It is clear that it is no longer supply and demand for oil that is dictating the price but is instead the financial markets and more importantly money flows tied to central bank policy.

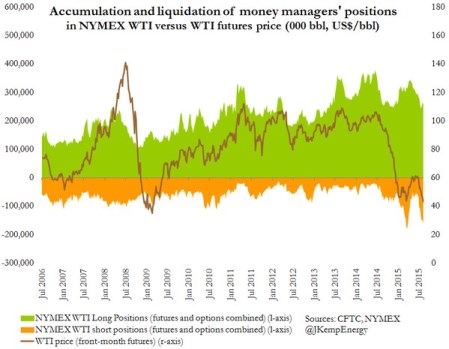

Bearish sentiment in the oil markets is taking over as net short positions near record highs. According to Reuters, 50 to 60 hedge funds have taken short positions that account for around 160 million barrels of oil in near term contracts. In fact, the amount of short positions in oil options and futures now exceeds levels in the great financial meltdown of 2008, believe it or not, despite talk of a good economy and the Fed needing to raise interest rates. Madness, right?

As I have stated before , money flows into financial assets have more to do with Fed policy and FX than fundamentals. Since the consensus is for higher rates in the fall, combined with Asian turmoil stemming from the yuan depreciation, the backdrop of short interest in commodities has risen despite fundamentals improving.

However, in the past month the inverse relationship between the rising US dollar and falling oil has decoupled, as the dollar is essentially flat Year To Date (YTD) while oil has fallen 35 percent to record lows. Some of this was tied to Iran supply worries in 2016, but most of it I attribute to short selling.

Related: This JV Could Trigger A Shale Boom In An Unexpected Venue

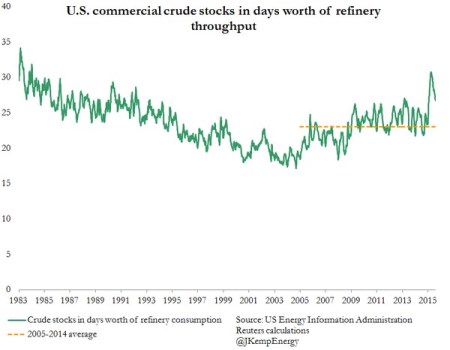

Fundamentally, almost every bear case presented by the media in 2015 has been proven false. Doomsday events such as rig count (vertical rigs being dropped vs. horizontal), Cushing overflowing, China demand slowing, to Iran floating storage of 50 million barrels being unleashed, U.S. production rising, have all been dispelled.

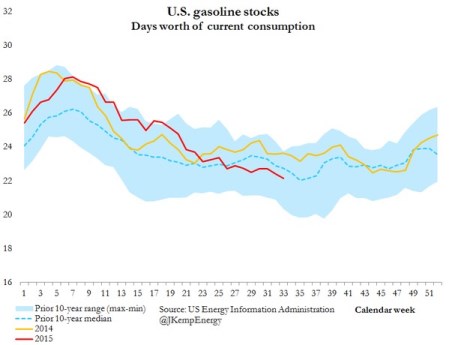

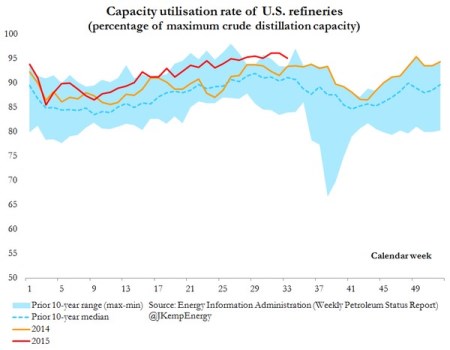

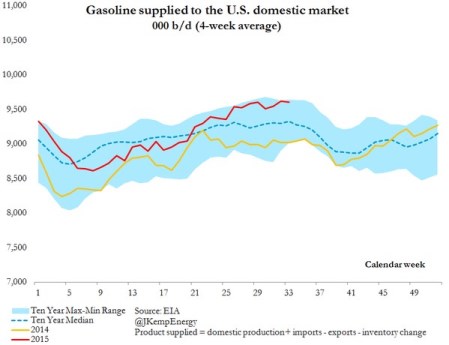

In fact, as I said, the fundamentals have even improved as U.S. production has entered into decline, crude stocks have been drawing down since the spring, and demand for gasoline is at record highs (much higher vs. expectations going into 2015). Furthermore, the worries on Iran are completely overblown given that the hype on floating storage – the millions of barrels of crude oil sitting in tankers turned out to be low quality condensate that is hard to process. Also, the 500,000 to 1 million barrels per day (mb/d) increase tied to the nuclear deal will be absorbed by higher demand, which has averaged 1 million barrels or more each year (in 2015, it has been even higher than that; closer to 1.4 mb/d or higher).

