Oil is a big talker at the moment and that is for good reason, as the news has kept the market frothing for further action and the lacklustre result of OPEC last week lead many to believe that the market is set for further lows.

In any trending market the longer it trends the more likely people are going to be to just jump in and push it down. Bandwagon theory in essence as people get greedy and push, push until the market finally pushes back and knocks people out the market. In the case of oil it still has some time to go on the charts I believe as the demand is still not there for cheap oil as China and Europe continue to struggle. Further adding to this Iraq just secured a deal that will add further supply to the markets in the long term.

So with OPEC sitting on its hands, the world is awash with oil and the markets are now looking for lower lows and this can be seen on the charts.

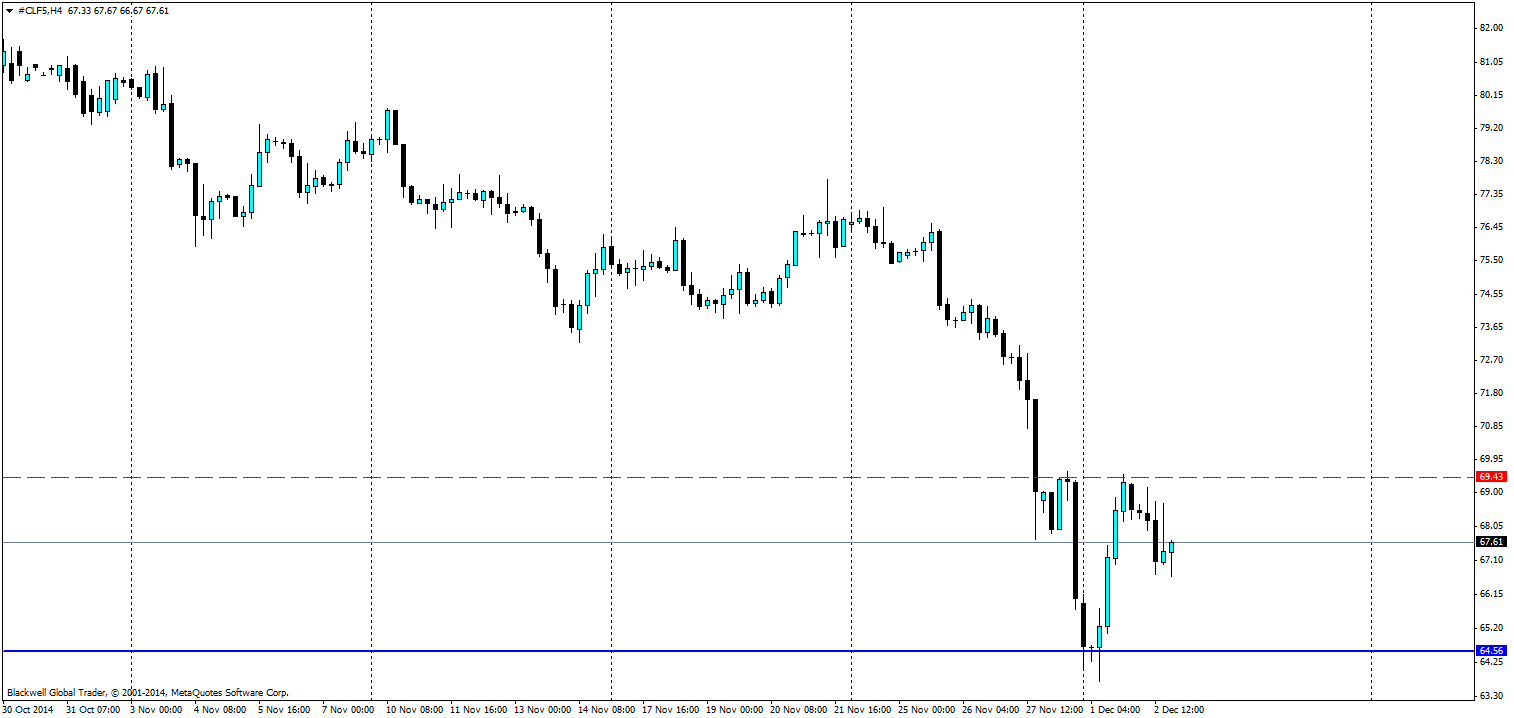

Last nights price action on the 4h chart shows some very important things to note. Firstly, price has hit the previous support and is now using that as resistance (69.43). So we know the market thinks there are further lows. Secondly, the candles show very long wicks which tell me that the sellers have pushed the buyers out when they’ve tried to come back into the market.

In fact, when we look at the overall long term trend here, we can see that this actually looks to be a brief correction in the market. Long term trend reversals after all, seldom happen without warning, and as such we should continue to treat the long term trend as king even on the shorter time frames.

So when looking at oil in the coming days it might be worth looking for lower lows and targeting the levels shown on the chart, certainly I feel there is cause for oil to drop even lower into the low 50’s at least as long term aggressive trends have been shown to be very volatile when it comes to oil, and until we see a genuine pick up in the market we will continue to see it fall week on week.