Markets can go to zero, where the price of an asset is worthless. Many stocks and bonds have lost all value when defaults and bankruptcies occur. In the world of commodities, a glut in the onion futures market sent the price to zero years ago. Longs took delivery of the onions, dumped them in rivers, and sold the burlap bags. In the electricity market, power along a transmission line is a use-it or lose-it proposition. During periods of oversupply, a position in the commodity can become worthless.

In an environment of demand destruction on the back of coronavirus, the members of OPEC and Russia dealt the crude oil market a substantial blow when they decided to flood the world with petroleum. The move was likely an attempt to force marginal producers in the United States out of business. However, the Saudis, Russians and other producers may have shot themselves in the foot as the price became a falling knife and halved in value. Now, some analysts are saying that the price of the energy commodity could fall to zero or lower.

The United States Oil Fund, LP (NYSE:USO) and the United States Brent Oil Fund, LP (NYSE:BNO) reflect the price action in the two benchmark crude oil futures markets.

Oil Holds Above $20 Per Barrel

At the end of last week, the nearby NYMEX crude oil futures contract was knocking at the door at $20 per barrel again.

(Source: CQG)

As the daily chart of May futures highlights, the price of crude oil settled at the $21.51 per barrel level. Open interest, the total number of open long and short positions in the futures market climbed from 2.124 million contracts on March 19 to 2.184 as of March 26. The rising level of open interest could signal speculative shorts increasing positions as the price of the energy commodity has not experienced a significant bounce, and the pandemic continues to grip the world and energy demand. Price momentum and relative strength were sitting in oversold territory at the end of last week. Daily historical volatility at over 125% reflects the nervous market and wide trading ranges.

The Energy Commodity Could Go Negative: Here’s The Scenario

On March 18, in an article on Yahoo (NASDAQ:AABA) Finance, Paul Sankey, a managing director at Mizuho Securities, said: “Oil prices can go negative.” In ordinary times, crude oil is a 100-million-barrel-per-day market. However, in the global pandemic that has caused the worldwide economy to grind to halt, surpluses are building. With OPEC members and Russia flooding the market with the energy commodity, and consumers buying appreciably less oil, inventories could overflow.

When crude oil comes out of the crust of the earth, it either goes to consumers or into storage facilities. There could come the point where existing storage reaches full capacity causing producers around the globe to pay customers to take the petroleum off their hands.

I believe that any move to zero or a negative level in the oil market would be a short-term condition. However, at specific production points like those in the Permian basin, the output could have no place to go and move into negative territory for a time.

The Big 3 Need To Strike A Deal And Stick To It

The world’s leading oil-producing nations are the United States, Russia and Saudi Arabia. The Saudis and Russians pull all the strings when it comes to the other members of the international oil cartel. The global pandemic and OPEC’s decision to abandon production cuts may have dealt a final blow to the cartel.

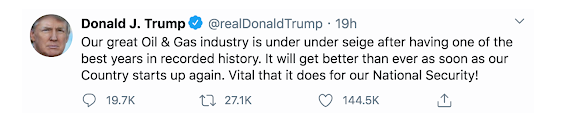

Crude oil is a matter of national security for most nations as it continues to be the energy commodity that powers the world. Saudi Arabia and Russia depend on petroleum sales for revenue flows. In the U.S., President Donald Trump expressed the importance of energy production in a tweet on March 26.

While the tweet was a sign that the administration in Washington, D.C. will provide financial support to debt-laden producers, the U.S., Saudi Arabia and Russia could together come to a production agreement to stabilize the price of the energy commodity.

The world could be heading for a new reality in the aftermath of the global pandemic. When it comes to the price of crude oil, the three leading producers have the power to provide price stability through cooperation. A crisis makes for strange bedfellows. In crude oil, a triad of the world’s most influential producers could emerge to keep the price from falling to a level where all would be losers.