Oil Slips As Tensions Ease

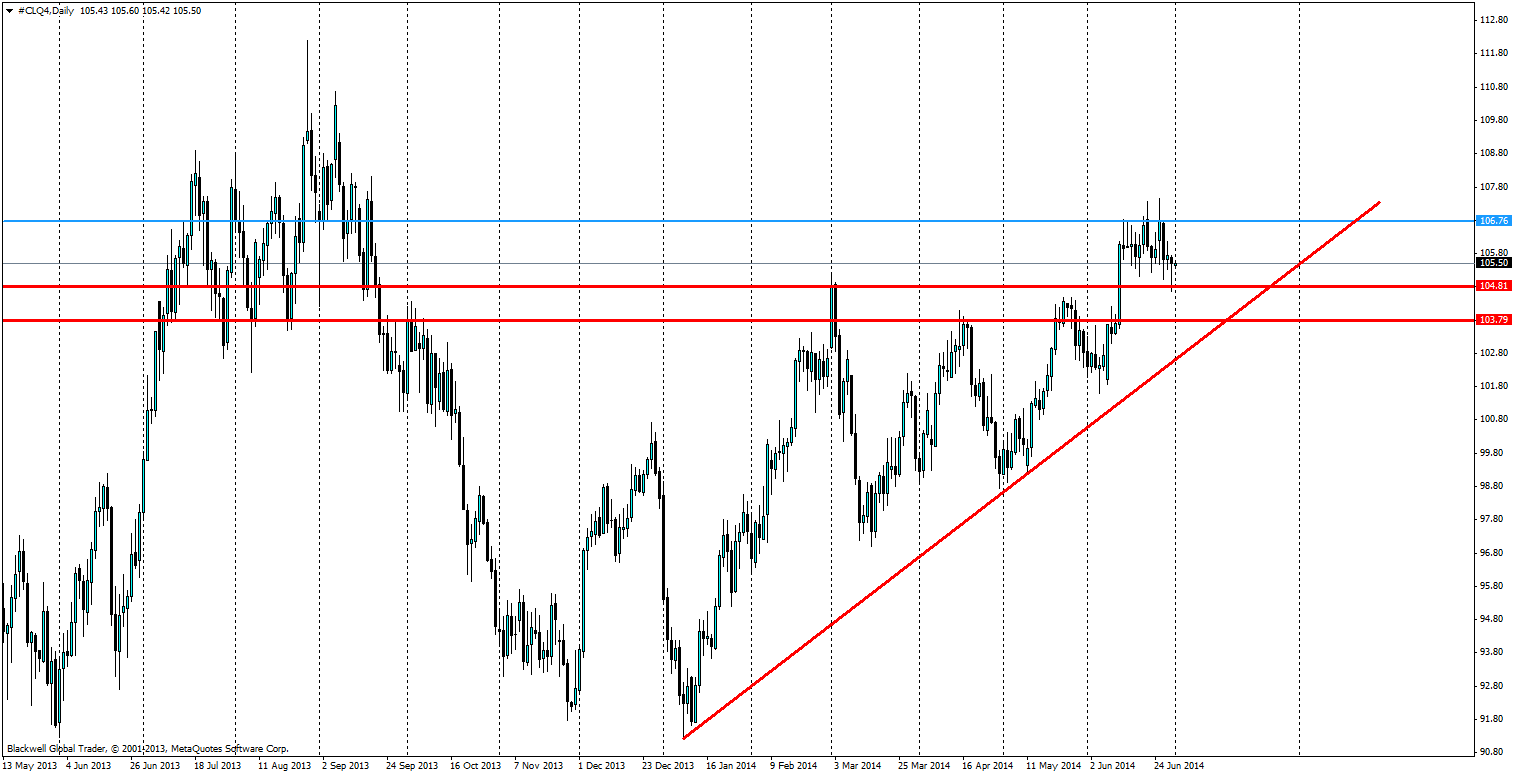

Oil has been looking fairly bearish over the past few candles on the daily chart, and my intuition when it comes to a fall is looking all the more likely. One only has to take a look at the strong level of resistance in the market to see why.

Source: Blackwell Trader (Oil, D1)

Oil markets have been in a bullish mode for some time, and technicals should never be ignored when it comes to commodities. But the majority of this bull run has been on the back of speculation about tensions increasing globally with Ukraine and Iraq, which are both crucial regions for energy exports, having an impact. Despite all of this a weak US dollar has also helped push up the price in the oil markets; I know many will be looking for US dollar strength, but it’s a while off if the US economic woes continue.

It’s clear on the daily chart that there is some movement lower, but this can be more clearly seen on the H4 chart.

