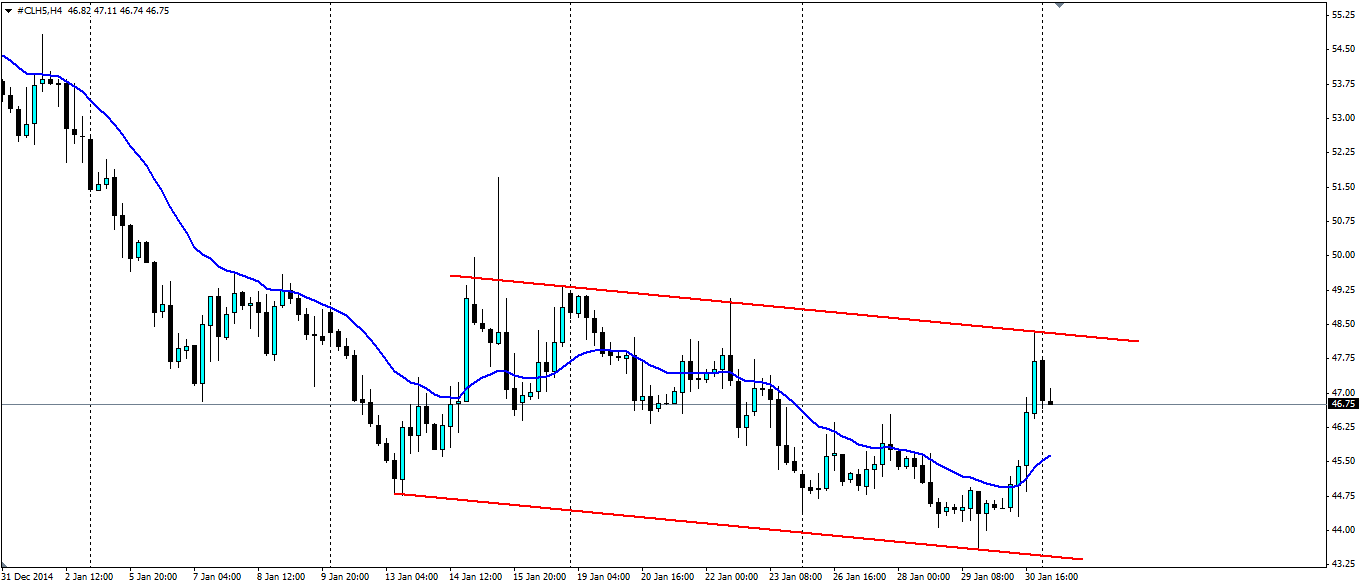

The Oil markets saw a surprise jump late last week as the market became concerned that output may shrink. This pushed the price of a barrel of crude oil up to the top of the current channel where it found resistance:

The surprising support in the price of oil came as a report on the number of oil rigs in use in the US showed that 94 rigs had been put out of action by drilling companies in a week. It was the single biggest weekly decline since the report began in 1987. That puts the number of oil rigs in operation in the US at a three year low. These are the first signs that market forces are beginning to work to curb the supply side.

News out over the weekend was for a strike in a number of US oil refineries. This provided further downward pressure on prices as the markets speculate the refineries will not be buying as much oil in the coming weeks.

Overall, there is not a huge change to the fundamental situation in the oil markets with OPEC still refusing to cut output. They appear to be determined to price the US producers out of the market and it appears they are having some effect (albeit a small one). But it appears we still have further to fall and certainly the bottom of the channel looks a likely target.

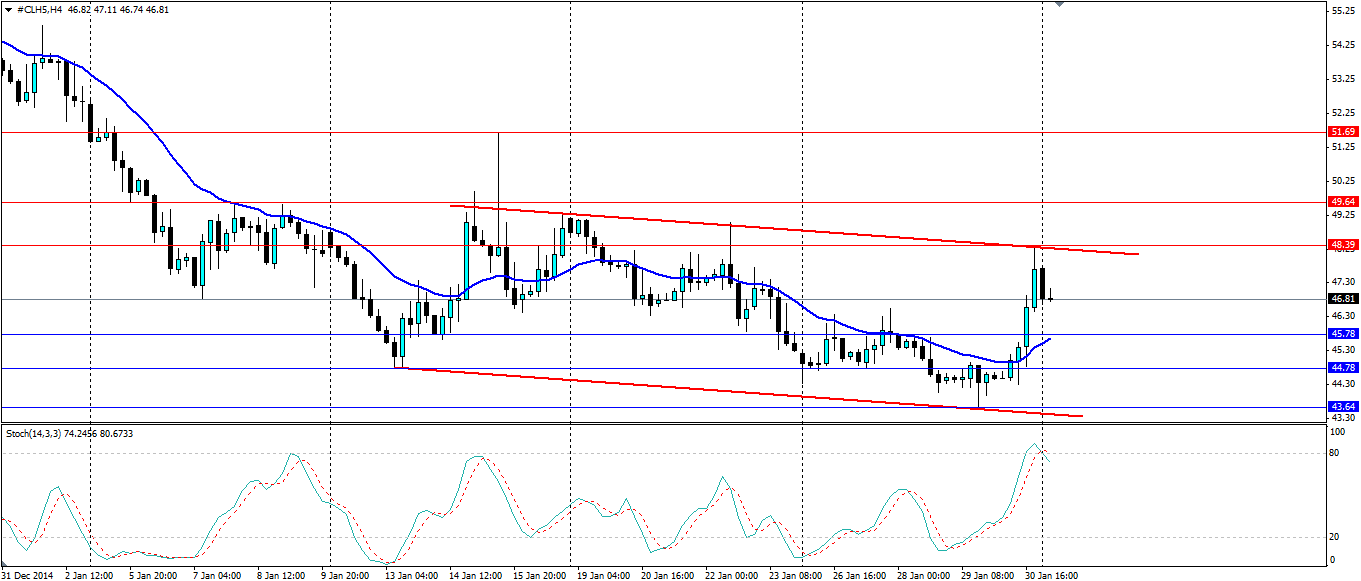

Technicals show the range that oil currently finds itself in. There has been a strong rejection off the top at $48.33 and we may see another test. If it holds and forms a double top, it would certainly be a signal for the bears to jump in and smash the price back towards the recent lows, below $44 a barrel.

We have seen the Stochastic Oscillator push briefly into oversold territory before it beat a hasty retreat. Look for resistance to be found at 48.39, 49.64 and 51.69 while support will be found at 45.78, 44.78 and 43.64.

Oil is respecting the channel it is currently in with a test of the top. Fundamentals have not changed a lot, so look for the price to head back towards the recent lows.