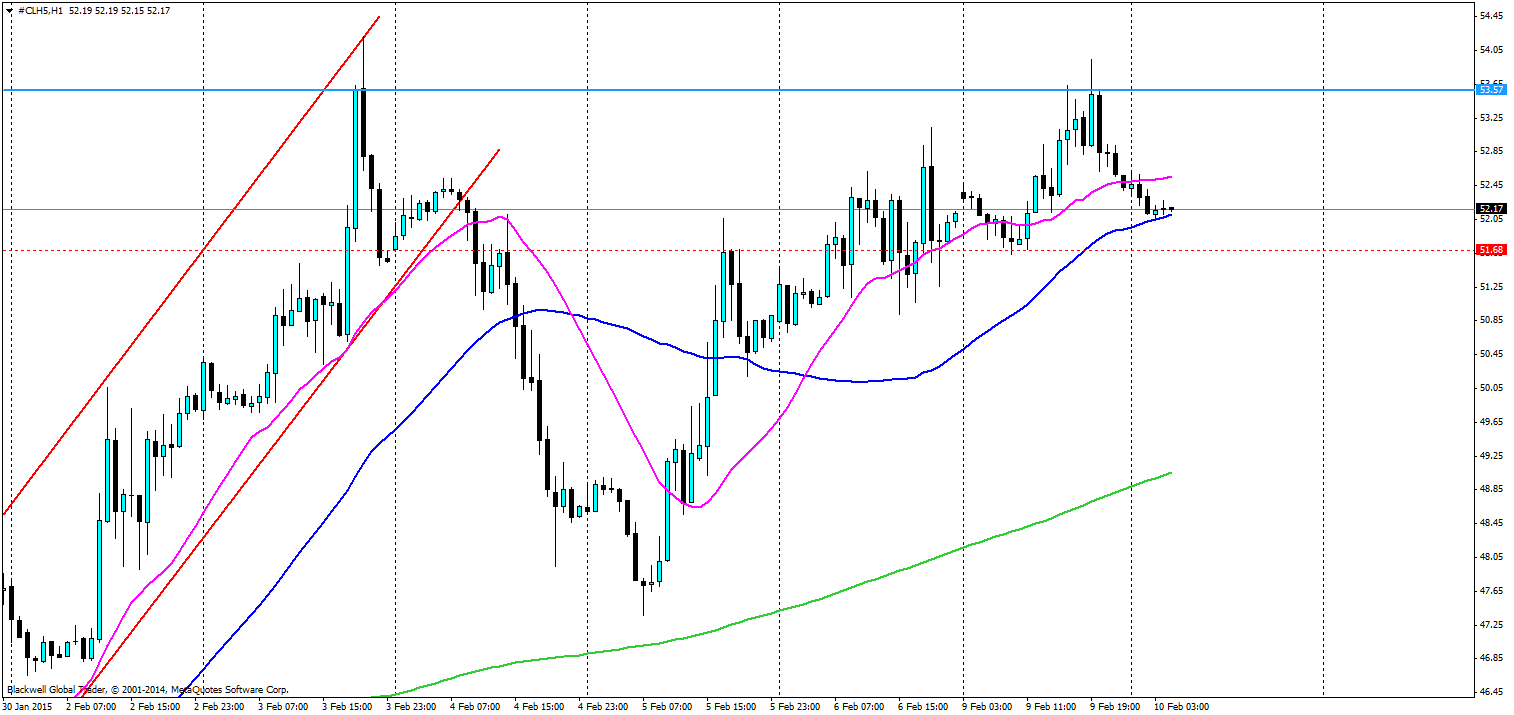

The market is now looking to move lower and 50 day MA will be the one to watch, as a breakthrough of this level would be a very bearish signal for the market. Short term, a break of the 51.68 level would be a likely move before a bounce, but I would be looking for this to break completely and a run down to the 200 MA level.

In the long term the markets are still taking into account oversupply, and it’s likely this won’t change until at least Q3 in 2015. Technicals are going to be the dominating feature until then as OPEC looks likely to ride this one out, and as the market plays its hand in a world which struggles to grow and looks to debase itself further.