The price of oil continues to sag, driven by a lack of demand coupled with supplies remaining at pre-COVID levels. The weakness in the commodity was further reinforced by yet another company in the sector, in this case Exxon Mobil (NYSE:XOM) confirming it is to cut 1,900 jobs in the U.S., in an attempt to shore up its balance sheet.

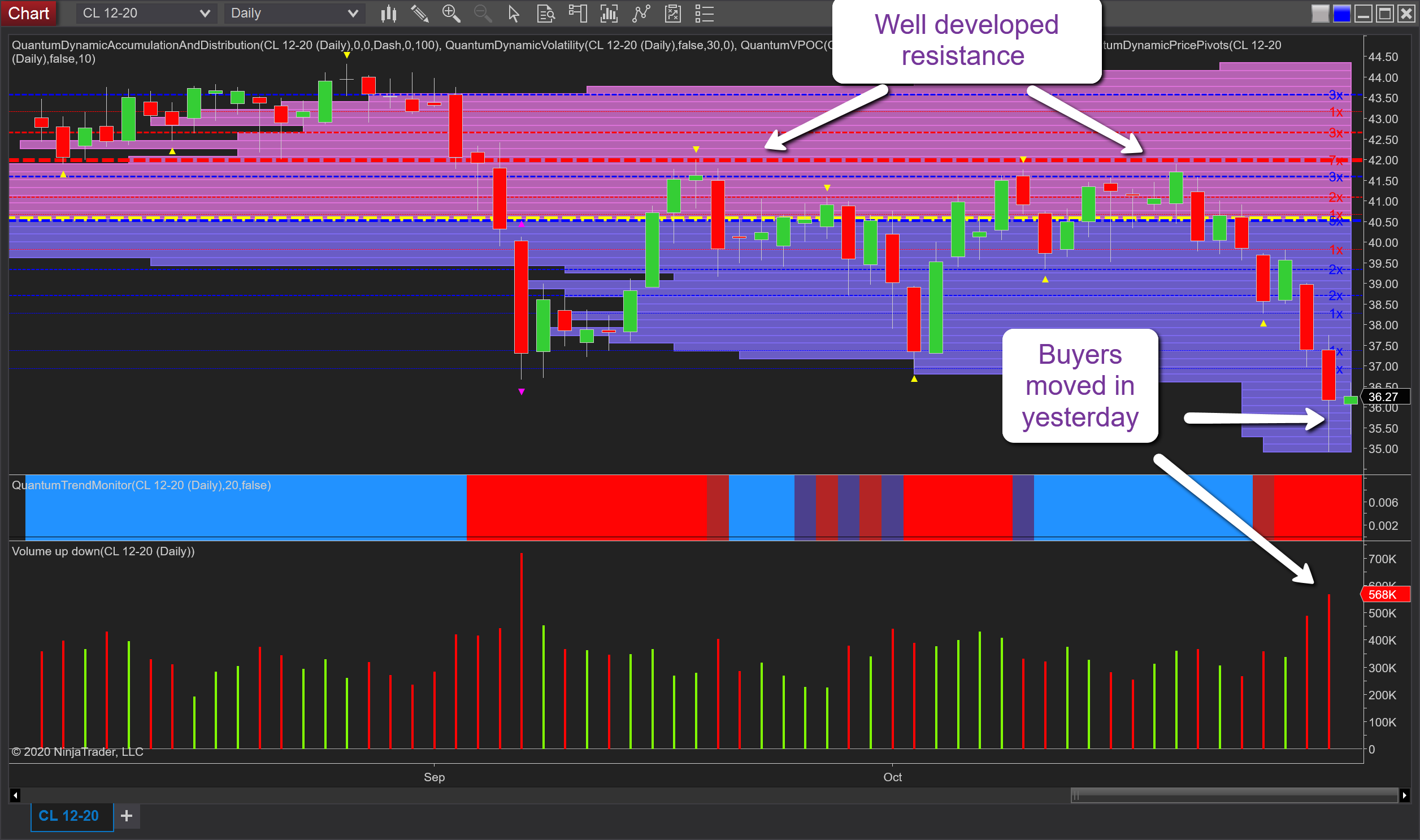

The technical picture confirms this structural weakness with the clear and well-defined ceiling of resistance now firmly in place at the $42-per-barrel level, and denoted by the thick red dashed line of the accumulation and distribution indicator. This is a level that has been tested repeatedly and is razor sharp in appearance as this week’s price action broke through into the low volume area on the VPOC histogram to the right of the chart.

However, yesterday’s volatile price action was also accompanied by some strong buying, as denoted by the deep wick to the lower body of the candle on good volume. As such we can expect to see a possible bounce in the price of oil over the next few days with a possible return to the $38-per-barrel area and beyond, and perhaps back to the volume point of control itself at $40.50 in the longer term. Beyond this, any progress higher is likely to be a struggle for oil and so it is likely to remain range-bound for the foreseeable future.