- Oil prices remain subdued due to recession fears and demand concerns.

- US stockpiles unexpectedly increased, adding to the bearish sentiment, EIA data out later today.

- Geopolitical tensions in the Middle East and China’s economic outlook are also contributing factors.

Oil prices continued to struggle yesterday as increasing recession fears kept bullish investors at bay. The prospect of a recession is exacerbating global demand concerns, putting additional downward pressure on oil prices.

Overnight, oil prices made a brief attempt to push higher as market sentiment temporarily improved.

Market participants are closely monitoring geopolitical tensions, as any significant conflict in the Middle East could drastically impact supply and support oil prices.

China’s economic outlook remains another factor weighing on oil prices. Recent data revealed that Chinese oil imports fell to their lowest levels since September 2022.

Adding to the bearish sentiment, US stockpiles posted an unexpected increase.

According to PI data, crude stocks rose by 176,000 barrels for the week ending August 2, while analysts polled by Reuters had anticipated a decrease of 700,000 barrels.

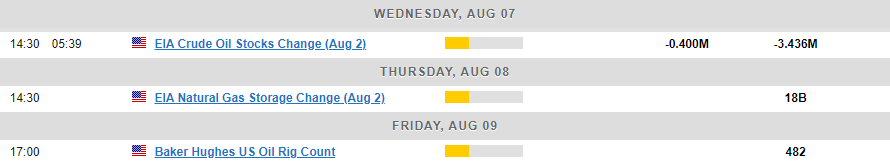

Later today, further insights into US stockpiles will be available when the Energy Information Administration (EIA) releases its weekly inventory data at 14:30 GMT.

As it stands, the upcoming EIA data is unlikely to alter the overall outlook on its own. Geopolitical risks continue to be the main concern, keeping market participants on edge.

Additional worries about a recession or global economic slowdown could further depress oil prices.

Technical Analysis Oil

From a technical perspective, Brent has been making its way lower since July 5 highs around 88.55 handle. This has brought the price to within a whisker of the lower band of the channel that has been in play since March 2023.

The low of this pattern rests around the 75.00 psychological level and this could prove a tough nut to crack for oil bears.

Brent Oil Chart Weekly, August 7, 2024

Source: TradingView

Dropping down to the Brent Oil H4 chart and price does appear to be attempting a recovery. Whether or not oil will be able to gain bullish traction remains to be seen but the H4 technical picture gives a sense of hope.

Having broken the descending trendline there is a possibility that a recovery may materialize, this is to say barring any new developments around a peace deal in the Middle East and an improving sentiment.

A H4 candle close above 78.500 will result in a change in structure and may attract more buying pressure.

Brent Oil H4 Chart, August 7, 2024

Source: TradingView

Support

- 76.50

- 76.00

- 75.00 (psychological level)

Resistance

- 78.50

- 79.315

- 80.00