Oil has been playing on techincals for some time, and last night after the US oil data, we saw a massive plummet as it drove down to close well below the bullish trend line in play. So when technicals fail we generally have to point the finger at something, and in this case long term fundamentals finally caught up with the U.S.

Crude oil inventories took a dive of 2.4 million barrels; not exactly a large drop, but still a drop nevertheless. In most circumstances you would expect to see a jump in the price of oil, but not in this case at all. In fact, we saw a large drop, and this was brought on by supply increasing. Currently, many middle eastern countries are recovering after the Arab-spring, this in turn has led to many now looking to increase oil production. Case in point; Libya, which is now starting to increase its supply again to the global market.

Additionally, we saw further supply opening up in America as well overnight and now even a case to lift the current crude oil export ban that has been in place in the U.S since the 70’s when we had the OPEC crisis. This is expected to help global prices shift low even further, as the U.S has now reached the point where it is no longer a net importer, but instead a net exporter.

Long term forecasts have so far pointed to supply increasing and prices being driven back down, and in the long term this is very much a reality.

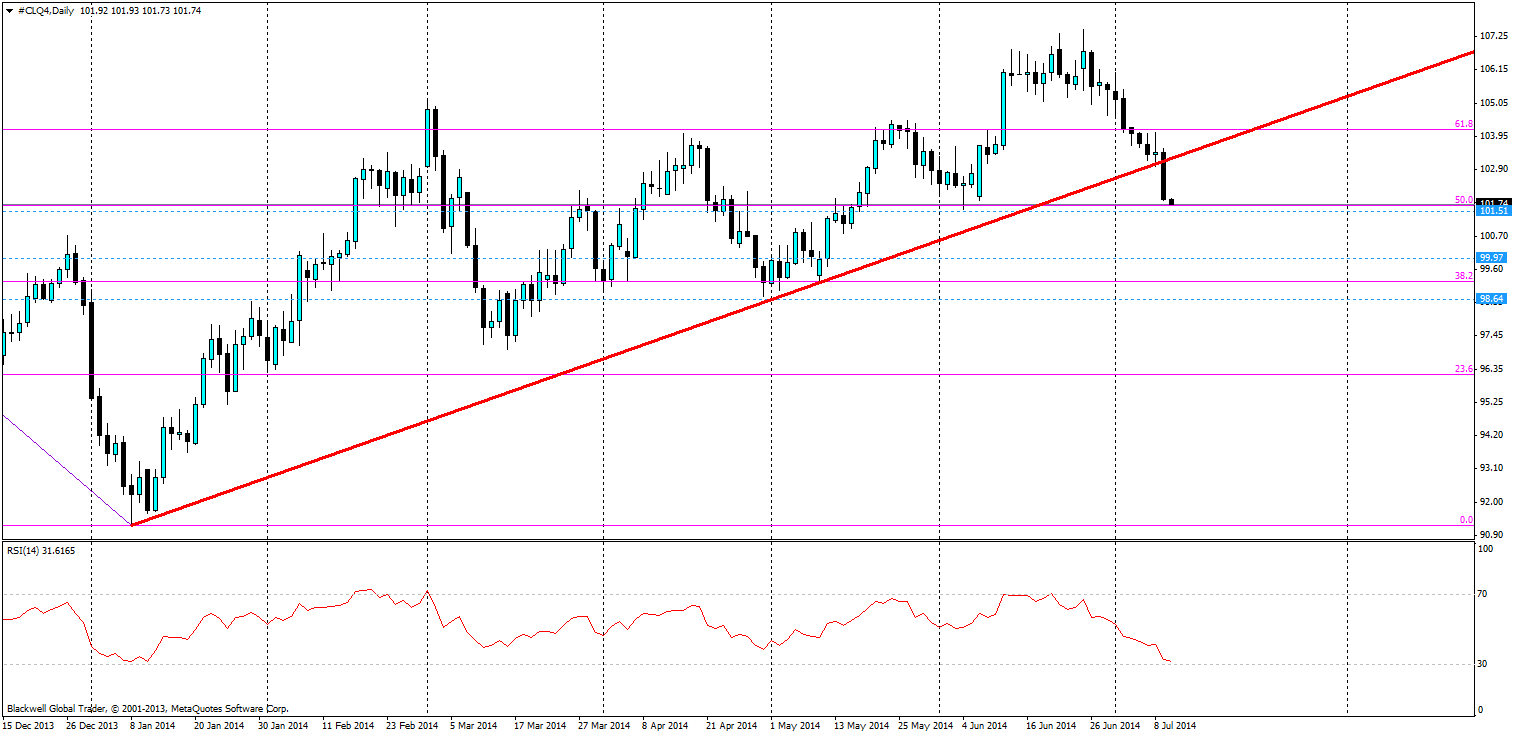

The technical bullish trend line which has been in play has failed completely as of last night, and markets this morning have so far looked to go even lower as I type this. Markets will now instead be looking very bearish as a result, and will be seeking key points to touch as it moves lower.

When it comes to commodities, fibonnaci lines to come into play quite nicely and this case is no different at all. Currently the markets are using the 50.0 fibonnaci level as a point of support, and this may hold in the short term as there is some degree of profit taking. The next level is 38.2 and this will likely act as a second level of support

Main price support levels can be found at 101.51, 99.97 and 98.64. All of these levels are likely to hold in the long term and act as points of consolidation. What will be key though, is if oil will actually use these levels in the medium term or instead push through down into the low 90’s over the course of the next few weeks.

Oil is certainly looking bullish as the long term fundamentals catch up with it. The next moves lower could lead to heavy selling pressure. What is certain is that prices over 100 dollars a barrel are looking unsuitable in the long run and lower lows should be expected.