Oil has found a bit of support in the market and the fundamentals are certainly helping. The recent break through the bearish trend line sets the commodity up for a strong bullish surge.

The Energy Information Agency (EIA) released their official weekly figures yesterday and that gave crude a nice boost. The result showed a draw in reserves of -4.20m barrels which is giving the market hope that the tide is turning in the oversupply of the crude oil market. Backing this up was the American Petroleum Institute (API) result earlier this week which showed a draw of -1.9m.

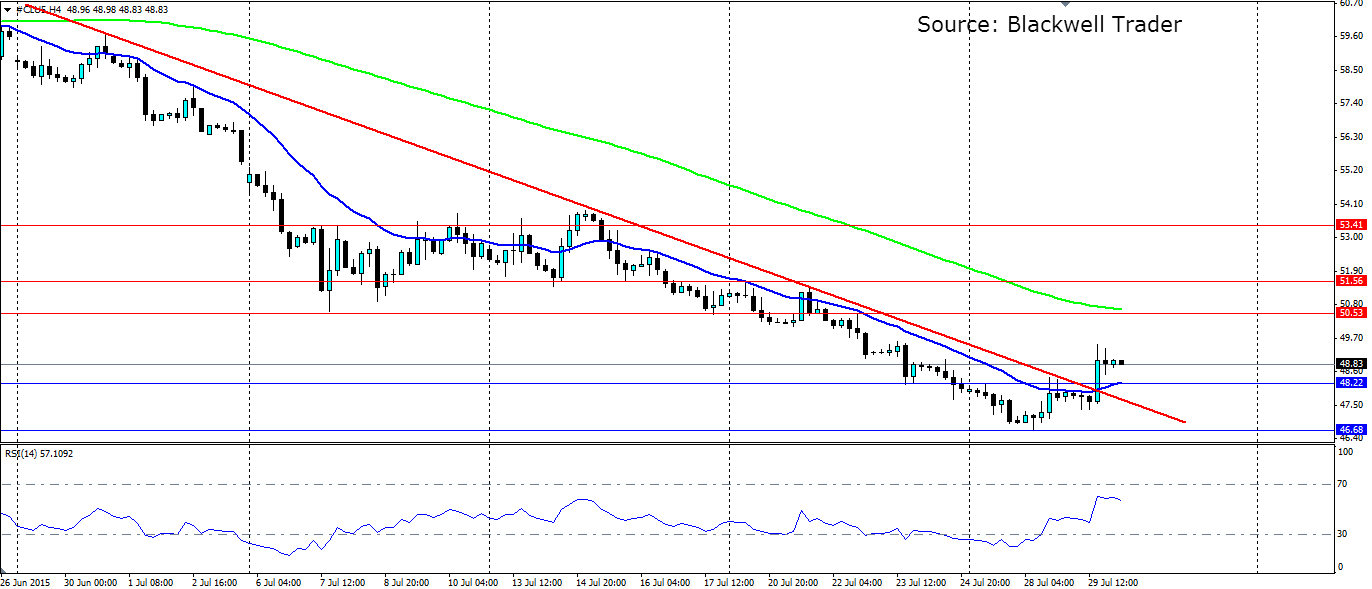

This has led to a sharp rise in the price of oil off the recent lows seen at the beginning of this week. WTI Crude for August delivery hit a low of $46.68 a barrel shortly before those API figures were released and has steadily climbed over the last few days to the current level of $48.89 a barrel. The good news has also helped oil to break out of the bearish trend it has been trading under.

Since late June, oil has slid from $61.50 as the bearish sentiment took hold. The trend line was tested numerous times on the way down and each time the bears defended it successfully. That was until late yesterday when the bulls won a decisive victory thanks to the EIA figures. The breakthrough came thanks to a bullish engulfing candle on the above H4 chart with a body $1.38 tall.

The RSI has followed suit with a lift out of oversold territory and a strong charge up past the 50 mark. It has tailed off slightly as the market consolidates and we may see the bears try to push it back down. In all likelihood, the 20 SMA on the H4 chart will likely act as dynamic support along with the $48.22 handle. If this level holds we can expect a solid charge higher.

Watch for the 100 SMA on the H4 chart to act as dynamic resistance, with 50.53, 51.56 and 53.41 all acting as resistance and target points for the leg higher. In the unlikely event that we see the bears regain control, look for the recent low at 46.68 to act as firm support.