- Oil prices have tumbled below the $80 mark

- Bearish catalysts have been weighing on oil markets

- But some predicting prices could climb back up to $100 in the coming months

It's been a rough couple of weeks in the energy market. As potential energy company investors, we are not sorry to see the back of last week in particular. That's the understatement of the year. Pretty near every negative sentiment-Recession, Fed tightening, Dollar strength, China demand, Inventory builds, or what amounts to the entire oil price Closet of Anxieties, came to pass this week. Oil-WTI took a tumble below $80 for the first time since Jan 11 of this year, closing Friday below its 200-day moving average of $89.00.This move has WTI nearing an important psychological level in the lower $ 70s, past which producers will sharply curtail capex to raise prices.

In this article, I will argue that the selling is overdone and neglects one basic truth about the oil market. It is under-supplied, and it is only the SPR releases that have been masking that fact. We are on the verge of an energy calamity that will begin to manifest itself in the coming months. As the economy of the world begins to accelerate in 2023, the era of energy insecurity will begin. The important takeaway is that there is nothing that can be done to prevent this “train from barreling into the station.” A recent NY Times article put it succinctly-

“That’s because there’s just no extra supply out there today at all. There’s a very little extra supply that the Saudis and the Emiratis can put on the market. And that’s about it. We’ve used the strategic petroleum reserve, and that’s coming to an end in the next several months. There’s just no extra cushion in the oil market right now.”

How did we get here?

The short answer is that for the period since 2014, producers have been disincentivized to explore for or sanction the mega-project that was the mainstay of the 2000-2013 era.

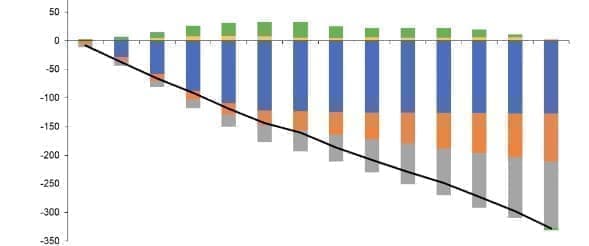

The graph above is telling us that for a lot of reasons-low oil prices for much of the period, governmental preferences shifting to alternative energy and discouraging production of “fossil fuels,” and capital restraint by producers globally that we have under-invested in upstream supply by hundreds of billions.

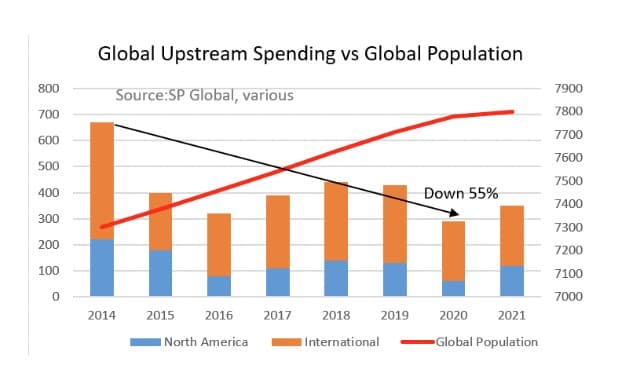

Longer term, we are confident that oil prices will rebound, probably toward the end of the year, as the SPR releases that have put excess oil on the market come to a halt. The graph above, compiled from SP Global and Worldometer tells a compelling story. Every year approximately 80 mm new people join the nearly 7.9 bn folks already here, all needing (but not always having) energy to power their lives. In six years from 2014 to 2020 spending on new upstream sources fell by 55%, while the world’s population rose by ~8%. The math doesn’t work.

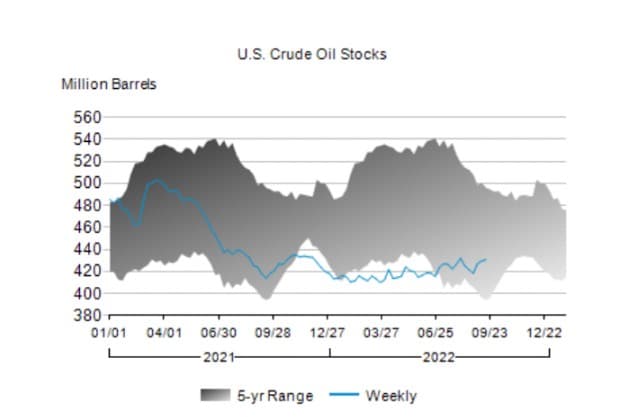

The oil market is undersupplied as the EIA graph below shows. Since March when the government announced the SPR releases to bring down domestic gas prices, inventories have risen about 15 mm barrels. If you back out the 172 mm barrels withdrawn from the SPR over this time, inventories would have shrunk to ~248 mm bbls. That may sound like a lot, but in reality with our ~19 mm BOD habit, it’s a ~13-day supply. Less than 2-weeks!

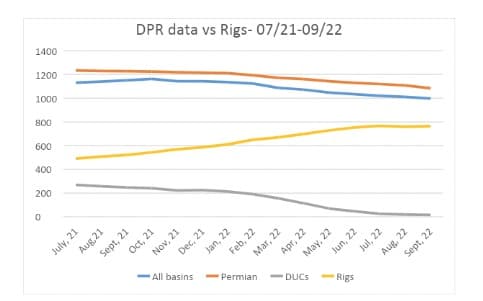

Not only are inventories being artificially inflated by SPR releases, the productivity of new wells as reported in the EIA-Drilling Productivity Report is on the decline. This is an admittedly simplistic measure as it just takes active rigs at a given point, and divides into new well production as reported by various sources-usually state regulatory agencies. The fact the yardstick is done in 4th grade arithmetic without sophisticated modeling, doesn’t mean it’s not instructive. It does reveal an undeniable trend in new well production. Across every key basin with the exception of the North Dakota and New Mexico basins, there is a pronounced decline in spite of steady growth in the rig count for most of this year.

