- Oil prices have declined over the past four days, but Brent oil remains at a crucial support level.

- The Chinese government has cut rates to stimulate economic growth following disappointing data. Will this help keep oil demand strong in H2?

- US GDP, PMI and PCE data could play a role in Oil price moving ahead while the Geopolitical situation needs to be monitored as well.

Oil prices have been on a four-day losing streak, but Brent is holding at a crucial support level following data showing declining US inventories. Ongoing uncertainty surrounding China continues to fuel demand concerns.

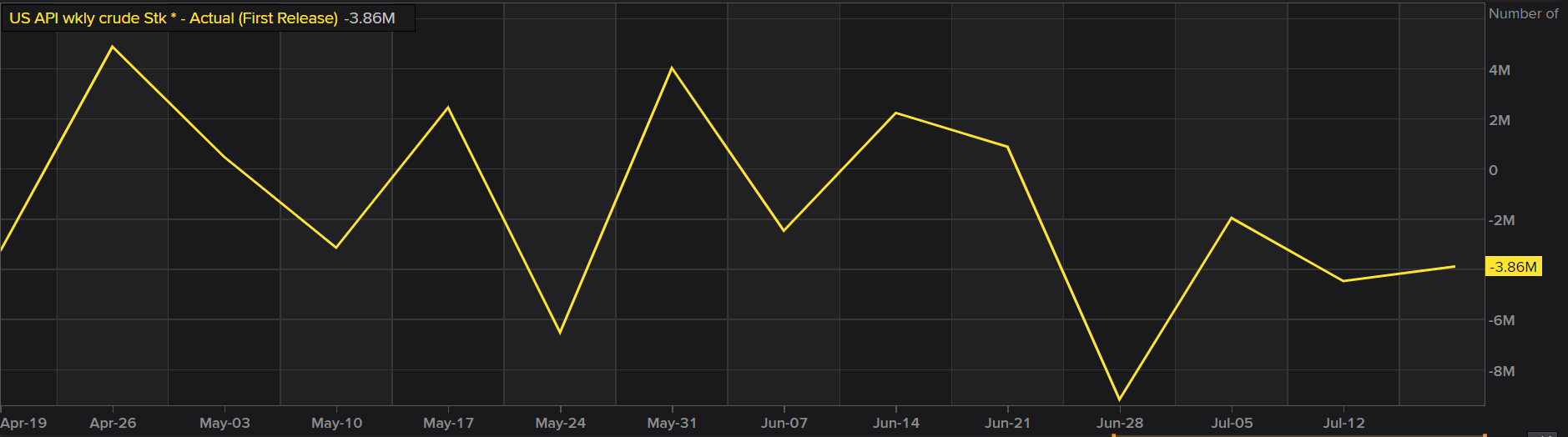

The American Petroleum Institute (API) reported a week-on-week decline in inventories, with crude oil stocks dropping by 3.9 million barrels, more than the anticipated 2.47 million barrels which was expected given the mid-summer period.

API Numbers Weekly

*The numbers show the stark decline as the summer months, highlighting the spike in demand experienced during US summers.

Source: LSEG

Oil bulls are also keeping an eye on wildfires in Canada, which threaten supply as some producers have already reduced production. Analysts note that a significant amount of supply is at risk, which could be a concern for market participants.

This outlook aligns with recent comments from OPEC+ members, who indicated that a change in output is unlikely in the near future. However, OPEC faces challenges from member states, as a July Reuters survey revealed that they have exceeded agreed targets for a second consecutive month.

This could pose a challenge for OPEC as it aims to keep oil prices stable at or above $80 per barrel.

In the medium term, I anticipate an increase in oil prices as the summer months in Europe and the US come to an end. A supply deficit is likely toward the end of Q3 and the beginning of Q4.

China Cuts Rates to Support Growth

The Chinese Government and the Peoples Bank of China (PBoC) announced its first major monetary policy move since February. PBOC Governor Pan Gongsheng announced at the Lujiazui forum that the 7-day reverse repo rate will gradually become the main policy rate, while other policy rates will “soften their role” over time.

It remains to be seen if other policy rates, such as the MLF, will follow today’s rate cut in the coming weeks. If they do, it could indicate that the PBOC is signaling the 7-day reverse repo rate’s new status as the primary policy rate.

This is seen as a move to achieve the economic targets following lackluster data last week which raised concerns about Chinese growth in H2 2024. It will be interesting to gauge developments moving forward and whether this move will have the desired effect.

The Week Ahead

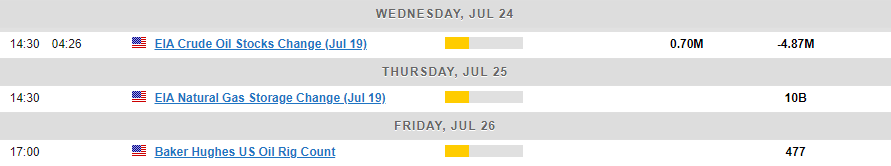

US data dominates the back-end of the week with PMI, GDP and of course PCE inflation releases. US Dollar strength or weakness is always a factor to consider when evaluating oil prices but unless the data leads to a significant shift in rate cut probability and timing, any moves are likely to be short-lived.

The EIA data will be released later today, and of course, the Baker Hughes US Oil Rig Count will be out on Friday. Geopolitics, as always, remains a concern, and any developments there need to be monitored.

Technical Analysis

Oil prices have been steadily declining over the past few days but encountered a significant support level yesterday. Although oil briefly dipped below this support region, it quickly recovered as US inventory data was released.

During the European session, oil has edged higher; however, with upcoming US data this afternoon, the markets are showing limited volatility. Immediate support is at 81.58, and a break below this level could lead to a retest of the psychological 80.00 mark.

Conversely, a move higher from the current levels would face resistance around the 83.00 handle, with the 200-day moving average positioned slightly above at 83.36.

Support

- 81.58

- 80.00

- 77.50

Resistance

- 83.00

- 84.72

- 85.30

Brent Crude Oil Daily Chart, July 17, 2024

Source: TradingView.com