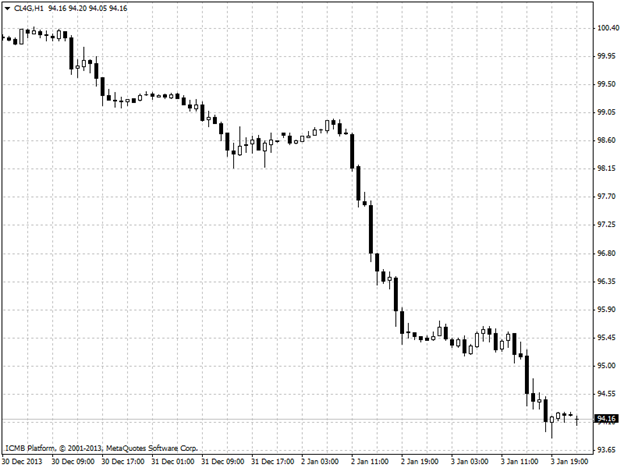

CL

Oil prices dropped on Friday as the market braced for rising Libyan output, while soft Chinese service-sector data softened demand for the growth-sensitive commodity as well. Oil falls as market braces for rising Libyan output, ignores supply data Oil prices largely ignored an otherwise bullish U.S. supply report. Ongoing expectations for Libyan oil exports to resume to near normal levels sent prices falling due to the added supply they'd bring to the global market. Libyan oil operations faced glitches in the recent past due to protesters disrupting production at various oilfields. Expectations for increased exports from South Sudan also nudged prices lower. Prices also slumped after data showed that China's non-manufacturing purchasing managers' index fell to 54.6 in December from 56.0 the previous month. Also this week, data revealed that China’s final HSBC PMI inched down to 50.5 in December from 50.8 in November, which bolstered the greenback's safe-haven appeal.

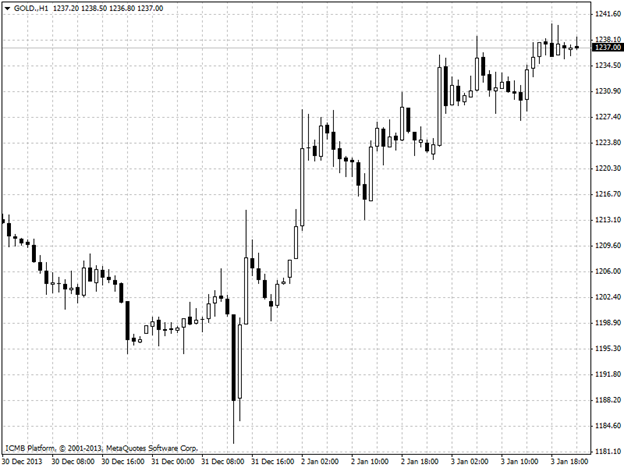

Gold

Gold prices carried Thursday's gains into Friday on reports of rising physical demand in Asia, while bottom fishers snapped up nicely priced positions after the commodity suffered its worst loss in 2013 in three decades. Reports of rising demand for gold bars and jewelry in Asia sent prices spiking on Friday, which brought in bargain hunters who viewed the yellow metal as an attractive buy. Gold prices fell about 29% in 2013 amid growing expectations that the Federal Reserve will taper its bond purchases in 2014 and possibly end the program later this year. Earlier Friday, outgoing Fed Chairman Ben Bernanke said any decision to trim the U.S. central bank's USD75 billion in asset purchases this year shouldn't be interpreted as a sign that tighter monetary policy is around the corner.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oil Prices Drop As Market Braces For Rising Libyan Output

Published 01/06/2014, 02:59 AM

Updated 04/25/2018, 04:40 AM

Oil Prices Drop As Market Braces For Rising Libyan Output

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.