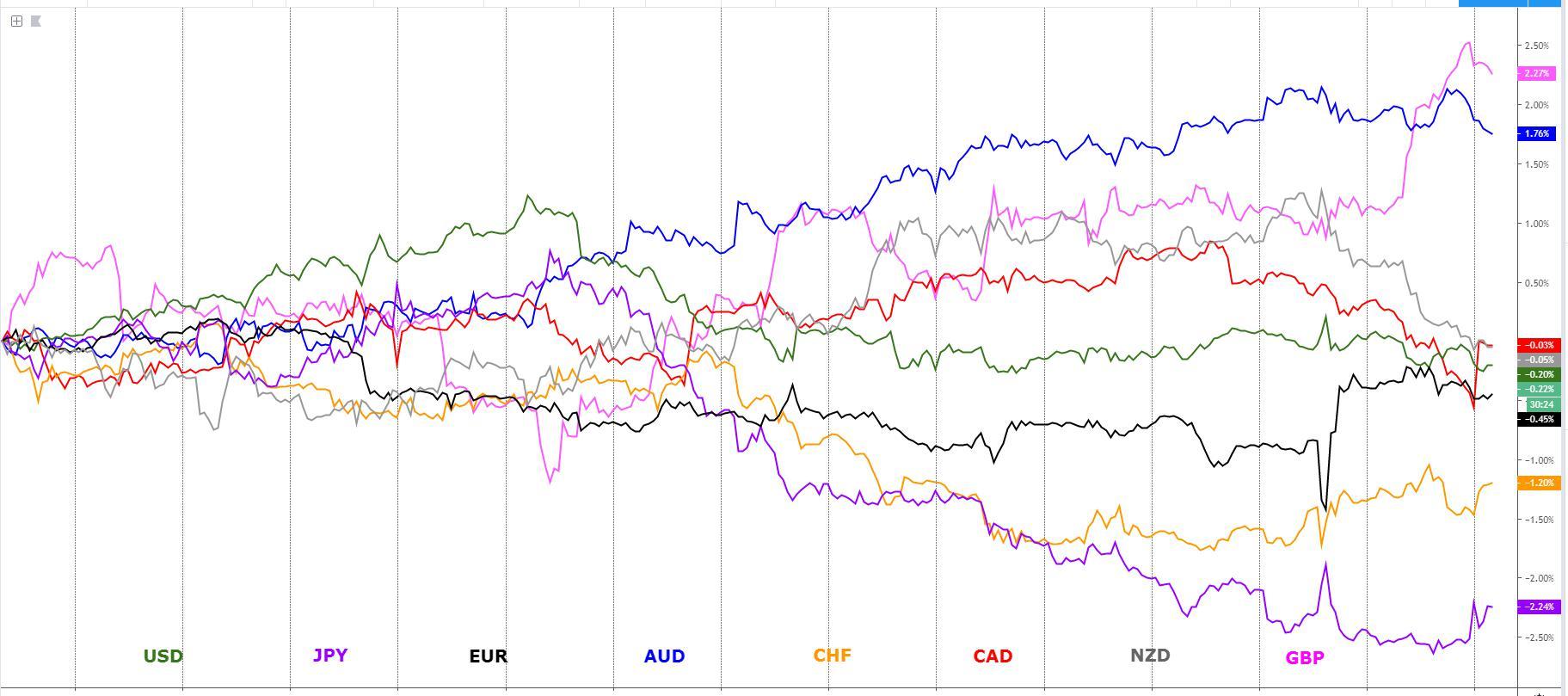

Crude Oil has gone ballistic higher after the unprecedented implications of the multiple Houthi rebel-claimed drone attacks to the world’s biggest crude production facility in Abqaiq and Saudi Arabia’s second-biggest production facility in Khurais. The immediate pattern during Intermarket hours has been quite predictable, with the Canadian Dollar, the Norwegian Krone and the Yen bought strongly.