Furthermore, China alone will add 600,000 barrels per day in refinery capacity, as it allows independent refineries to process oil. What has been incrementally negative has been additional capacity added by Iraq and Saudi Arabia since the start 2015. However, aside from Iran, OPEC doesn’t have any spare capacity left and, Saudi Arabia has already announced intentions of reducing output by 200,000-300,000 barrels per day post their seasonally strong domestic period.

Yet even though the dollar has weakened recently, oil has still collapsed some 35 percent. The E&P equities have fallen even further as in addition to shorts, there are also pressing bets on the upcoming fall credit redetermination and hedge funds taking positions in E&P bonds while shorting equities.

All these things still don’t explain the panic in oil markets other than financially driven events that aren’t directly tied to the supply and demand of oil which, as I stated, has improved vs. the start of 2015. In fact, demand is soaring while days of supply are improving dramatically as evidenced by the charts the charts below:

Related: Oil Price Collapse Triggers Currency Crisis In Emerging Markets

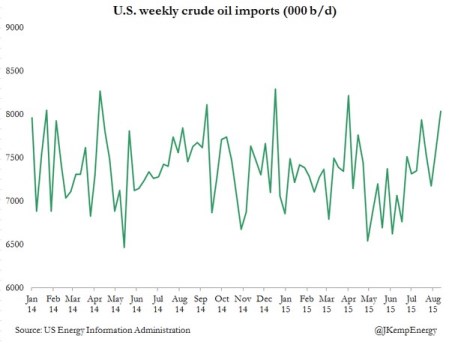

In addition to the precipitous drop in oil is the mystery of oil imports which, over the last three months, have risen dramatically while U.S. production has fallen. Why would this occur as the media continues its portrayals of a supply glut in the U.S.?

Last week, and almost every week in which oil inventories have risen, it has come as a result of surging imports at a time that U.S. refineries have promised 700,000 barrels per day in additional light sweet oil capacity dedicated to shale production.

Suffice it to say, something smells rotten. Since June, U.S. imports have risen by over 1 mb/d to near record levels achieved back in April of this year. How can we be awash in domestic production yet be importing record amounts of foreign oil? I posed this very question to a senior executive of an E&P company and the answer was: Saudi Arabia.

Not many people realize that Saudi Arabia owns a 50 percent stake in the Motiva oil refinery, one of the largest in the entire nation. As a 2013 NYT article clearly states Saudi Arabia’s intention was to assure a market for their oil and, in some cases, sell it below market prices no less. I wouldn’t be surprised that the partly Saudi-owned refinery is intentionally importing more oil than needed, as it would play into the overall Saudi strategy to damage U.S. shale production.

If the chart below is correct and gasoline supplied to the U.S. domestic market rose 500,000 barrels per day while U.S. production held nearly flat since the start of 2015, how in the world are inventories in the U.S. so high according to the EIA?

Related: Why Water Is More Important To Iran’s Future Than Oil

As I stated in previous articles, until the Fed admits the strong dollar and rate hike threats are off the table signaling a policy change, efforts on depressing oil prices won’t subside. The U.S. economy is weakening not strengthening and has been for some time. Historical QE initiations have started at just about these times, as markets begin to crash, yet we still hear about higher rates. Has the FED changed course on stimulus instead, using falling commodities vs. QE? Maybe for a time, but recent data indicates that isn’t working either.

Look for a significant U.S. dollar correction in the coming months, marking a turn in commodities in general. Until then, we are in a perfect storm where forces are driving prices lower with little regard for the fundamentals, due to Fed policy and just the pure greed of funds who can push oil futures lower, so as to maximize short equity returns or to buy assets on the cheap.