US dollar strength is reigning supreme across all markets at the moment and oil is no exception. One key level of support has recently broken and that could lead the price lower with supports being tested along the way.

(Source: Blackwell Trader)

The oil market has largely priced in the oversupply and has come to expect ever increasing crude oil reserves. Even last week’s 10.4m barrel surplus only provided a $1.60 fall when 6 months ago that would have resulted in a drop 5 times as large.

Supply is showing some signs of slowing, which could provide a little bit of strength. The EIA expects US supply to grow at 3,000 barrels a day for April, compared to 98,000 barrels a day seen in February. The market could be responding to lower prices.

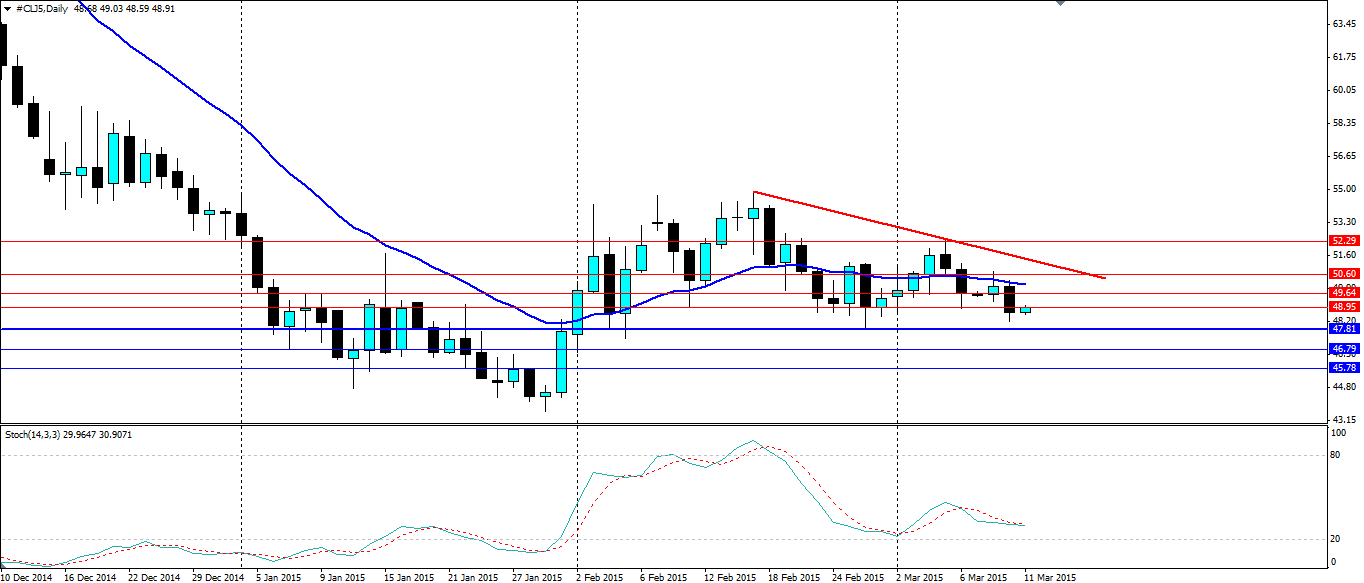

But crude is priced in US dollars and when the dollar goes up, oil must come down. The weak euro and the Fed talking up an interest rate hike mid-year has sent the bulls piling into the dollar index which is bad news for oil bulls. The short term bearish trend currently in play has already invalidated the key support level at $48.95, with the price breaking through and now using it as resistance.

If the momentum continues, look for the next level of support at $47.81. This level looks rather solid with several tests along the way. This may prove tough to break, but if it fails, 46.79 and 45.78 will be targeted. A movement up will look for resistance at 49.64, 50.60 and 52.29 with the bearish trend acting as dynamic resistance.