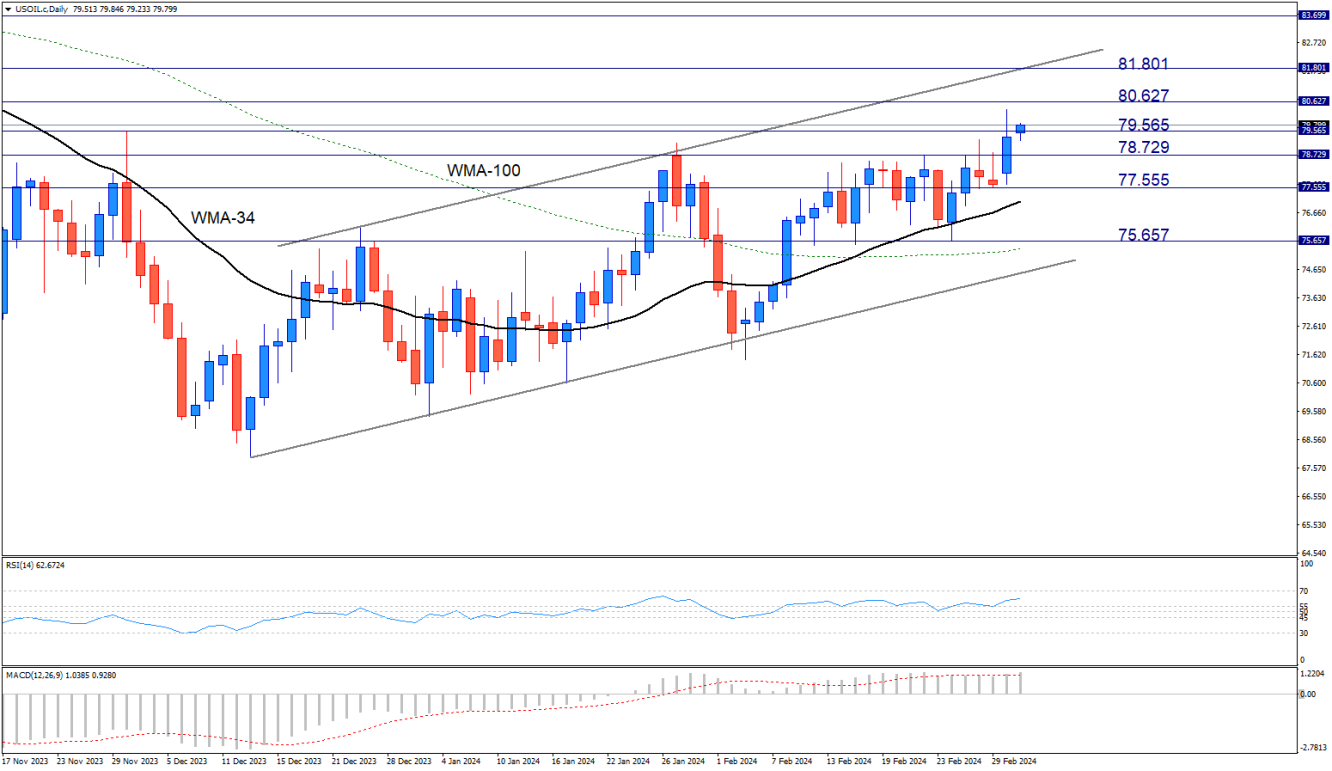

West Texas Intermediate (WTI) oil maintains its upward channel on the daily chart, initiated in mid-December. After a period of range-bound trading, Friday's session concluded above the pivotal weekly resistance of $78.729, allowing buyers to test their market strength. If the momentum carries beyond Monday's resistance at $79.565, bullish targets are projected at $80.627 and $81.801. Momentum oscillators also validate the buyers' dominance.

The Alternative Scenario

Should sellers manage to uphold the $79.565 resistance, immediate support is found at $78.729. Should the bearish correction persist, further support levels at $77.555 and $75.657 are estimated, marking the potential channel's floor.

Price Chart

Timeframe: Daily

Oscillators and Risk Alerts

- RSI: Bullish

- MACD: Bullish

- Moving Averages: Bullish

Given the alignment of the RSI, WMAs, and MACD with the main bullish scenario, there is a high probability that the uptrend will continue. However, traders should remain vigilant for any signs of reversal, particularly if the RSI begins to diverge or the MACD bars cross below the signal line.

Influential Events

Global economic growth remains a fundamental backdrop for oil markets. This week, investors will closely monitor the European Central Bank and the Bank of Canada meetings, U.S. labor market data, and European economic growth figures. Furthermore, the weekly commercial inventory data to be announced on Wednesday could provide clues to the current state of supply and demand in the market. An unexpected rise in inventories could contribute to price adjustments and temper the bullish trend.

A Bullish Horizon with Caution on the Charts

In the wake of OPEC+'s decision to extend voluntary production cuts on Sunday, oil prices continued their ascent on Monday. Brent crude futures, after a 2.4% rise last week, persist in their upward trajectory, while U.S. West Texas Intermediate (WTI) flirts with the $80 threshold following a 4.6% increase the previous week.

The tightening physical market remains a key price driver as OPEC+ prolongs its 2.2M barrels per day production decrease into the second quarter. This decision comes amid global economic concerns and anticipated increases in production outside the group later in the year. Aligning with some OPEC+ members, Russia has unpredictably committed to reducing its oil output by 471K barrels per day for the second quarter. According to Investing.com, concurrently, Brent's prompt monthly spread climbed by 6 cents, hitting 92 cents per barrel, while the six-month spread increased by 9 cents to $4.43, indicating traders' anticipation of a supply contraction relative to demand.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil Prices’ Targets Amid Expectations of Tighter Supply

Published 03/04/2024, 05:09 AM

Updated 04/05/2024, 10:24 AM

Oil Prices’ Targets Amid Expectations of Tighter Supply

Technical Overview

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.