-

Oil prices remain stable despite a turbulent weekend and a strong US dollar.

-

Chinese economic data, including disappointing GDP growth and declining refinery output, raises concerns about oil demand.

-

The focus shifts from supply concerns in the US to demand worries in China.

-

Technical analysis suggests a potential for a triple bottom pattern in oil prices, with key support and resistance levels identified.

Oil prices remained resilient this morning following a turbulent weekend. An attack on US Presidential hopeful Donald Trump has seen the US Dollar start the week on the front foot, but Oil prices have held firm.

Data out of China this morning stoked fears around demand again, something that market participants had hoped was in the rearview mirror. The overall fundamental picture remains largely positive, but demand concerns may hamper any further gains in the short term.

Chinese Data

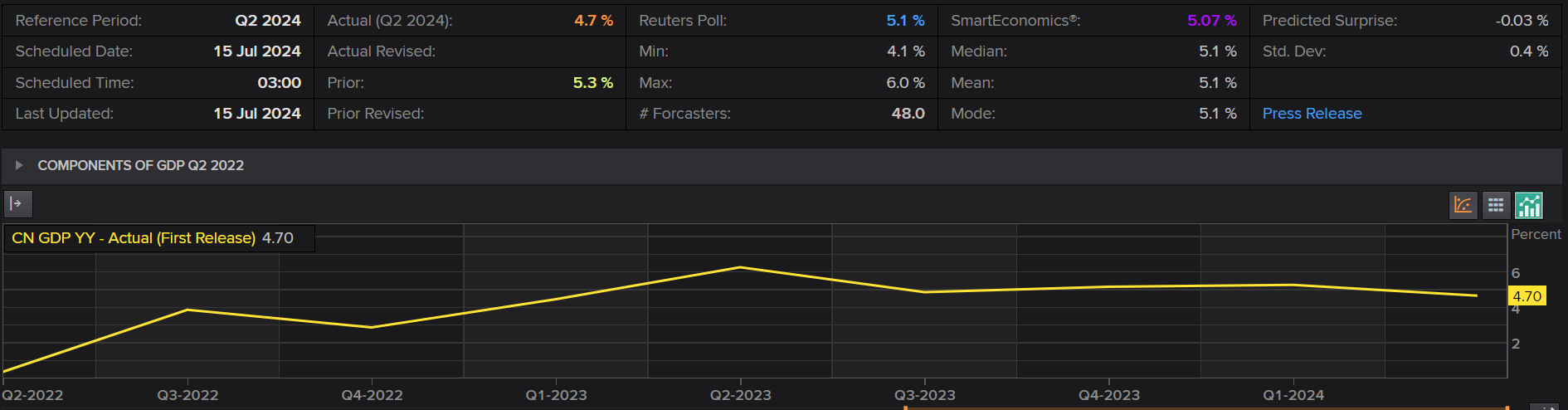

China’s GDP data released this morning was disappointing as sluggish domestic demand bites. The data prompted several investment banks to lower their GDP forecasts.

GDP growth slowed to 0.7% quarter-on-quarter (QoQ) seasonally adjusted (SA) in Q2, down from 1.6% QoQ in Q1 and below market expectations of 0.9%, impacted by slower retail sales growth.

Domestic demand and consumer confidence remain weak, with the NBS also attributing the slowdown to extreme weather events and flooding. Although industrial output growth is cooling, it exceeded market expectations, highlighting the uneven nature of China’s recovery.

Strong exports are supporting manufacturing activity, with shipments rising 8.6% year-on-year (YoY) in June, up from 7.6% in May. The secondary industry, which includes manufacturing and construction, grew by 5.6% YoY in Q2, down from 6.0% in Q1, while the tertiary industry, or services, increased by 4.2%, down from 5.0%.

Chinese GDP Q2 YoY

Source: LSEG (click to enlarge)

Chinese refinery output declined for the third consecutive month due to planned maintenance and weak fuel demand, leading independent plants to reduce production. Output for the first half of the year was down 0.4% compared to the same period last year, indicating a sluggish economic recovery and reduced processing profits for refineries.

Crude oil imports for the month of June dropped 11% while H1 imports were down 2.3% YoY. According to the IEA, the Chinese share of global oil demand growth is declining to 40% this year from last year’s 70%.

This decline in China has reignited worries about demand, a notable shift from the past two weeks, when supply concerns were prevalent in the US.

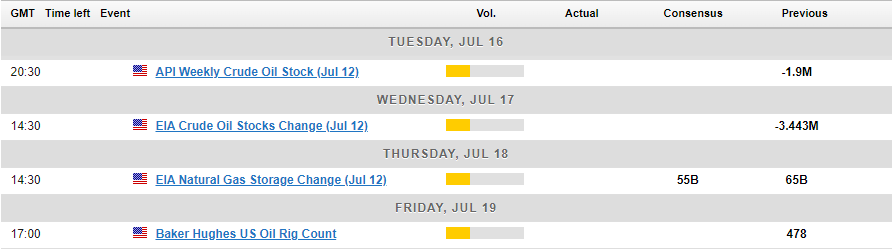

The Week Ahead

Oil inventory data is very important as the US and Europe are in the middle of summer. This period is typically the peak driving season in the US, leading to high demand for petroleum and other oil-related products.

Due to the busy summer season in the US, there is a good chance that weekly oil inventories will decrease more than expected. This could help keep oil prices strong and prevent any significant long-term price drops.

Geopolitics also remains a concern and could play an important role in the absence of high-impact US economic data.

Technical Analysis

Oil prices snapped a four-week winning streak to close around 2.33% lower. The weekly timeframe has price testing the 100-day MA, which could be a stern area of resistance.

The daily timeframe is even more interesting, as it appears markets could be setting up a triple bottom pattern. Such a pattern would no doubt embolden bulls, eyeing further appreciation in oil prices.

A daily candle close below the 85.25 handle opens up a potential selloff in Brent crude, with support levels at 83.50 and 82.50 coming into focus. Immediate resistance rests at 86.21, with a break above carrying oil toward 87.90 and potentially the 90.00 psychological level.

Support

-

85.25

-

83.50 (200-day MA)

-

83.00

-

81.58

Resistance

-

86.21

-

87.90

-

90.00 (psychological level)

Source: TradingView.com