Quick Take

Traders are waking up this Monday to an 'eye-popping' move in the price of Oil, with Brent Crude up over 20% soon after the open, following the unprecedented accuracy in an attacked perpetrated in multiple Saudi Oil refinery facilities, claimed by Houthi rebel from Yemen. The attack happened in the world’s biggest crude production facility in Abqaiq and Saudi Arabia’s second-biggest production facility in Khurais. The ramifications were felt throughout the marketplace, from currencies to stocks and bonds. The immediate pattern during Intermarket hours has been quite predictable, with the Canadian Dollar, the Norwegian Krone and the Yen bought strongly. The first two on the basis of its strong correlation with Oil as one of the largest exporting nations, while the Yen gets a bid as the geopolitical risks are heightened as the US points its finger to Iran. In terms of the main losers, the Oceanic currencies AUD, NZD were hit due to the increase in risk aversion, with the Turkish lira and Indian rupee especially fragile due to the nations’ profile as heavily dependable on Oil imports. The key topic of discussion that the market is seeking out answers for is the length of the disruption before full capacity is back on track. Will it be just a matter of days, weeks, or months? Obtaining clarity in this front is essential to adjust the outlook for Oil and the wider market profile.

The indices show the performance of a particular currency vs G8 FX. An educational article about how to build your own currency meter can be found in the Global Prime's Research section.

Narratives In Financial Markets (Oil Special)

* The Information is gathered after scanning top publications including the FT, WSJ, Reuters, Bloomberg, ForexLive, Institutional Bank Research reports.

Oil skyrockets at the open in Asia: Oil has opened more than 10% higher after the unprecedented implications of the multiple Houthi rebel drone attacks to the world’s biggest crude production facility in Abqaiq and Saudi Arabia’s second-biggest production facility in Khurais. Photos released by Trump administration show the extent of the weekend attack on the Saudi oil industry.

When could the Saudis return to full capacity? While still unclear how much production has been lost, reports indicate Saudi Arabia has temporarily lost out of circulation around 5.7mb/d of oil output, which accounts for about 5% of world output. Even if the press reporting on the matter suggest most of it can be recovered within days, it may take weeks to return to full capacity.

Insights view by Danske Bank: As Danske Bank’s Senior Analyst Jens Nærvig Pedersen notes: “Even if only a temporary output loss, we see it as a significant blow to the oil market in several ways. Firstly, the oil market is used to output disruptions, but nothing of the magnitude witnessed in Saudi Arabia over the weekend. For example, disruptions in Libya due to rebel attacks are normally 200-300kb/d. Secondly, Saudi Arabia normally holds some spare production capacity, which it can deploy when output is disrupted elsewhere in the oil market. The market knows this, which means it tends not to overreact to supply disruptions. After this weekend, the market may be more hesitant in trusting this self-stabilising mechanism. Thirdly, the market is used to geopolitical tensions in the Middle East. Besides the effect of outside sanctions, it is rare that they affect oil production. The oil market may become more averse to geopolitical news going forward.”

Iran's involvement investigated: Saudi officials are refusing to be easily persuaded by the immediate claims that Yemen's Houthi rebels are the only ones to blame as the orchestrators of the attacks, suspicious that Iran or Iraq may also be involved. Reports speculate that cruise missiles, which according to US officials, appear to have come from a west-northwest direction, not south from Yemen, were spotted, casting doubt on Houthi claims they launched drone attack from Yemen.

Geopolitical tensions could quickly rise: The fact that the US is pointing the finger to Iran as the responsible for the attacks invalidates the notion that the US and Iran may return back to the negotiating table anytime soon, which is what the firing of the US National Security Advisor John Bolton was partly caused by. In other words, the downward pressure on Oil based on a relaxation of the geopolitical risk between the US and Iran as one standalone factor that influences Oil supply prospects no longer holds true.

