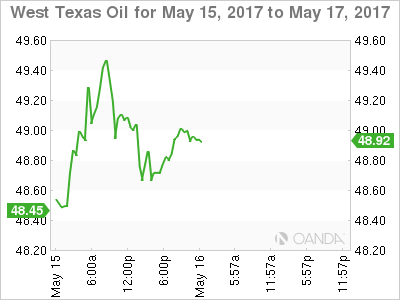

The risk-off tone that was consuming early trade yesterday gave way to a wave of investor optimism seemingly taking solace from Chinese President Xi’s global infrastructure pledge and world oil markets which rocketed higher on the OPEC supply cut extension news. The Russian and Saudi plan to extend production cuts until the end of Q1 next year was the real showstopper, resulting in a massive rally on crude and dragging energy producing stocks along for the ride.

Global equities optimism soared, with China markets touching March highs and European stocks extending their post-French election rally, Tokyo was up on a weaker yen, and US equity indices continued their march toward record territory

The oil patch news overshadowed yesterday’s China data trifecta, which saw all the headlines miss market expectations. Growth in industrial production slowed to 6.5% you from 7.6%, retail sales slowed to 10.7% yoy from 10.9% yoy, and fixed asset investment slowed to 8.9% yoy from 9.2% yoy previously. Both commodity and regional markets would have traded softer on the China data miss, but investors were willing to overlook this soft patch as yesterday’s WTI gusher topped $ 49.60 per barrel and backed by China’s infrastructure pledge

Amidst all the Oil Patch optimism, shale oil producers indeed capped overnight momentum when the US Department of Energy came out with a forecast that US shale production would increase by 122,000 barrels per day, next month. WTI dropped to $48.95/b where it closed and has consolidated in early Asia.

I suspect we have not seen the last of the shale gang as ongoing concerns over the clash of OPEC and shale will continue as near-term battle lines get drawn.

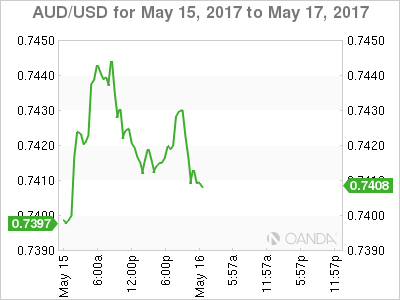

Australian Dollar

Commonwealth currencies continued squeezing higher overnight benefiting from surging crude prices. While the highly oil correlated Canadian dollar is taking up much of the highlight reel, the Aussie did manage to consolidate its gains above the .74 handle as the massive oil price rally underpinned global commodity prices in general. Relatively strong overnight session for the Aussie, but this picture looks all too familiar, so I expect the market to be very cautious and on guard for a significant AUD short squeeze

While specs have been tentatively fading the overnight AUDUSD moves, convictions are not very strong. With the US Treasury yields mired in range trade mentality, and a June US rate hike all but priced in, it comes down to a near-term commodity play for the Aussie with Commonwealth dealers overly focused on oil prices.

Nevertheless, today’s RBA minutes and Thursdays employment data will be this week’s national focal point.

The market was in short cover mode entering the RBA statement as WTI started ticking higher, but as for the RBA , while it was highly unlikely the RBA would provide us with a significant shift in deliberation, and on cue, the Australian Central Bank steers steady the policy course, so back to the commodity watch.

But Thursday’s employment report will be closely watched to see if the recent string of buoyant employment reports extends. Another robust print would have investors discounting early year weakness which could see the Aussie move toward the .75 handle

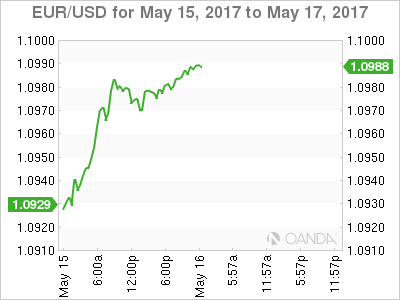

Euro

The euro had an inspiring session amidst the risk-friendly environment. While there was an absence of EU data, equity inflow and a market-friendly outcome for Angela Merkel in the critical state of North Rhine-Westphalia has been moderately euro supportive. But overall, the US dollar is still sensitive from Friday’s US data disappointment and given that there is little more than second tier US economic data on this week's calendar, the US dollars response could be weak, and there may be further downside playing out.

EM Asia

With oil driving sentiment and underpinning commodities, emerging markets were back in focus, rallying on both higher commodity prices and buoyant risk sentiment.

The local view is certainly joyous on the back of President Xi’s global infrastructure pledge, but traders are also taking note of the PBOC Q1 Monetary Policy Report which should ease some of the angst around the Mainland's interest rate policy. While mainland administrators are dogged about deleveraging the speculative elements within the financial system, credit to the real economy is not a concern and had not slowed, apparently.

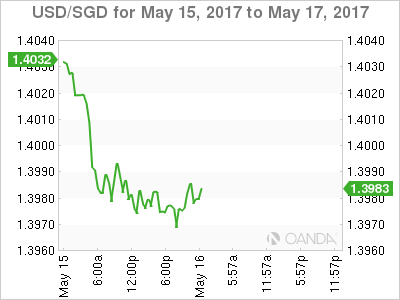

The two highlight currencies overnight were the Singapore dollar and the South Korean won. The SGD closed below major support of 1.4000 and consolidated around 1.3975 awaiting the next USD catalyst while the KRW touched 1115 before rebounding.