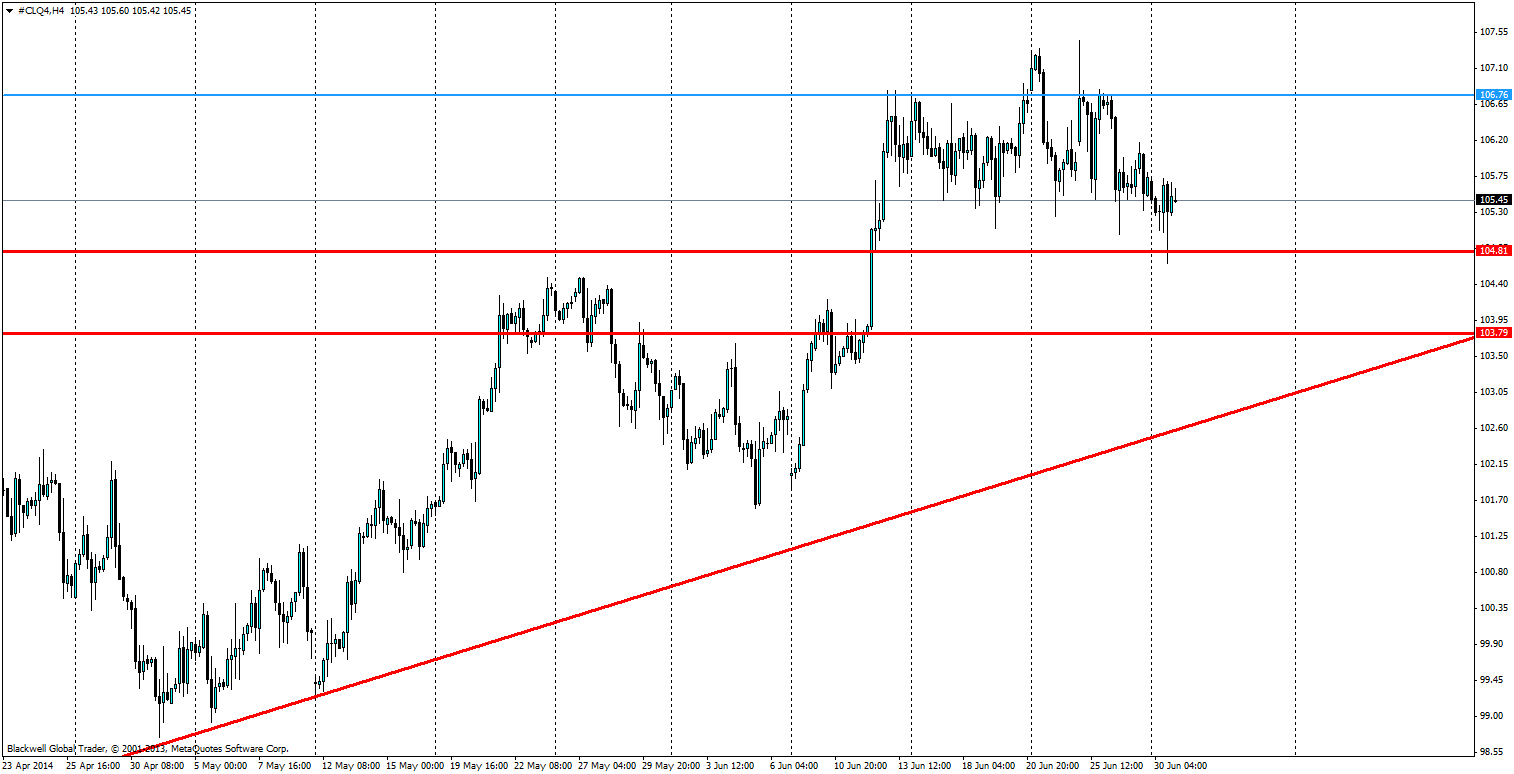

Source: Blackwell Trader (Oil, H4)

The H4 chart shows a clear down trend starting to form over the short term, a combination of lower lows and lower highs on the candles. It looks likely that this trend is set to continue into the lower areas of the chart. But support will likely be a point for it to turn, and these points can be found around 104.81 and 103.79; with 103.79 the most likely point for a bounce upwards when it looks to continue its bullish trend. The trend line would also most likely act as dynamic support for oil in the event of a push through support.

Any push through this trend line would be a solid signal for the bears, but given the fact there is still a fair amount of tension in the Middle Eastit’s unlikely we would see a clean break through – unless we had a massive dollar strengthening and even that seems some time off.

So for the short term it’s looking likely that the bears will have their way as they seek the trend line lower, technicals are giving it a boost, and so is the current fundamental outlook. Concern in Iraq has been the main reason for rises, but with military action taking place and many nations joining the fray, it looks likely there will be some end in sight in a few months.

In the mean time I am bearish on oil, and until we see any escalations or further strengthening of the US dollar it’s likely to continue its fall and traders will profit on the short side of it, rather than the long side.