The markets are witnessing an intensified dollar sale, affecting a wide range of assets, but not Crude Oil.

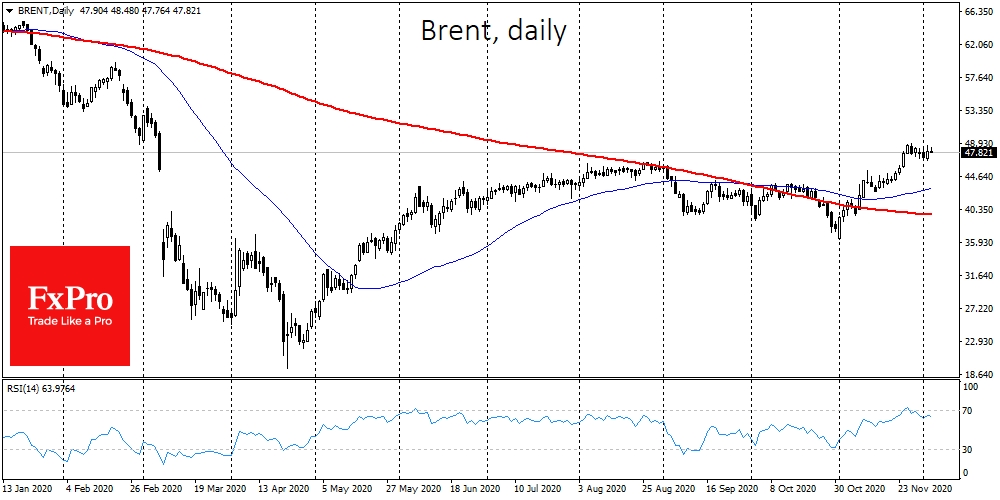

Oil grew throughout November but somewhat lost momentum at the end of the month. The events of early December bring back optimism in oil quotes, suggesting that the rally could develop in the coming weeks.

The rise in quotations at the end of last week has halted after signs of a disagreement among OPEC+ delegates concerning the fate of further quotas. Initial agreements implied an increase in quotas from early 2021.

However, the increase in virus cases raised concerns about the rate of recovery in demand, so the main objective by early November was to maintain current production quotas for another 3-4 months.

On the demand side, the situation was better than expected due to the recovery in production. Expectations of restrained supply and improved demand prospects in November led to a sharp increase in the price of more than 30%. This rally seems to have caused several OPEC+ members to change their position on the deal.

Along with signs of a recovery in demand in Asia and Europe, the cartel saw a recovery in actual production and drilling activity in the US, i.e. future production. This brought back to the agenda the question of whether OPEC+ is shooting itself in the leg by allowing space for independent companies to build up production. As a result, independent companies are increasing their market share as prices rise.

Russia and Saudi Arabia seem to understand this, so it was reported periodically this week that negotiations were at a stalemate, bringing us back to the same issues that came up in the spring. Back then, it resulted in an uncontrolled increase in production for several weeks. Fear of a repeat of this situation has put oil on the sidelines of the market rally since late last week.

Production is developing recovery in key economic regions, meaning that there is no need for production restrictions as tight as they were in March. The current quotas could likely be extended by a month or two, followed by further smooth increases. This is at least in the plans. Brent quotes may be able to grow to $50 before the end of this year and approach $60 by the end of 2021.

The FxPro Analyst Team