These are interesting times for oil traders and speculators with Friday’s OPEC meeting in Vienna now on the horizon. The question that will then be answered is whether the group will cut output to stem the supply glut that is now increasingly having to be held offshore around the oceans of the world.

Yesterday’s oil inventories did little to ease the constant pressure on oil prices, with a forecast draw of -0.6bbls being reversed by a consequent build of 1.2bbls, and helping to drive oil prices ever lower. The US dollar too is adding its own weight, with many commodities now under the cosh of an ever strengthening currency.

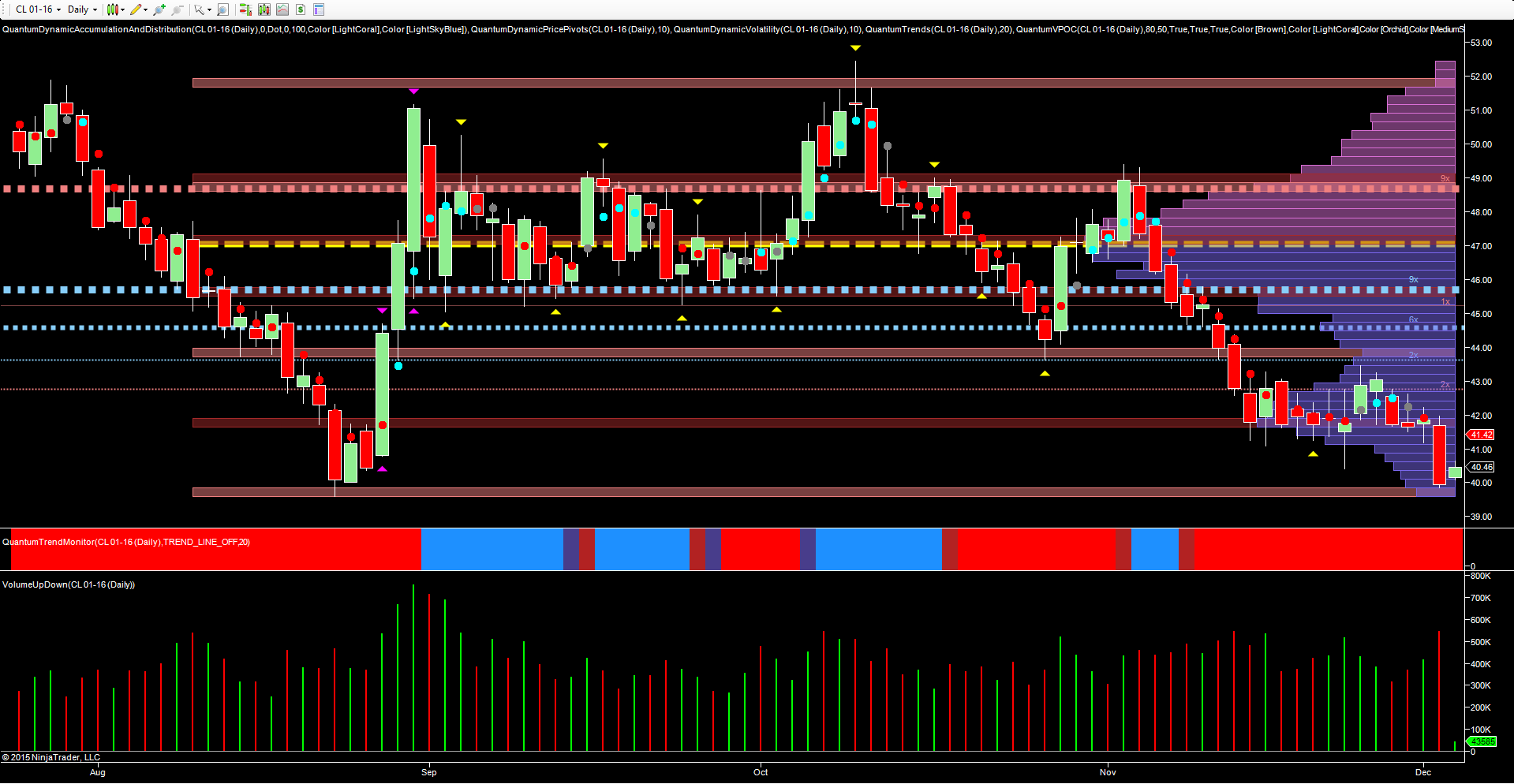

From a technical perspective, yesterday’s move lower carried increased significance for two reasons. First the wide spread-down candle of yesterday’s oil trading session was accompanied by high volume, confirming the heavy selling, whilst also rising against selling volumes in late November. All of which confirmed the very bearish picture for the commodity.

Second, the wide spread-down candle also closed well below the congestion phase which had been building in the latter part of November, with oil finding some support in the $41 per barrel area, suggesting a possible platform of support being built as a result.

This particular bubble was burst in yesterday’s session with oil closing at $39.94. This potential platform of support has now become a solid region of resistance in any recovery. It is also interesting to note that the VPOC (volume point of control) on the daily chart has also moved lower from the $60 per barrel region to now rest at the $47 per barrel area, confirming further the very bearish picture.

Much now depends on the outcome of the latest meeting and whether OPEC are likely to continue the price war on the alternative energy producers. If so, then longer term we could see oil prices continue lower still, down towards the $32 per barrel area last seen in 2009.

In the short term, the low of 39.59 per barrel of August is now on the horizon. Should oil prices move through there, then we can expect to see downside momentum increase once again as the relentless fall in oil prices continues in the run to Xmas.