Lenth of production recovery key: It’s important to note that exports from Saudi should not suffer any disruption this week as inventory is used up. What the market is most concerned about is evidence of a prolonged shutdown in the supply of Oil due to the damage to the production facilities. According to Goldman Sachs Energy Research, the price of Oil will be based on how long it may take for the production to be resumed. Brent oil may trade $3 to $5 higher if the shutdown time is less than a week, up $5 to $14 if the shutdown is longer, 2 to 6 weeks. If the shut down of production is more than 6 weeks, the price may trade over $75 with shale oil production getting a big boost.

The effect in FX felt via Oil & Risk currencies: The immediate repercussion in the forex market has seen the Canadian Dollar, Norwegian Krone and the Yen bought strongly during the interbank operations ahead of the retail open. The CAD, NOK boost came as a result of the correlation with the energy instrument while the Yen gets a bid as the geopolitical risks of a confrontation between the US/Saudi Arabia and the responsibility for the attacks rises, especially if the eventual findings point at Iran as the mastermind. If the perception of a higher geopolitical risk premium is needed, JPY, CHF should stay bid. In terms of the main losers, the Oceanic currencies AUD, NZD were hit due to the increase in risk aversion, and even to a greater extent, losses were seen in the Turkish lira and Indian rupee due to the nations’ profile as heavily dependable on Oil imports.

Optimism to recover half the production this Monday: An industry expert at Energy Aspects was quoted by Bloomberg as saying Saudi Arabia will probably restore almost half the oil production lost as early as Monday but the full resumption may take weeks. In the meantime, Saudi will draw on reserves to maintain supply. Note, a large disruption in Saudi Arabia which drains most of the spare capacity from Saudi Arabia will see OPEC members coverage of any supply disruptions as limited.

Trump ready to release Oil from the USPRS: Trump authorised, “if needed”, and yet “to-be-determined” release of oil from the U.S. Strategic Petroleum Reserve after Saudi attacks, which has helped to stabilize Oil a tad. He tweeted: “Based on the attack on Saudi Arabia, which may have an impact on oil prices, I have authorized the release of oil from the Strategic Petroleum Reserve, if needed, in a to-be-determined amount...”

Conflicting drivers for bonds: Traders must be on the watch about how global bond yields, with the US 30-year bond dividend as the bellwether, react to the events in Saudi Arabia. There are two opposing forces at play that remains up for debate which one will override the other. On one hand, the supply disruption causes higher Oil prices, which if sustained over time, causes inflationary pressures, which is a bearish event for bonds as the premium to hold fixed-income decreases given that Central Bank’s rationale to be overly dovish is no longer justified. On the other hand, if the attacks lead to a credible rise in geopolitical risks, which contributes to keeping the macro risk-off conditions, in that case, the market will most likely seek out bonds as a protection play.

GBP rules to rooster: The Pound has been a stellar performer in the last 24h as the market continues to price in that UK PM Boris Johnson may persuade the EU to sneak out a few compromises on the Irish border, hence raising the prospects of a deal. Boris Johnson is set to meet with EC President Juncker (his tenure ends Nov 1) for Brexit talks this Monday.

US economic data surprises to the upside: The latest US economic data came on the bright side, as both US retail sales and US consumer sentiment exceeded the expectations economists had called for. US August advance retail sales came at +0.4% vs +0.2% expected, while the University of Michigan Sept prelim US consumer sentiment stood at 92.0 vs 90.8 expected. It adds to the case for the Fed to strike a hawkish surprise during this week’s FOMC, which is due on Wednesday. In the retail sales front, the control group retail sales are on track for an annualized rise of over 7.5%, which is very strong.