Reading it carefully a case can be made that the Drilled but Uncompleted well-DUC, count withdrawal that occurred from mid-2021 through January of this year was largely responsible for gains in production registered so far this year. There is certainly an observable trend that well performance in the shale basins began to fall off as DUCs declined.

This is true regardless of the underlying reason, which I have postulated in the past could be due to exhaustion of premium drilling inventory. This has been documented several times recently in widely read publications that include the Wall Street Journal.

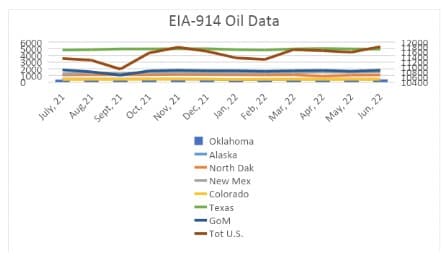

The data from the DPR is confirmed by information compiled from the EIA 914-monthly report. Only in North Dakota and in the Gulf of Mexico-GoM, do we see a gain from May to June. In the case of the GoM Murphy Oil’s, (NYSE:MUR) Kings Quay production contributed about 80K BOPD, and BP’s Herschel provided another 20K BOEPD, toward the 179K BOEPD shown for the month.

Higher drilling costs are also beginning to impact profitability as was noted in an even more recent WSJ article. What this means is that maintaining or increasing production will come under a sharper lens as margins compress, and operator’s balance sheet priorities come into play. Almost without exception shale drillers have told us that their priorities are returning capital to shareholders through special dividends and share buybacks, paying down debt, and holding production to low single digit growth. If oil prices hover in the $70’s for any time, expect cuts in operating budgets which will show up in the rig count soon.

The takeaway from this section is that U.S. production will rise to 12.6 mm BOEPD in 2023 as the EIA suggests in this month’s edition of the STEO, isn’t very high. Current trends are heading in the other direction, and the catalysts for a reversal of course are just not present. The current weakness in oil prices has producers sharpening their budgetary knives. Inflation is eating at already tight budgets, and nature itself may intervene with poorer quality rock than was available in the past.

Is any help coming from OPEC?

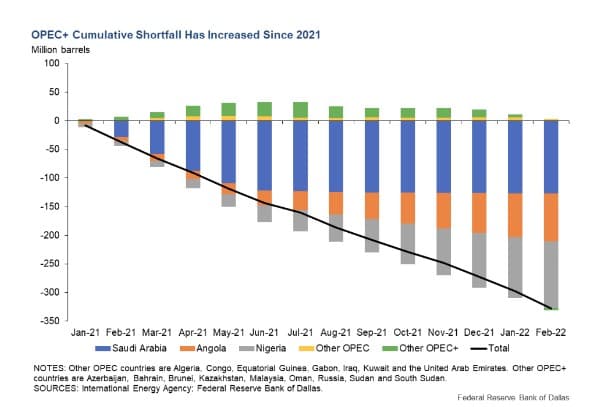

OPEC and its sometime collaborator when interests align, Russia have fallen short of producing up to full quota levels by a significant amount. Some reports have this shortfall at more than 3 mm BOPD at present. In fact the CEO of Aramco (2222) made a widely read pronouncement earlier this month that the world was on the precipice of an energy shock of massive proportions.

“But when the global economy recovers, we can expect demand to rebound further, eliminating the little spare oil production capacity out there. And by the time the world wakes up to these blind spots, it may be too late to change course.”

The Dallas Fed put out a report documenting the OPEC shortfall as well that points to key source of underperformance at the feet of none-other than Saudi Arabia. It only runs through February of this year, but shows clearly the Kingdom of Saudi Arabia producing about 1.2 mm BOPD below quota.

To put a cap on this discussion of whether the Kingdom can dig deep and come up with more oil when the world needs it, we have commentary from the defacto Saudi leader himself, Prince Mohammed bin Salmon, also known as MbS-

“The kingdom will do its part in this regard, as it announced an increase in its production capacity to 13 million barrels per day, after which the kingdom will not have any additional capacity to increase production,” he said in a wide-ranging speech.”

In his address the Prince noted that it would not be able to reach the 13 mm BOPD capacity level until 2027. This should knock on the head any notion that OPEC or its primary member, Saudi Arabia can turn a valve and add significantly to world oil supplies any time soon.

Your takeaway

No one can predict what the oil market will do over the short haul of the next few months. There are so many factors, many of which we noted in the opening paragraphs of this article, that it’s impossible to say when this selling pressure will be relieved. My best guess it will happen with a massive inventory draw when the SPR releases finally cease.

Perhaps it could be a Fed pivot. These interest rate hikes are crushing consumers and driving adjustable rate mortgages and HELOC payments higher every month. At some point the Fed will pause if history is any judge. A stock market that’s declined 50% in a few months, hundreds of thousands of people without work, inflation in the double-digits…will all demand it. That will spark an intense rally in oil prices in my view.

Or it may be something else entirely in the scope of things I’ve highlighted or an outlier I missed. What I can confidently say is when market sentiment shifts, we are in for a sharp surge in oil prices. It will be led by a crushing demand globally for oil and gas, the steady supply of which is increasingly in doubt.