Oil is storming to new multi-month highs, rising for the seventh week. Prices have grown high enough to be of interest to US oil producers and, locally, a threat to markets.

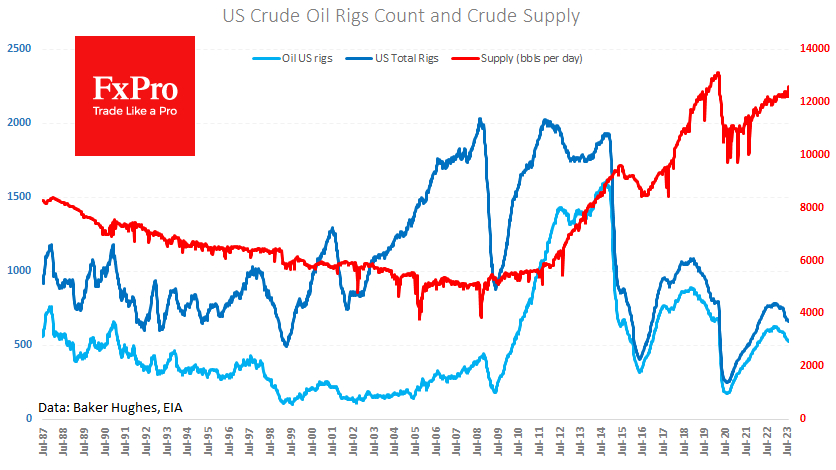

Data released by the Department of Energy on Wednesday noted a jump in production rates to 12.6 million BPD, up from 12.2 million in recent weeks and the average since the beginning of the year.

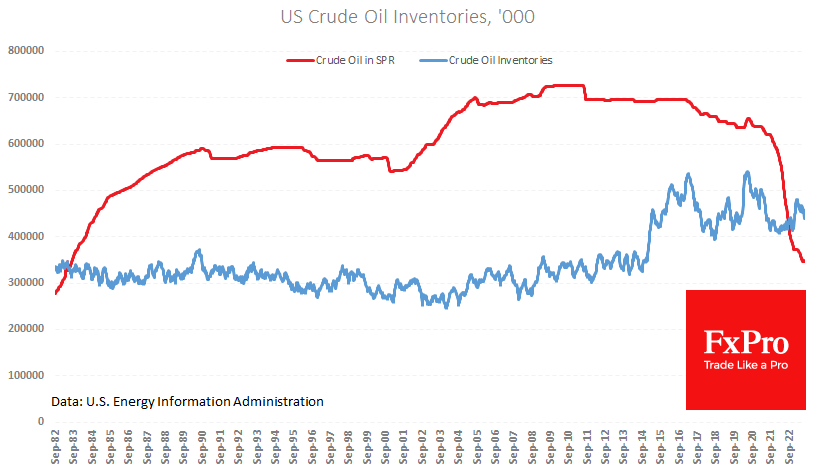

Thanks to the increase in production, commercial stocks rose by 5.8M and the Strategic Petroleum Reserve (SPR) by 1M. Recall that the previous data showed a decline of 17M in the last week of July, after 0.6M and 0.7M in the prior two weeks.

Commercial oil stocks are now 3.2% higher than a year ago and have been on track to bottom out for eight years, despite previous large injections into the market from the SPR.

Oil production has likely become attractive to US companies after rising by almost a quarter in the past seven weeks, with inventories at relatively low levels by recent standards.

However, it remains to be seen how sustainable the increase in production will be, as the number of active drillers has been falling steadily since December. There was a decline in the number of oil rigs that began after the price of WTI settled below $80 per barrel, and the recent increase in production started after the price rose above that level. Still, we did not see a drilling activity reversal.

While rising oil prices often signal the health of the global economy, they could now cause market volatility. Increasing oil and gas prices in recent weeks are bringing inflationary risks back into play. At the same time, the developed world has severely constrained its ability to use its accumulated reserves.

In this environment, rising energy and other commodity prices will prevent central banks from turning to rate cuts or even additional tightening in the coming months.

The FxPro Analyst Team