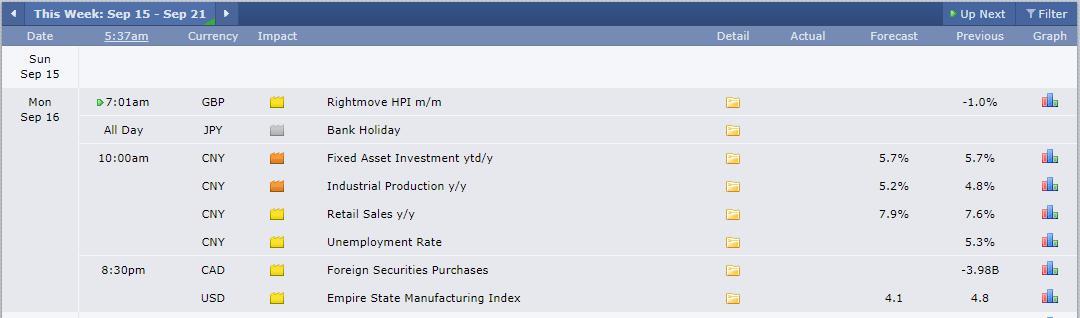

Recent Economic Indicators & Events Ahead

Source: Forexfactory A Dive Into The Charts

The EUR index, as argued in Friday’s analysis, remains at risk of encountering setbacks on the way up due to its overextended nature but also for technical reasons. The hybrid index, which is equally weighted against a G8 FX basket, is aiming to penetrate and find acceptance above not only a critical resistance but also the third test of a descending trendline. What we saw on Friday is a head fake pattern, which may lead to the downward pressure returning even if it’s still premature as the index remains above the 13d ema baseline. Besides, the huge rejection off lower levels post the ECB is a major testament that we may have reached a meaningful bottom, which makes playing EUR shorts not the best currency to try and capitalize on.

The GBP index is by far the most bullish currency out there, but again, the move from last Friday is way out of whack, which suggests a short-term correction is needed to attract sufficient bids to keep the trend going. What’s become clear is that the market is intensifying its conviction and hence the pricing out of a hard Brexit as the GBP price action reflects. Should the GBP return back within the region between the baseline and 1x ATR, that will definitely make it a more interesting play at fairer valuations rather than having to pay up to get exposure. Today’s meeting between UK PM and EC President Juncker is a risk event to factor in.

The USD index is retesting a key level of support and in my opinion, which is backed by the technicals, this is a market that trades at an incredibly attractive level from a risk-reward perspective, which would essentially translate in finding the best possible USD vs G8 FX deals out there to exploit what could be a decent run-up in the currency if bids continue to be found through this level of support currently tested. The retest is also occurring in low volume, which doesn’t tend to be a great sign for an eventual breakout. As a trader, if your system can trigger a long position in the USD, I am inclined to think the current position where the currency is traded can pay good dividends. What’s more, the risk of a hawkish surprise by the Fed genuinely exists as the economic data in the US and the US-China trade war relaxes a bit.

The CAD index sold off quite harshly out of nowhere last Friday even if the currency has now recouped over 50% of its losses driven by the staggering rise in Oil prices. Note, the rebound in the CAD comes after a rejection off a key level of support identified in the index (again). The index remains with an overall bearish outlook as the baseline was lost last Friday, but I must say that its penetration does not carry much substance as the breakout came on low tick volume, not to mention that the correlation with Oil implies upward pressure may continue short term.

The NZD index has transitioned into bearish territory after a move that while it lacks the participation of sellers as depicted by the low tick volume (aggregate), it follows what’s still a clear downtrend structure in the price configuration. With the fisher transform turning its slope to bearish and the CCI back below 0, there are enough indications that the market may continue to struggle. Note, the onset of this renewed downward pressure came after a key level of resistance was rejected on a sizeable upper shadow candle last Thursday.

The AUD index is rolling back from a macro level of resistance, where I warned that if the trend is going to find its first major struggle, that is the location where sitting offers will concentrate in AUD pairs vs G8 FX. The opening of Asia this Monday has seen a downgap as risk aversion picks up marginally, even if the pullback is still within the context of a strong uptrend. In the coming days until the FOMC shows us the way by being the driver to ramp up volatility, the range between the resistance line above and the baseline should cover the eventualities.

