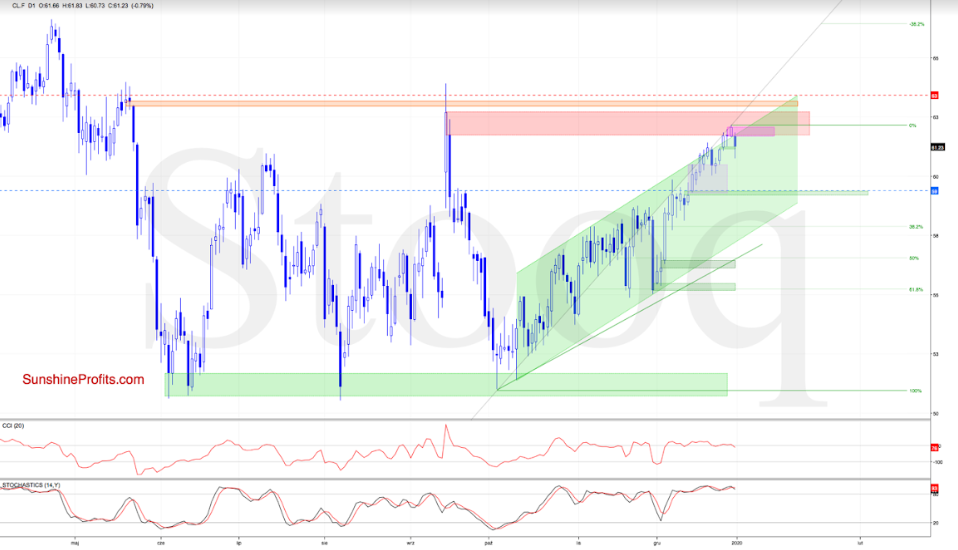

Although oil bulls managed to push the futures higher and broke above the upper border of the rising green trend channel during yesterday’s session, Monday’s upswing turned out only temporary.

Earlier today, crude oil futures opened the day with the bearish pink gap, invalidating yesterday’s breakout above the channel. This bearish development triggered further deterioration in the following hours, which means that our yesterday’s analysis is up-to-date also today:

(…) the sizable red gap remain in play. It keeps supporting the bears and lower values of the futures in the coming week(s).

