The confrontation in Venezuela between Nicolas Maduro (and his entrenched government) and Juan Guaido (and his supporters advocating for change) has intensified this week. On Tuesday, there were minor clashes, and it seems some from the military joined Guaido’s side. Still, Maduro hangs on to power.

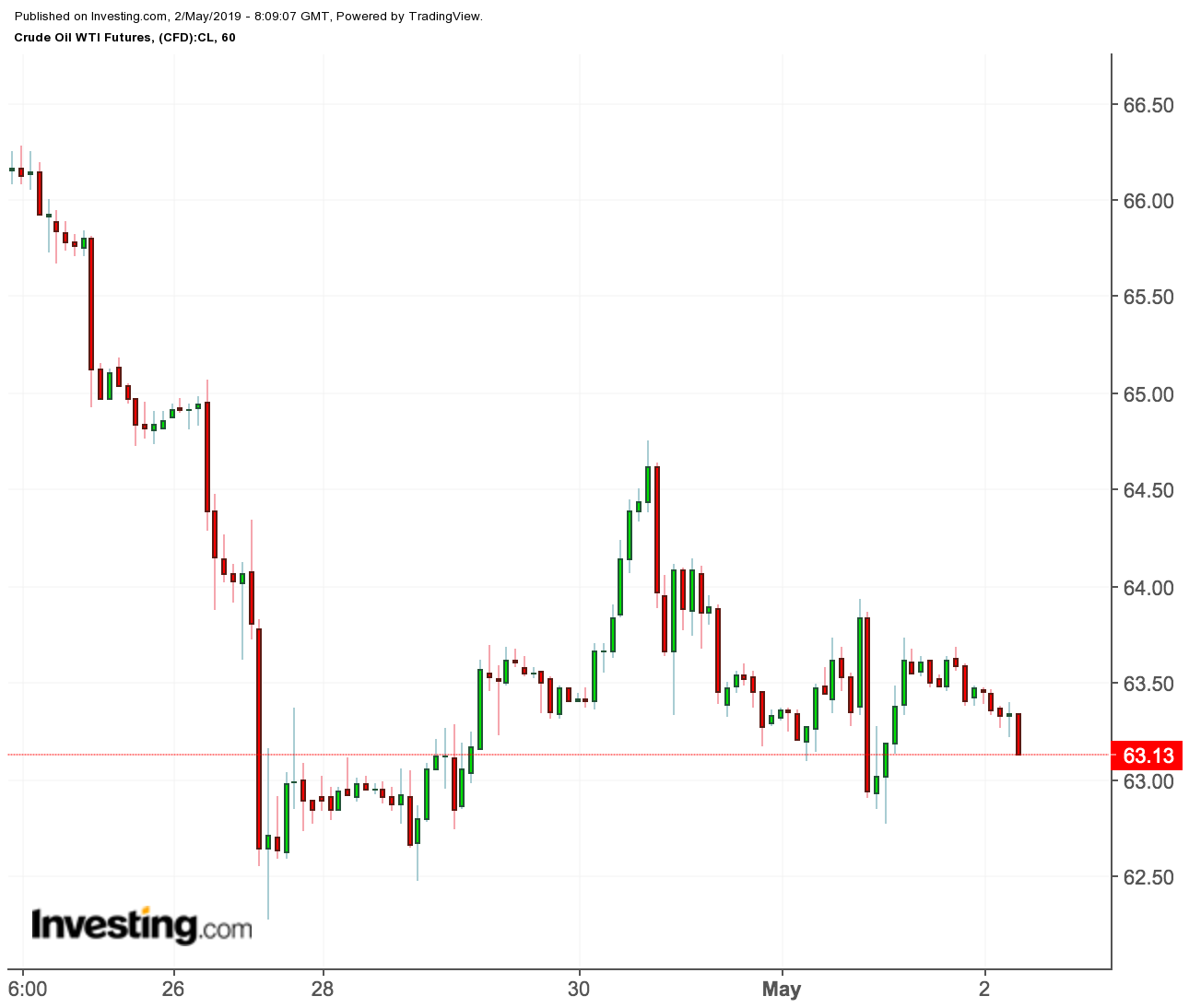

Oil prices rose on Tuesday as news of the potential coup attempt spread, although there is no evidence that the military activity and protests are impacting Venezuela’s oil producing region. According to Argus, activities at Venezuela’s primary oil terminal are proceeding normally.

Guaido supporters have not attempted to gain control of Venezuela’s oil fields or oil transportation facilities, but it is possible they could become strategic secondary targets for Guaido’s side if it cannot make progress in Caracas. In fact, PdVSA officials believe that it is only a matter of time before the oil production region becomes more heavily impacted by the conflict.

There is a great deal of confusion regarding how much oil Venezuela has been producing recently. According to OPEC’s information, Venezuela produced only 732,000 bpd of oil, in March. However, several independent tracking firms say that Venezuela produced as much as 830,000 bpd in March. The disparities also extended to April. According to Reuters, production dropped by 100,000 bpd in April. Argus reports that Venezuela’s production increased to 800,000 bpd in April, and Platts reports that Venezuelan production is up to 955,000 bpd.

Despite the U.S. sanctions on Venezuelan oil, only some customers have stopped purchasing what oil the country is still exporting. India’s Reliance refinery has cut most of its purchases of Venezuelan crude and also stopped supplying Venezuela with needed diluents for its heavy oil. However, India’s Naraya refinery, which is partially owned by Russian interests, is still accepting shipments of Venezuelan crude, some of it as payment for oil-backed debts.

China has also continued importing Venezuelan oil as payment for debts. U.S. refiners also received some crude oil from Venezuela at the end of April, but this was mostly oil that had already been paid for. The imports for the U.S. did not violate the sanctions, because companies were given until 28 April to wind down their oil shipments from Venezuela.

It would appear that the greatest threat to Venezuela’s current oil production is Venezuela itself, not the U.S. sanctions. Loss of power and lack of diluents continue to be the primary causes of decreased production and exports. If Venezuela can keep the electricity running and continue buying diluents, then traders should expect Venezuela to continue to export between 800,000 and 1 million bpd.

The U.S. may succeed in pressuring Indian refiners to drop their imports from Venezuela, but the Chinese National Petroleum Company (CNPC) would likely pick up these barrels and resell that crude oil on the market. However, if fighting picks up or moves to the oil regions, then markets could see significant and prolonged outages from PdVSA.