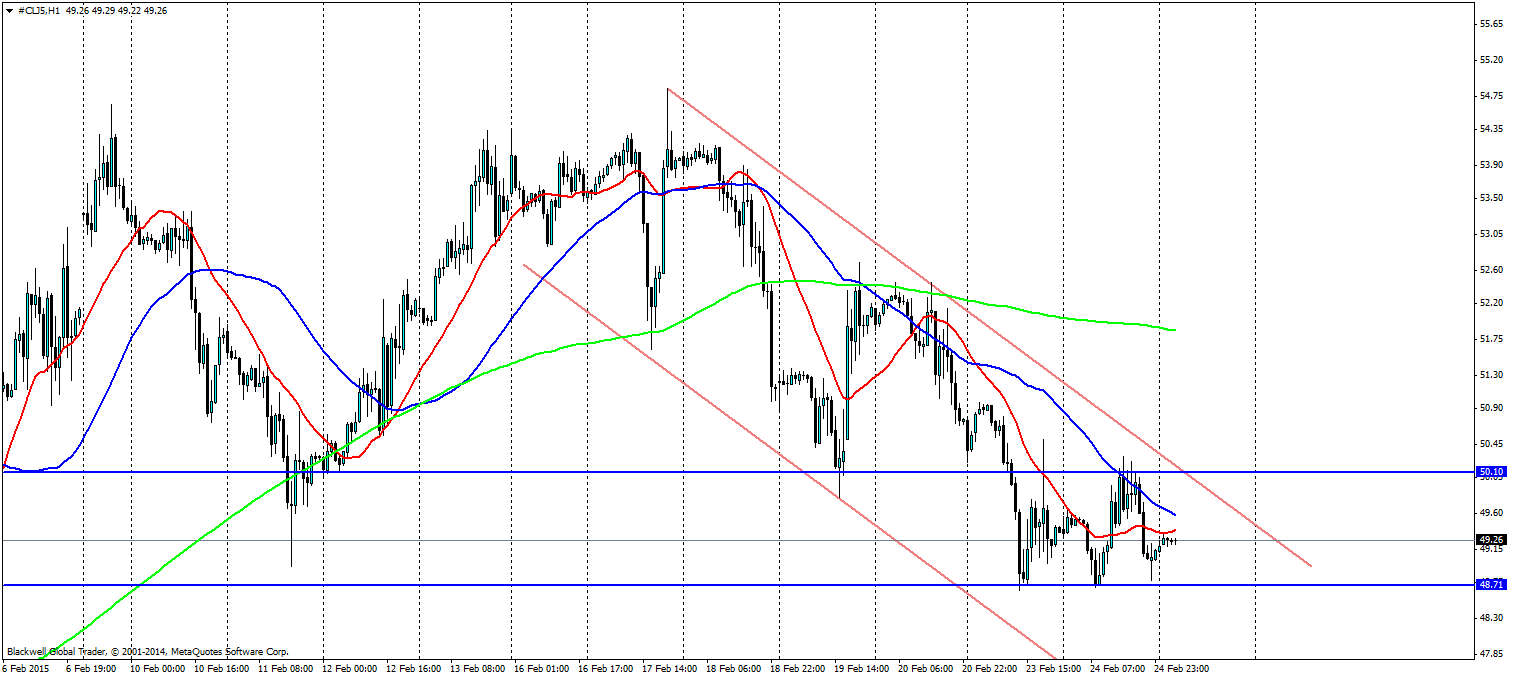

Crude Oil markets are sliding down the charts and that is somewhat expected as of late. Markets have continued to push lower as of late and a double bottom on the 48.71 had been ominous of a large scale pull back as the bulls had been looking for opportunities. However the market failed to find ground to go further and has since looked to push lower.

For oil markets, it’s possible we could see a further run from the bulls now and a solid retest of the 50.10 level. However, the market while looking bearish is looking for a point to push back down and the 50.10 level is where the bears will be looking to rush into with the backing of the trend line.

For market participants the next levels down are 46 and 44 dollars and the market may even look to push further, but it’s too early to tell if the 48.71 level is going to give way, but what markets will be looking for here is a big swing in order to make the most of trading conditions at present.

The main thing that will be key is crude oil inventories due out at 15:30 GMT, expect a big swing from the market here. The levels on your chart will be key to play this out. Last week’s aggressive pullback was sold down heavily and it’s possible that a pullback based on fundamental data may continue to get sold as the market believes oversupply is a persistent problem in the long run until demand picks up – which is looking some way off when you look at the current global economy.

Orders below the 48.71 could also catch a fair bit of momentum as well and traders will be looking for this level to snap and the selling freight train to continue. The question is which will it swing and if levels will hold in the long run?