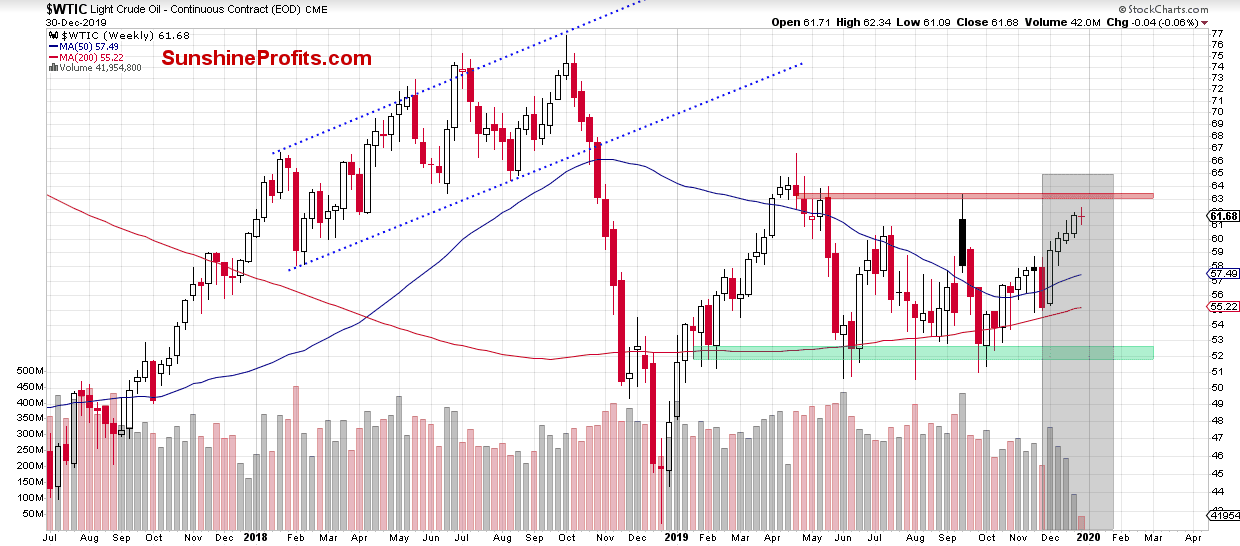

Let’s take a look at the weekly crude oil chart. The volume is progressively declining, raising doubts about the bulls’ strength going forward.

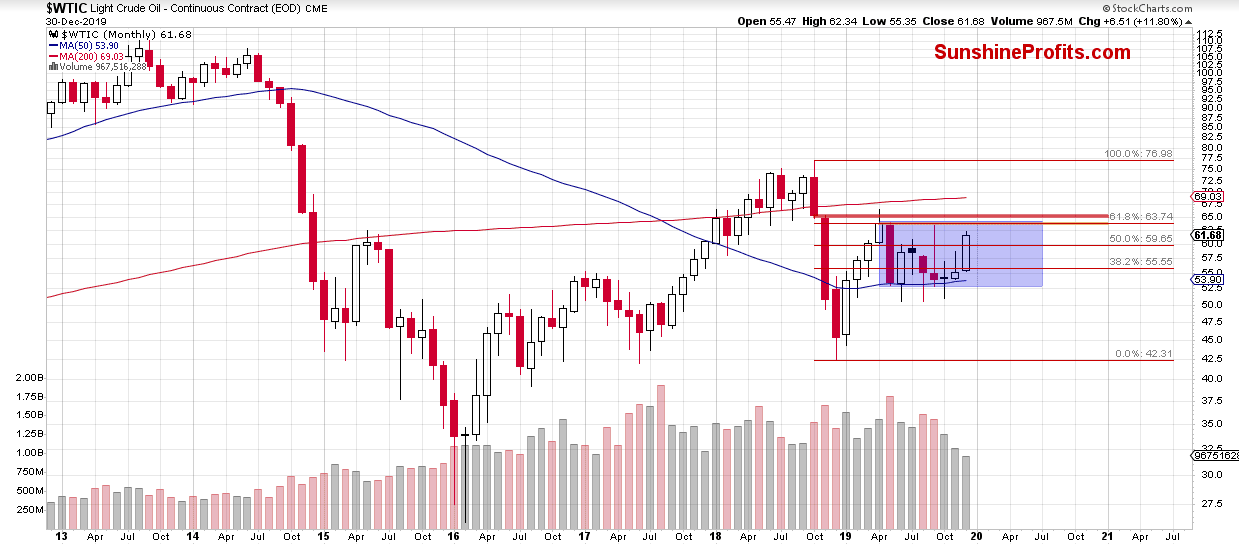

Let’s zoom even further out, and inspect the monthly chart.

The long-term perspective shows that recent weeks’ price action hasn’t really changed the overall situation much. Crude oil is still trading inside the blue consolidation below three key resistances (the red and orange bearish gaps and the 61.8% Fibonacci retracement), which form a major resistance zone for the coming week(s).

Additionally, the volume is decreasing on a monthly basis, which raises the probability of a reversal in the near future.

Therefore, as long as there is no breakout above the said consolidation, another move to the downside would not surprise us and reversal in the coming week(s) is very likely.

Taking all the above into account, we continue to think that lower values of crude oil and crude oil futures are ahead of us. Should it be the case and the futures move lower, the first downside target will be the green gap created on Thursday. If it is closed, the next target will be the lower border of the purple consolidation and the next green gap, which is where our initial downside target currently is.

Summing up, yesterday’s crude oil gains have evaporated in a flash as the red gap ahead coupled with the extended position of the daily indicators brought a reversal lower. The short position continues being justified from the risk-reward perspective, and it is supported by both the weekly and monthly perspectives.