Crude oil bulls are quite confident in the future and that’s what helped Brent to rise. The asset is trading at $45.16.

Market players are obviously having a positive and friendly attitude towards the future, picking the signals of the global economic recovery from different macroeconomic data, from Chinese to American.

The latest report from Baker Hughes showed that the Total Rig Count lost 2 units over the week that ended on Nov. 20 and is now equal to 310. It’s the first time in the past several weeks the indicator dropped and investors were very enthusiastic about this piece of news. Over the last 12 months, the Total Rig Count lost 493 units if compared with Nov. 22, 2019.

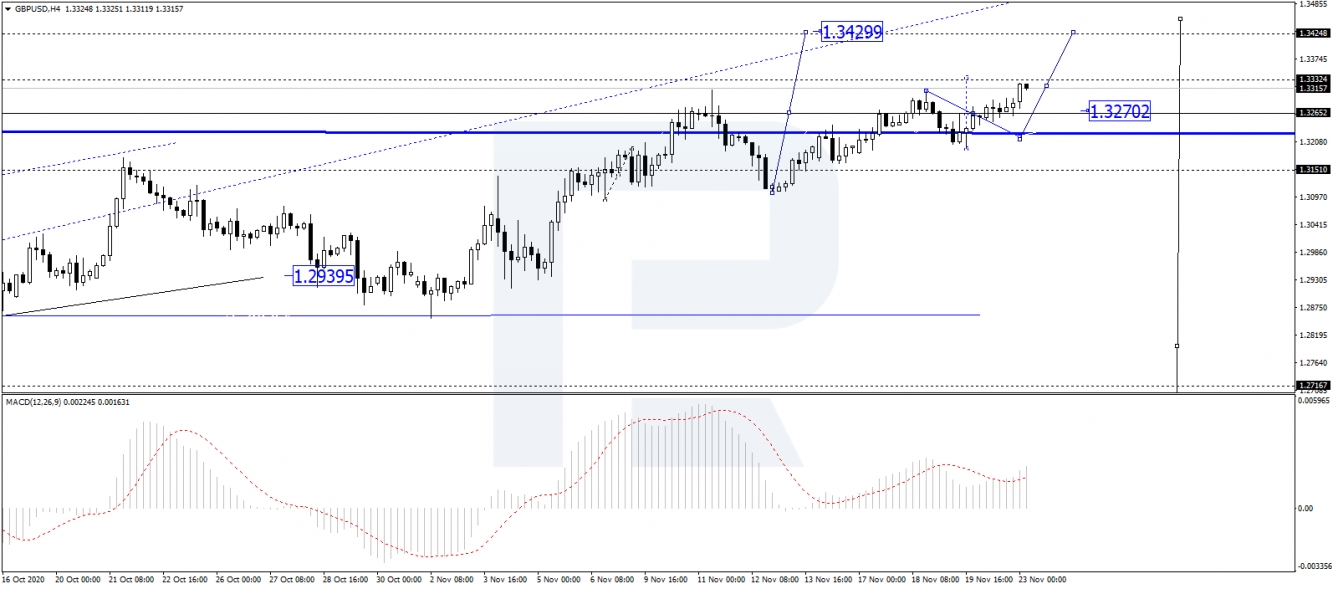

In the H4 chart, Brent is forming the ascending wave towards 45.50. After that, the instrument may correct to reach 44.10 at least and then resume trading upwards with the key upside target at 48.50. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is steadily moving upwards after entering the histogram area.

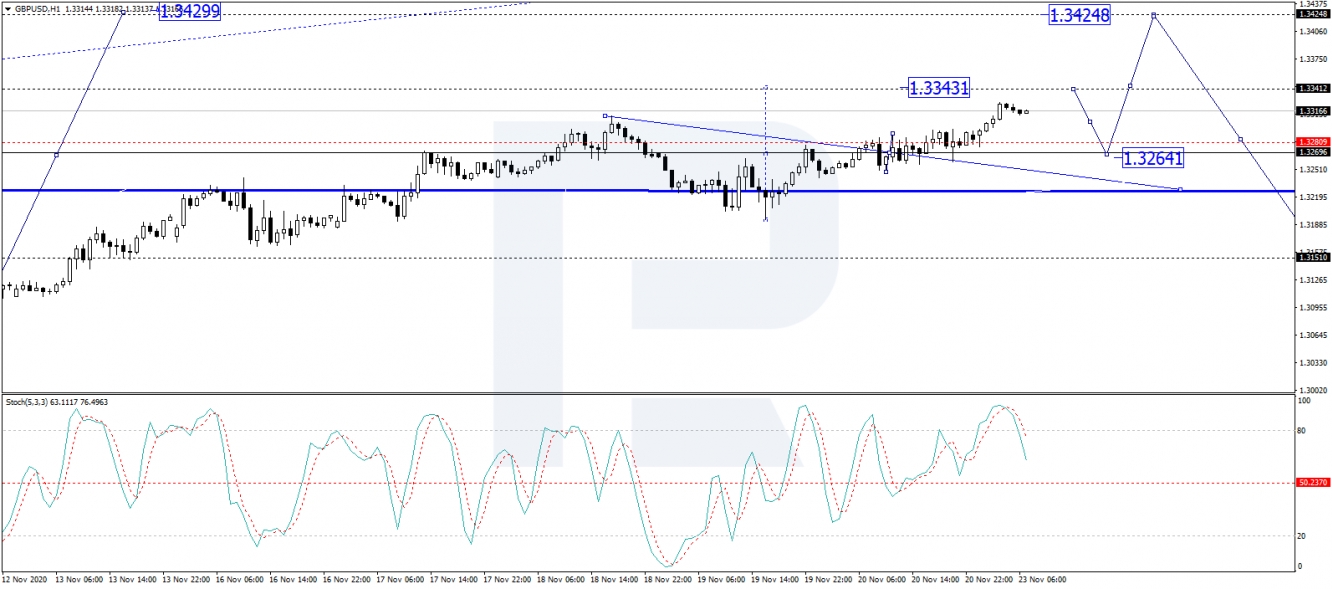

As we can see in the H1 chart, Brent is growing towards 45.50; this movement should be conserved as the fifth structure within another ascending wave. After reaching this level, the instrument may start a new correction with the first target at 44.75 and then consolidate above this level. If the price breaks the range to the downside, it may continue the correction to reach 44.10. From the technical point of view, this idea is confirmed by Stochastic Oscillator: its signal line is moving above 80 within the “overbought area” and may start falling towards 50 at any moment.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.