The JPY index has found buyers during the interbank session, but let’s not forget that the index remains in a clear bearish path with no technicals backing up the current bounce on the daily. The geopolitical landscape should dominate to determine the risk mood, which will have the most impact in the pricing of bonds and the JPY as a result. I’d be very cautious to overcome in any Yen longs as the evidence to turn bullish is nowhere to be found yet.

The CHF index,like the JPY, remains in bearish terrain but the performance of the currency has definitely been more meritorious, especially as the ECB triggered an eye-popping reaction in the EUR that dragged with it the Swiss Franc. The index is now testing a critical area of resistance as is the 13d ema baseline, where selling pressure may pick up again. Positioning to sell the currency certainly carries its fair share of appeal at these levels within the context of what I still see potentially as an unfinished bearish cycle ongoing since the 100% proj target was never reached before what I see still as an interim bounce as part of an incomplete bearish leg.

Important Footnotes

- Risk model: The fact that financial markets have become so intertwined and dynamic makes it essential to stay constantly in tune with market conditions and adapt to new environments. This prop model will assist you to gauge the context that you are trading so that you can significantly reduce the downside risks. To understand the principles applied in the assessment of this model, refer to the tutorial How to Unpack Risk Sentiment Profiles

- Cycles: Markets evolve in cycles followed by a period of distribution and/or accumulation. To understand the principles applied in the assessment of cycles, refer to the tutorial How To Read Market Structures In Forex

- POC: It refers to the point of control. It represents the areas of most interest by trading volume and should act as walls of bids/offers that may result in price reversals. The volume profile analysis tracks trading activity over a specified time period at specified price levels. The study reveals the constant evolution of the market auction process. If you wish to find out more about the importance of the POC, refer to the tutorial How to Read Volume Profile Structures

- Tick Volume: Price updates activity provides great insights into the actual buy or sell-side commitment to be engaged into a specific directional movement. Studies validate that price updates (tick volume) are highly correlated to actual traded volume, with the correlation being very high, when looking at hourly data. If you wish to find out more about the importance tick volume, refer to the tutorial on Why Is Tick Volume Important To Monitor?

- Horizontal Support/Resistance: Unlike levels of dynamic support or resistance or more subjective measurements such as fibonacci retracements, pivot points, trendlines, or other forms of reactive areas, the horizontal lines of support and resistance are universal concepts used by the majority of market participants. It, therefore, makes the areas the most widely followed and relevant to monitor. The Ultimate Guide To Identify Areas Of High Interest In Any Market

- Trendlines: Besides the horizontal lines, trendlines are helpful as a visual representation of the trend. The trendlines are drawn respecting a series of rules that determine the validation of a new cycle being created. Therefore, these trendline drawn in the chart hinge to a certain interpretation of market structures.

- Correlations: Each forex pair has a series of highly correlated assets to assess valuations. This type of study is called inter-market analysis and it involves scoping out anomalies in the ever-evolving global interconnectivity between equities, bonds, currencies, and commodities. If you would like to understand more about this concept, refer to the tutorial How Divergence In Correlated Assets Can Help You Add An Edge.

- Fundamentals: It’s important to highlight that the daily market outlook provided in this report is subject to the impact of the fundamental news. Any unexpected news may cause the price to behave erratically in the short term.

- Projection Targets: The usefulness of the 100% projection resides in the symmetry and harmonic relationships of market cycles. By drawing a 100% projection, you can anticipate the area in the chart where some type of pause and potential reversals in price is likely to occur, due to 1. The side in control of the cycle takes profits 2. Counter-trend positions are added by contrarian players 3. These are price points where limit orders are set by market-makers. You can find out more by reading the tutorial on The Magical 100% Fibonacci Projection